Traditionally, the labour market has always been the hottest topic of policymakers, given that unemployment can cause much more misery than any increase in the cost of living (inflation) or any drop in the stock market. While any worsening in economic conditions can have an effect on the well-being of the populace, it is seldom the case than anything matters more or is more direct than the employment conditions of the overall population. It is not accidental that, of all the economic variables, labour and capital are the ones most often used to gauge an economy’s potential.

Both for good and for bad, the labour market does not rely on just on one indicator. This is because each individual variable focuses on just a part of the market and viewing them together allows us to correctly assess the complete state of the labour market. Nonetheless, data releases do not always point to the same direction and it is thus up to us to assess whether this new information is suggesting good or bad developments. To do this, we first need to understand what each variable aims at capturing and how this relates to the economy. The remainder of this article does exactly that as it talks through every aspect of the labour market indicators and elaborates on their uses. While not explicitly addressed in every variable, it should be remembered that what matters for FX movements is the difference between actual and forecasted values.

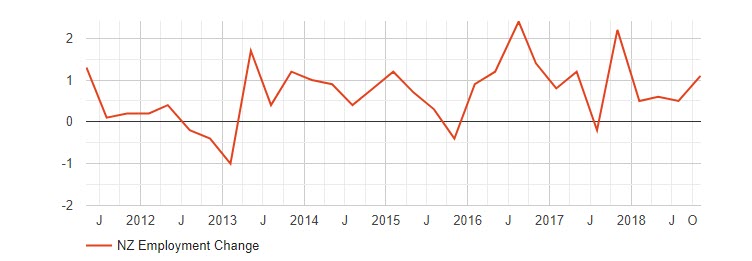

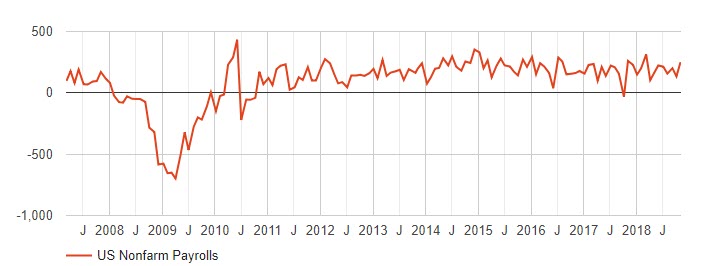

- Employment change

Employment change simply measures the change in the number of employed people over a period of time, usually a month. In combination with the unemployment rate, this indicator allows us to observe the rate of new job creation in a market. If the unemployment rate is stable, but at low levels, growth in employment should mean that new jobs are being created, which is always beneficial for the economy. In general, the more people are employed the more money people will have and hence the more spending there will be in the economy. Higher spending means higher economic growth which is always beneficial for the currency. In this sense, employment change can also be used as a leading indicator for the future state of the economy. It is thus not a coincidence that the US version of employment change, Nonfarm Payrolls, has a very strong impact on the markets, often causing a more than 200-pip change upon announcement.

Source: HF Markets Economic Calendar

- Unemployment Rate

Unemployed people are defined as those who are eagerly active in looking for a job, able to obtain it, but have yet to find one. This definition excludes pensioners, students or underage people from it and thus assists in obtaining a better view regarding job destruction and creation in the economy. After obtaining the number of unemployed persons, this is divided by the total labour force. The latter is simply comprised of the number of employed and unemployed people. If the unemployment rate increases then the rate of job destruction is higher than the rate of job creation. While usually considered a lagging indicator, small increases in the unemployment rate are usually observed prior to the start of a recession. As with most indicators, emphasis should be placed on its trend when it comes to evaluating an economy´s performance. An interesting complication is that persistent moves in the opposite direction of what had been observed until now can be used as an indicator for an economic reversal.

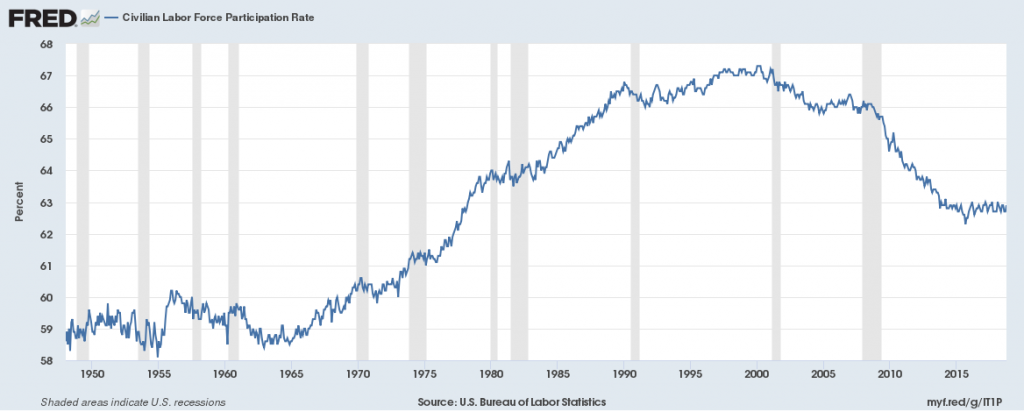

- Participation Rate

In the case where a recession badly hits the economy, some people may become disappointed from the constant search for employment and decide they will stop actively looking for a new job. This, according to the unemployment definition, means that they will not be included either in the unemployed or the employed pool of citizens. In other words, this means that these people will no longer be included in the labour force but will be part of the greater definition of the working age population, which just measures the number of people who belong in a certain age group and are able to work but choose not to. Participation rate is an important indicator because it measures the willingness of people to participate in the workforce. If the economy is doing well then more people are willing to join the labour force, hence the participation rate is bound to increase. Overall, a higher participation rate is usually better for the economy and the currency.

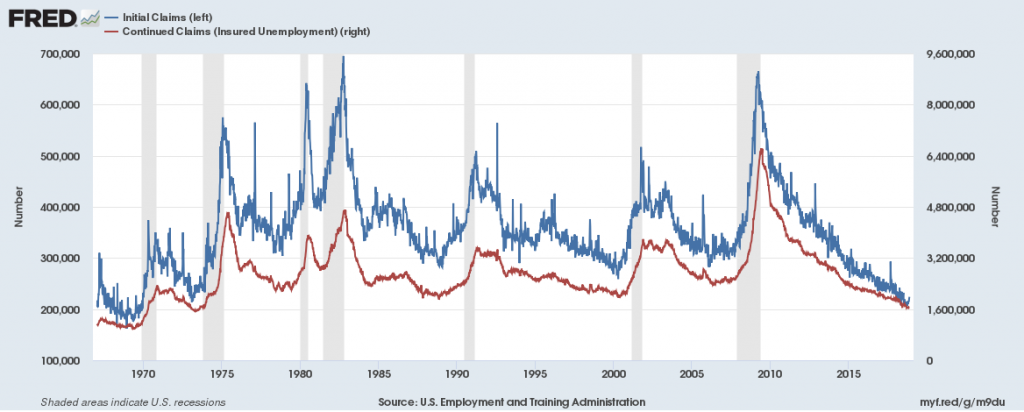

- Initial and Continuing Jobless Claims

The Unemployment Rate comes out once a month, but policymakers and traders want more frequent information. To this end, Initial Jobless Claims measure how many people have filed for unemployment benefits in the previous week after being separated from an employer. As such, Initial Claims can serve as a leading economic indicator once its volatility, due to its higher frequency, is also taken into consideration. While Initial Jobless Claims measure emerging unemployment, Continued Jobless Claims measure the number of persons which have already filed an initial claim in the past and have experienced at least one week of unemployment since then. The number of persistently unemployed persons, while not serving as a leading indicator, provides an overview of labour market conditions and usually serves as confirming evidence of the state of the US economy. This behaviour can be viewed in the graph below, where the level of Initial Claims rises in the run-up to recessions, with Continued Claims lagging a bit but generally being on the same course.

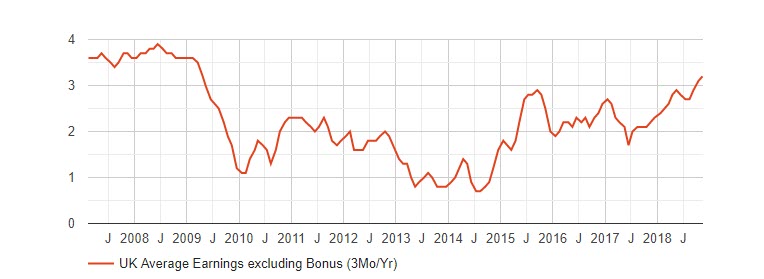

- Labour Earnings

After being employed, the most important thing is how much one is actually earning. Earnings, which also come under other names such as average hourly earnings (US), average earnings (UK), or wages (Australia) are important as they are a leading indicator of inflation and growth. Higher inflation would mean that prices would increase and hence a corresponding increase in the wage level should take place in order for workers not to lose any purchasing power. However, this would mean that their purchasing power has been increased and thus they would be purchasing more, leading to an increase in inflation. As is well known, demand-side inflation is a side-effect of economic growth and hence higher labour earnings should signify that both inflation and the economy are growing, with the expected positive impact on the FX market.

Source: HF Markets Economic Calendar

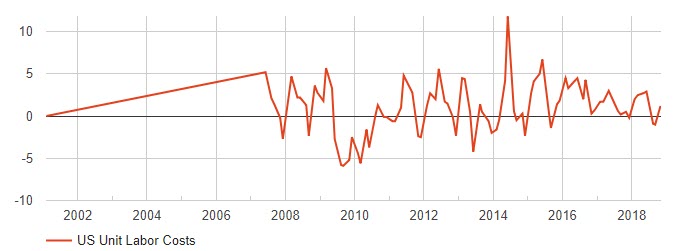

- Unit Labour Cost

The major difference between Labour Earnings and Unit Labour Cost (ULC) is that the latter is a broad measure of productivity as it is defined as the average cost of labour per unit of output produced. In rough terms it is the wage a business pays a person divided by the number of products he or she produces. On a global scale, differences in ULCs are important to determine the competitiveness of an economy. Naturally, the higher the ULC the worse for an economy given that this means that it produces less output at a higher cost than other countries. This should mean that as ULC rises exports should fall and imports should increase thus negatively affecting GDP in the country. Thus ULC can be a leading indicator for both GDP and the trade balance, the two most important determinants of exchange rates.

Source: HF Markets Economic Calendar

It should be borne in mind that the above indicators can register mixed signals. For example, the unemployment rate could come out lower than expected, while NFPs could register a deterioration, as was the case with the US labour data release on October 5, 2018. The Dollar registered an initial decline following the worse than expected NFP results but then the market quickly corrected for this, following its understanding that the overall outcome was positive for the economy and the drop was only attributed to the hurricane season. Thus, traders need to be actively involved in the markets to be able to quickly assess the significance of an announcement.

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.