FX News Today

Asian Market Wrap: Japanese markets were closed for the holiday, which means there are no Treasury quotes this morning, but elsewhere in Asia yields mostly declined as stock markets were once again under pressure, led by Chinese indices. Concerns over the impact of trade tensions on the growth outlook are weighing on sentiment and traders are not very optimistic that the G-20 meeting in Argentina will bring a break through. The Hang Seng is down -0.53%, while Shanghai and Shenzhen Comp lost -1.97% and -2.96% respectively. US futures are also heading south and the front end Nymex future has fallen below the 54 mark once again and is trading at USD 53.24 per barrel.

European Fixed Income Outlook: 10-year Bund yields are down -0.3 bp at 0.365% in opening trade and 10-year Treasury yields are down -0.2 bp at 3.061% after coming back from yesterday’s holiday. The 2-year Schatz yield is down -0.2 bp at -0.589%. A sell off on mainland China equity markets dominated quiet holiday trade in Asia and the renewed flaring up of risk aversion and the confirmation of the contraction in German economic activity of -0.2% q/q in Q3 at the start of the session is underpinning Bunds in early trade. US futures are heading south, led once again by Nasdaq futures and oil prices also fell back again. Brexit developments and Italy’s budget spat with Brussels remain in focus today. The calendar still has preliminary November PMI readings for the Eurozone.

Charts of the Day

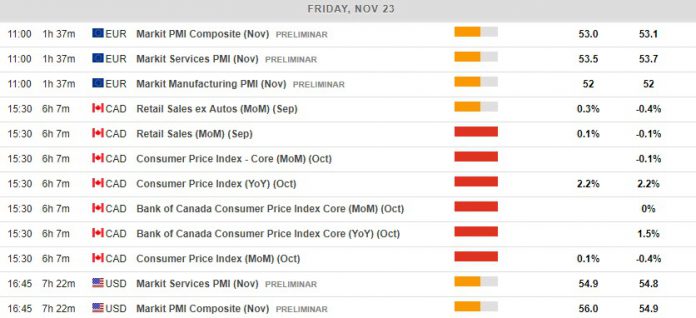

Main Macro Events Today

- Euro Area Composite, Services, and Manufacturing Markit PMI – While the Manufacturing PMI is expected to come out at 52, the same level as last month, Services PMI is expected to deteriorate slightly in November, to 53.5 from 53.7 last month, with this also having an effect on the Composite PMI which is expected to deteriorate to 53.0 from 53.1. Still, all indices remain above 50, indicating an expansion.

- Canadian Retail Sales and CPI – Retail Sales are expected to have grown by 0.1% in September compared to -0.1% in August. The CPI is expected to have remained at 2.2% in October, similar to September.

- US Services and Composite PMI – Both US indices are expected to register an improvement, with the Services PMI moving to 54.9 compared to 54.8 in October and the Composite PMI jumping to 56.0 from 54.9.

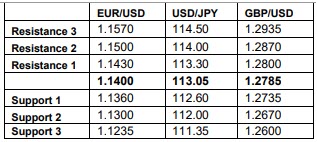

Support and Resistance

Click here to access the HotForex Economic Calendar

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.