FX News Today

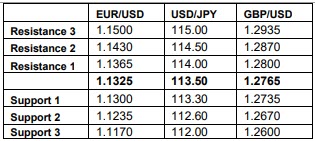

FX Action: USDJPY has settled around 113.50 after printing a 12-day high at 113.65 yesterday. Most Yen crosses have seen a similar price action, remaining generally buoyed but off yesterday’s highs and remaining in narrow ranges so far today. The JPN225 closed 0.64% higher in what was a mixed session on Asian bourses, with Chinese stocks again underperforming, despite a solid rebound on Wall Street, where the USA500 closed 1.55% for the better. Markets are looking ahead to Friday’s Trump-Xi meeting, though the former said on Monday that it is highly unlikely he will delay trade tariffs on China, with the tariff rate set to jump to 25% on $200 bln worth of Chinese goods imports in January, while threatening to put tariffs on a further $267 bln worth of Chinese imports. USDJPY fundamentals (yield differentials and the associated contrast between Fed and BoJ policy paths) remain supportive, though periodic episodes of risk aversion have been an intermittent offsetting bearish force.

Asian Market Wrap: 10-year Treasury yields are down -0.2 bp at 3.052% and JGB rates climbed 0.8 bp to 0.085%, as Asian stock markets struggled to maintain the optimistic mood from Monday. US President Trump dampened hopes of progress in US-Chinese trade relations at the G-20 meeting and said in an interview with the Wall Street Journal that he expects to move ahead with raising tariffs on $200 billion of Chinese imports to 25 percent from 10 percent currently. Trump said it was “highly unlikely” he would accept China’s request to hold off on the increase. Trump also said Apple’s iPhones could be hit by new tariffs. The Hang Seng, which outperformed yesterday, lost -0.33% today. The CSI 300 is down -0.28% while the Shanghai and Shenzhen Comp are down -0.19% and -0.01%. The ASX outperformed with a gain of 1.00%, but overall stocks outside of Japan are swinging between gains and losses in muted trade, while US futures are slightly lower, and oil prices appear to have stabilised above USD 51 per barrel.

Charts of the Day

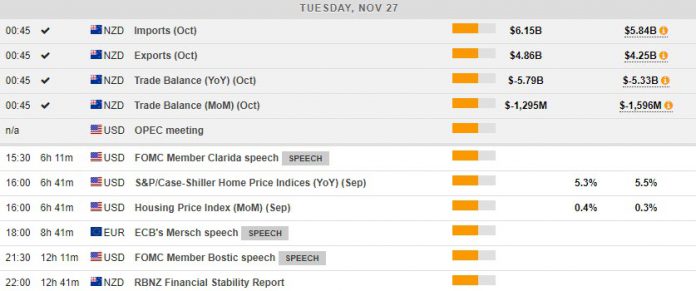

Main Macro Events Today

- FOMC Member Clarida Speech – Ahead of the Fed meeting in mid-December, FOMC Member and Vice Chairman of the Board of Governors Richard Clarida is set to speak at the Clearing House and Bank Policy Institute Annual Conference.

- Case-Shiller and Housing Price Index – The main housing indices are expected to show relatively mixed signals, with the Case-Shiller index expected to record a slower growth rate at 5.3% compared to 5.5% last month, while the Housing Price Index is expected to register a 0.4% growth compared to 0.3% growth.

- Conference Board Consumer Confidence – The Conference Board Consumer Confidence Index is expected to come out less positive than last month, at 136.2 compared to 137.9 although still registering signs of strong growth in the economy.

- New Zealand Financial Stability Report – The financial stability report provides insights into the Reserve Bank of New Zealand’s view of inflation, growth and general economic conditions in the country.

Support and Resistance

Click here to access the HotForex Economic Calendar

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.