EURUSD, H1

Italy sticks to spending plans, according to Prime Minister Conte, who said the upcoming negotiations with the EU won’t be easy as the government intends to stick to its pending plans. Conte said he tole EU’s Moscovici that “social stability counts more than that of finances”. Italian bond yields continue to back up on the report, after already starting to move higher again amid a flurry of headlines first suggesting that the deficit target may be lowered, then questioning this again. The 10-year yield is up 0.8 bp at 3.293%, the ripple through to the EUR pulled EURUSD down sub 1.1270 and EURJPY under 128.25. The slightly weaker than expected German GfK added to the downside bias for the common currency. Richard Clarida’s speech yesterday added to the USD bid, could Governor Powell later today, cool the USD gain? Consensus is that he will re-iterate the gradual approach to rate hikes over the coming months with the emphasis on the data. Currently the CME Group has the chance of a rate hike at the next FED meeting back close to 80% at 79.2%. Details can be found here http://goo.gl/ajJkYa

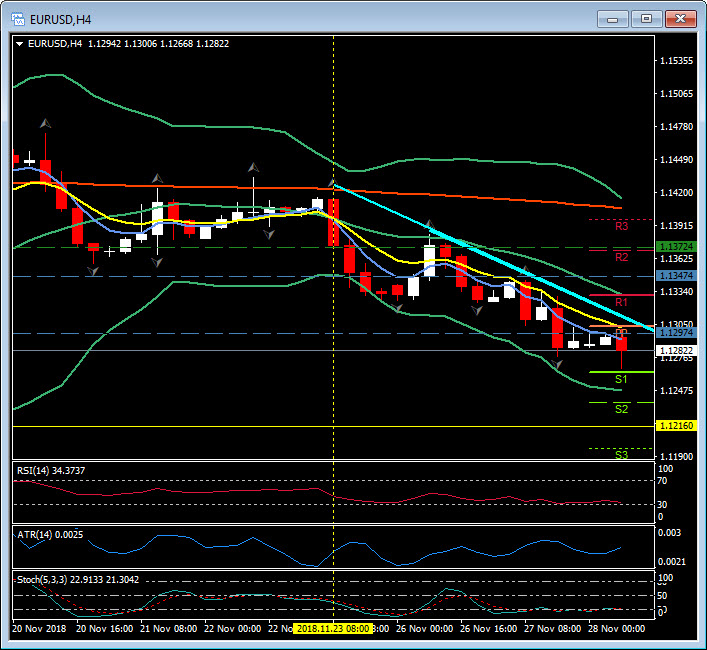

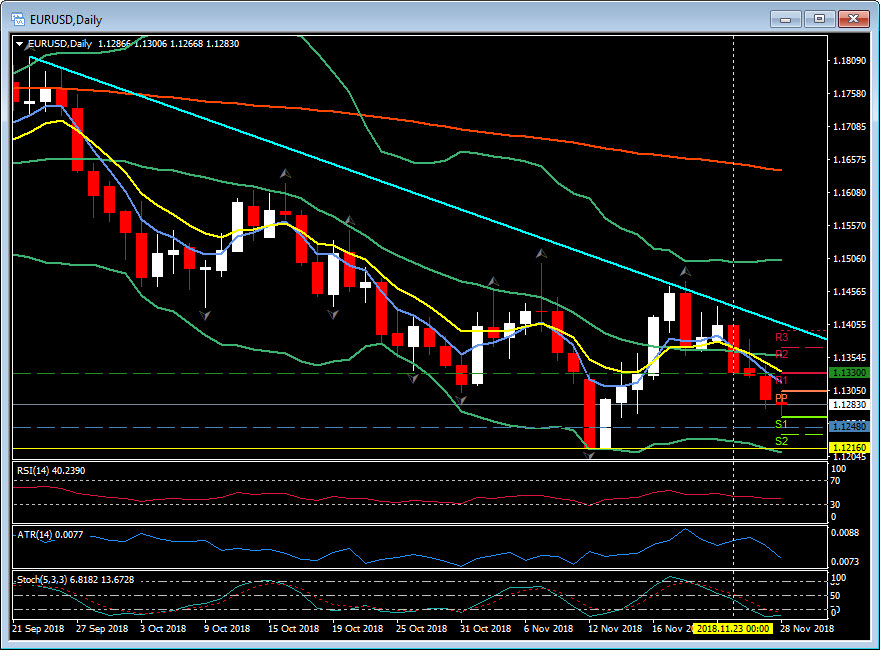

EURUSD remains under its 20 day moving average, with the current month low sitting at 1.1216 (November 12). The H4 and daily time frame turned lower again last Friday (November 23) following a flirt higher the previous week to 1.1450.

Click here to access the HotForex Economic calendar

Stuart Cowell

Head Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.