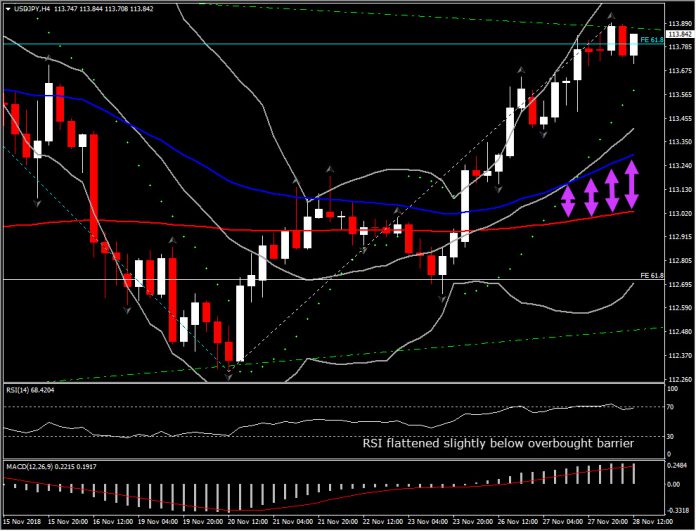

USDJPY, H4

Yen softness has been the main theme so far today, with most Dollar pairings remaining in narrow ranges and comfortably within yesterday’s ranges. USDJPY is trading firmer, concomitantly with a rise in global stock markets, with the pair posting a 2-week high at 113.90, which was seen after Trump threatened to blanket rise in car import tariffs to the US.

AUDJPY and other Yen crosses have also lifted. The main Chinese share indexes have gained over 1% while USA500 futures are up in overnight trading, extending the 0.3% gain seen in regular trading on Wall Street yesterday.

The Trump administration’s economic advisor said there is scope for a possible “breakthrough” in US-China trade relations at the dinner meeting scheduled on Friday between Trump and Xi, while the Chinese ambassador to the US said in an interview with Reuters that Beijing will not use US Treasuries as a trade weapon. These helped lift sentiment, though markets could be set for some heightened volatility should Trump and Xi fail to deliver.

USDJPY’s fundamentals (yield differentials and the associated contrast between Fed and BoJ policy paths) remain supportive, though periodic episodes of risk aversion have been an intermittent offsetting bearish force.

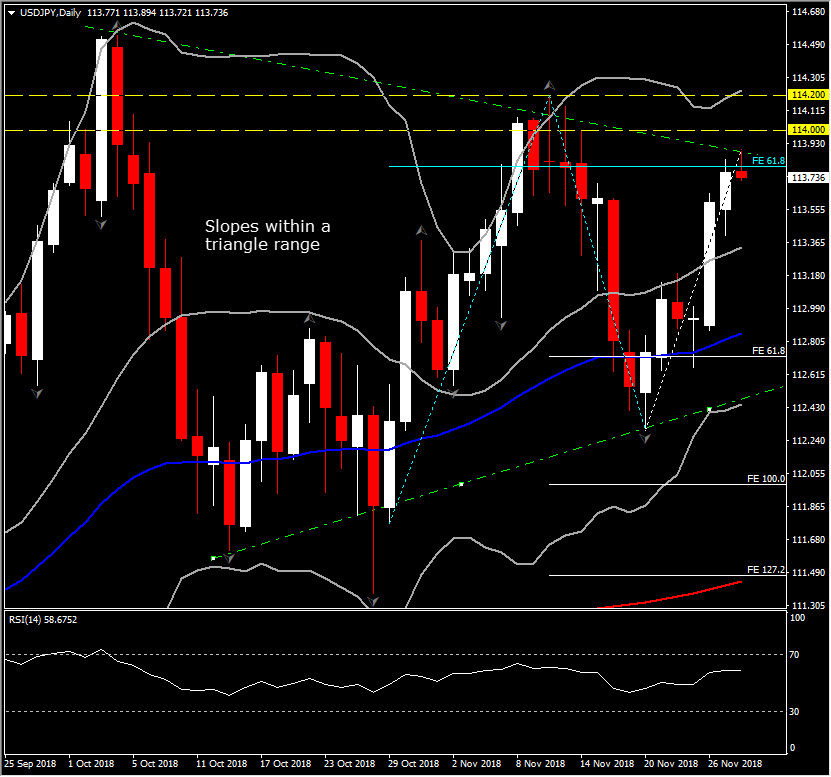

So far today, the pair remains above 113.70, retesting the upper line of the triangle formed since October. The retest of the upper line traditionally alerts to the potential reversal of the price, however technically, the bullish picture for USDJPY remains in both the intraday and daily timeframe.

In the 4-hour chart, the asset is trading above all moving averages, with the gap between 20-, 50-period MA and 200-SMA rising. MACD lines are increasing above signal line and neutral zone, whilst RSI slopes towards overbought barrier again. In the near-term, USDJPY holds Resistance at 114.00-114.20 area, and Support at 113.40-113.65 area.

The Resistance area represents the round 114.00 hurdle and November’s top. Therefore if the asset reaches this area, then this could reflect the potential retest of year’s top at 114.50.

Oppositely, a reversal to yesterday’s low and just a breath above 20-day SMA, could turn the outlook to a negative one again. In this case the doors towards 112 area open again.

Click here to access the HotForex Economic calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission