Recent news suggest that Donald Trump could impose a 25% tariffs on import duty on car imports from all countries except Canada and Mexico as of next week, after the G20 meeting. This would come against the White House’s pledge not to move forward with imposing tariffs on the EU or Japan as long as progress is made on the trade talks.

Auto producers did not respond well to this news: Daimler experienced a 3.1% drop in its stock price yesterday, while Volkswagen (Volksw) shares dropped by an impressive 4.5%. Following these developments, the Euro also depreciated by 3%, despite the EU50 maintaining Monday’s earnings.

The impact on the automakers may not be as large as discounted by the markets though: Daimler already operates a vehicle plant in the US and has another commissioned production and assembly plant in the country, while it also operates a joint venture in the US and one in Mexico which would also be unaffected by the tariffs. In a similar manner but to an even greater extent, Volkswagen operates one production plant in the US and four additional ones in Mexico. In the era of globalisation, it is important to remember that many companies already have a large manufacturing presence in their core markets.

The difference between the magnitude of the market reactions can be assessed via the significance of the United States as a market: US sales have been declining for Daimler, registering a 6.7% drop in the January-October period, while overall sales were boosted by impressive growth in Asia. Volkswagen on the other hand is seeing its US sales increase, most likely due to a rebound after the Dieselgate scandal.

With short-term MA below the longer-term MA, but with the potential for crossing it, Daimler’s stock price appears to be headed towards the EUR50.96 Resistance level (Fib. 23.6%) in the 1-hour chart, which is also supported when using the last two days’ price movements, and could become the next Support level if the price crosses it, with the potential of reaching the Fib. 38.2% level at EUR 52.13, with another strong Resistance level at EUR 51.45.

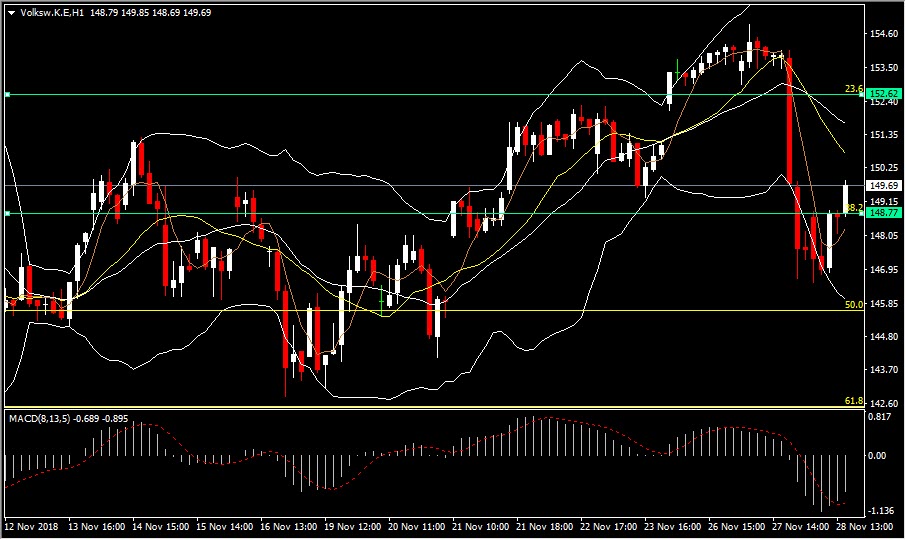

Perhaps due to the sharper drop in price, the Volksw share price rebounded in the European opening, closing above the Fib. 38.2% (EUR 148.78) from the October 25 low at the time this article is written. The next Resistance level should stand at approximately EUR152.61 (Fib. 23.6%), a path which is also supported by the upward movement of the short-term MA towards the longer-term MA. However, when the last two days’ movements are taken in consideration, the next Resistance level is found at EUR 149.72.

Click here to access the HotForex Economic Calendar

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.