The week of December 3 will be packed with data releases, though information on the labor market will likely be the focus. Another solid increase in payrolls is widely expected, with the jobless rate remaining at a 49-year low. The trade deficit should widen in October while the ISM and ISM-NMI should respectively rise and decline, overall remaining at high levels. Michigan sentiment should improve in early December. Meanwhile, construction spending is seen rising but with a decline in factory orders. Vehicle sales should slow in November and productivity should be unrevised. Wholesale inventories are expected to rise and consumer credit should post another increase.

As the highlight of the week will be Friday, the market is turning its attention as usual mainly on the NFP number. Nonfarm payrolls are seen rising 215k after a solid 250k increase in October. Year to day, payrolls are averaging 213k, up from 182k in 2017 and 195k in 2016. The unemployment rate is expected to remain at a 49-year low of 3.7%. Average hourly earnings should rise 0.2% for a y/y gain of 3.1%, steady from October which was the firmest pace since April 2009. Overall, the labor market should continue on its current strong path over the coming months.

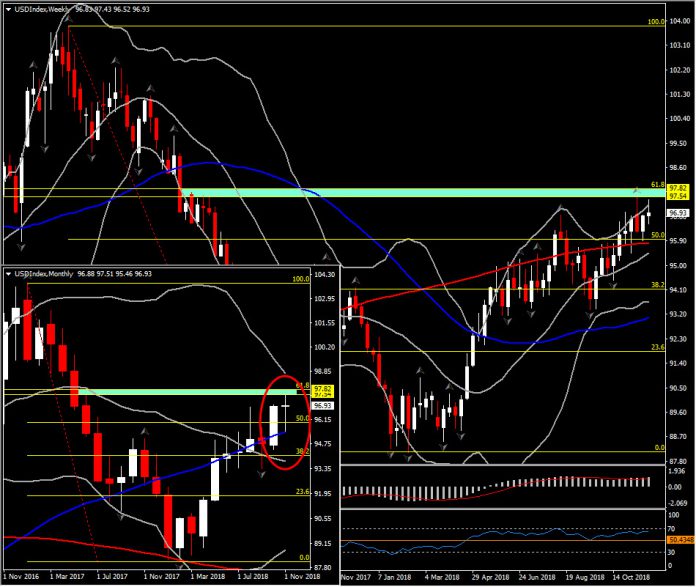

However as it is the beginning of a new month, it will be interesting to watch the performance of the most significant currency in the world, the Dollar. The USDindex has been in a constant incline during 2018 after the rebound from 3-year lows on January 16, at 88.13. However currently the asset is at a key Resistance area, as it is trading just 0.80 below 61.8% Fibonacci retracement level set from 103.80 high.

A strong push above this Resistance area could raise hopes for the continuation of the year’s upwards movement and turn the attention towards 2017 highs. The next Resistance levels on the break of this key area area 99.00 and the psychological 100 level. Immediate Support holds between the 200-week SMA and the 20-week SMA, at 95.40-95.80 area.

However there is a lot of uncertainty over in the US right now, ahead of the G20 meeting in Buenos Aires after so many mixed signals from Trump the past couple weeks on the potential for a trade deal. The Goldman report suggests that escalation of the trade war will be the most likely result of the Saturday Trump-Xi dinner, though the recently signed USMCA deal suggests there is precedent for a positive surprise. On the other hand, China skeptics Navarro and Kushner are on the US guest list.

Meanwhile, the dovish turn by Fed’s Powell may help backstop stocks, with Fed’s Williams to discuss a future downturn in the global economy. The markets continue to forecast a 25 bps hike in the funds rate target at the December 18 meeting, to 2.25% – 2.50% and the Fed may be seen downgrading dots to two tightenings in 2019.

Technically the outlook is bullish for USDIndex, but the fundamentals may reverse it during December. A retrace from 61.8% Fib. level, i.e. 98.00 level, may switch the outlook to negative one and drive the asset towards the next Support area at 3-month lows, at 94.00-94.30 area.

Click here to access the HotForex Economic calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.