Big news yesterday was that the US Yield Curve had inverted. What this means is that the long term bond yield is now lower than the short term bond yield and hence their subtraction is negative. This is big news given that inverted Yield Curves are usually good predictors of recessions, as the late-2007 experience showed, even though its relative accuracy is not that great: researchers have found that the recession has come in as little as six months, or as long as two years.

In our introduction to yield curves, about two months ago we noted that the idea behind the use of a Yield Curve is to measure investors’ perception of risk and future developments both in the bond market as well as in the overall economy. Short-term bonds should carry lower yields than longer-term ones because lending to someone for a shorter period of time is less risky for the investor. As such, Yield Curves should be positive.

However, in times of fear regarding the future of the economy, investors seek the safety of longer-term bonds for their funds. Lower growth or recession mean lower or even negative stock market returns for investors. Given that no investor wishes to experience this, they turn to the bond market, where the return from holding a bond is secured until maturity. Furthermore, given the uncertainty with regards to when the recession will take place and how long it will last, investors tend to put their money in longer-term bonds. The rationale behind this move is that if a bond reaches maturity then the investor will have to replace it with another bond. If this takes place during a recession then the new bond will have a lower return than the one the investor was holding because many others would also want to move their funds to safer assets. As such, it is easy to see that investors would much rather secure their money in a longer-term bond and rest assured that their returns are safe.

This behaviour means that demand for these bonds increases and yields subsequently decline, leading to a greater than expected reduction in longer-term yields, forcing them lower than shorter-term ones. As such, fear regarding the economy’s future results in an inverted yield curve.

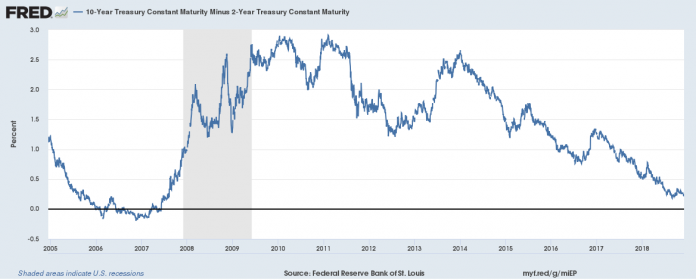

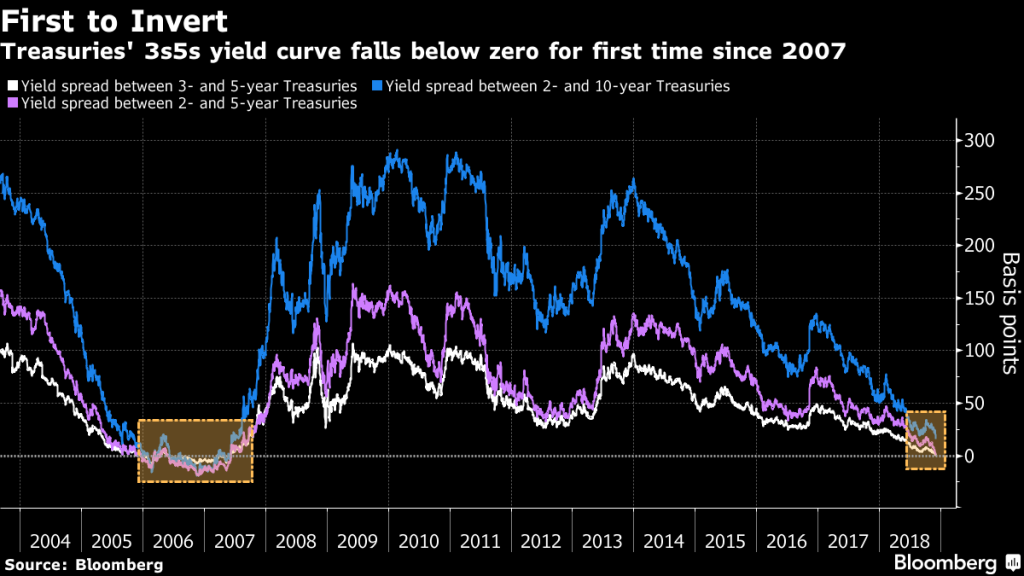

Yesterday, the 5-year bond yield was lower than the 3-year yield for the first time in more than a decade. However, notice that this is a very early indicator for a recession, as the last time this occurred it was more than 25 months before the actual recession. The next candidate for crossing the zero line is the 2- and 5-year yield curve, while the most important one, the 2- and 10-year, is still holding up (see figure below). Nonetheless, this is most likely because of the increase in the US government debt, which forces yields up as the supply of bonds increases, more than offsetting the decrease due to the move in safer assets.

Thus far, we’ve got high government debt, Yield Curves either close to zero or below it, and the Fed at an already low policy rate and holding a huge chunk of government debt, which means that if things go south there are really very few policy options to tackle this.

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.