GBPJPY & EURGBP

The main movers today have been the Dollar, which has declined concomitantly with Treasury yields as markets recalibrate the Fed policy outlook, the Yen, which has attracted a safe-haven bid as the US-China trade “truce” faded and global stocks turned lower, and Sterling, which spurted a big figure higher versus the Dollar on Brexit-related news.

Cable surged by a big figure to a 3-session high of 1.2840, GBPJPY spiked to 144.75 from 143.91 bottom,while EURGBP dove by nearly 50 pips in making a low at 0.8889.

The Pound’s gains were sparked by Brexit related news, with a report today suggesting that the UK should be able to unilaterally revoke Article 50 and remain in the EU if it so desires. This is the non binding opinion by the Advocate General of the EU’s Court of Justice, and has been taken as a buying cue as it suggests there is a way back for the UK if there is a second referendum on EU membership, and the public then decides to remain (even though EU leaders have repeatedly stated that the door remains open for the UK to reverse the Brexit process).

BoE Governor Carney also made a speech earlier, where he repeated that the UK finance sector is prepared for, and will survive, any Brexit scenario — including a disorderly no-deal scenario.

The Pound still remains down by an average of 1.8% versus the Dollar, Euro and Yen from month-ago levels and is maintaining what has been estimated to be a 12-14% Brexit-related discount in trade-weighted terms relative to what would have been likely levels had the 2016 EU vote been in favour of remaining in the union. The major focus in the UK is on the House of Commons vote on the Brexit deal, next Tuesday. It still looks likely to be voted down, despite the best efforts of Prime Minister May and her allies to sell it. If it is voted down, and if PM May is taken down by a parliamentary no confidence vote, then a new general election will be on the cards. If May did survive a no confidence motion, then a second EU referendum would be likely.

GBPJPY

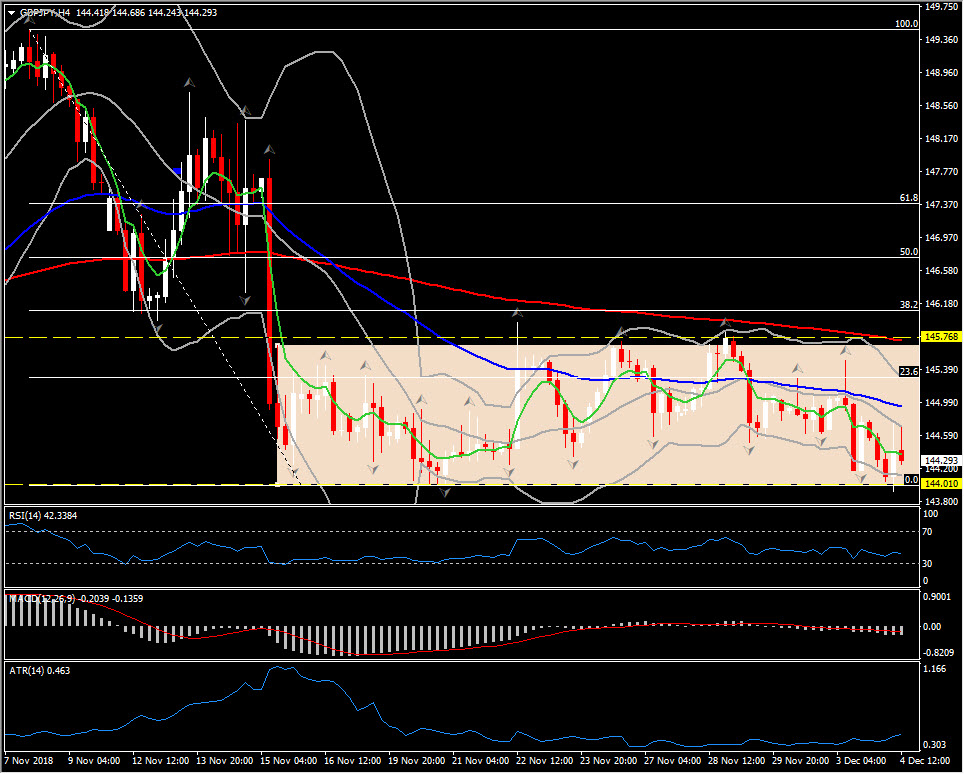

In the forex market meanwhile, GBPJPY retested its 144.00 bottom during the London open, before rebounding up to 144.75 on the news announcement as stated above. The pair has been in a ranging market since November 16, and seems unable yet to provide a clear direction in the medium term. However the near term picture supports the negative outlook for GBPJPY, as it is bearish for the 4th consecutive day.

The momentum indicators in both 4-hour chart and daily chart, present a neutral to negative picture in the short term. RSI is slipping lower from its 44 high so far today, while the MACD oscillator holds negatively below signal line but very close to neutral zone, suggesting that there is still indecision in the market.

Hence a continuation of the downside movement along with a confirmed closing today below 144.00 Support level, could open the doors to the 143.00-143.30 area.

The upside swing could find immediate Resistance at the confluence of day’s peak and 50-period EMA at 144.90. If the pair sustains its move above this hurdle, the next handles are between yesterday’s peak and the confluence of the 10-day Resistance, 20-day SMA and 50-day EMA, at 145.50-145.80 area.

As for the EURGBP cross, as mentioned in our report on November 20, the pair is struggling to sustain any gains above October’s peak which has been retested 3 times since then. The break of the triangle on November 19 and 29, raised hopes for an increase of the bullish bias, however only a decisive break of October’s peak at 0.8940 strong Resistance level, would suggest the retest of the 0.9030-0.9085 barrier. Immediate Support is set at yesterday’s low at 0.8860, and the next Support is at 0.8830, which coincides with the -week Support area and the 200-day SMA.

In the 4-hour chart, the pair rebounded from 0.8888 low and is likely to retest the 0.8940 barrier again. Support is set at the 20-period SMA, at 0.8905. On the break below this Support level, the next handles are between 0.8875-0.8888.

Click here to access the HotForex Economic calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.