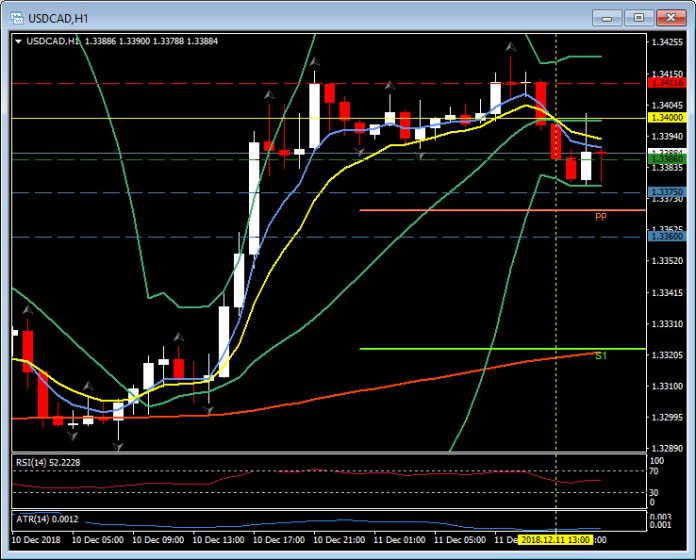

USDCAD, H1

Today’s US PPI report revealed slightly stronger than expected gains in November of 0.1% in the headline and a 0.3% in the core index that left y/y readings at 2.5% and 2.7%. The rise reflected a 0.3% gain in services prices but a 0.4% decline in goods prices, with the latter depressed by a 5.0% decline in energy prices that included a 14% plunge in gasoline prices. Expectations are now for:

- A flat December PPI headline reading and a 0.1% in core prices for y/y gains of 2.5% and 3.0%.

- A flat reading for headline CPI and a 0.2% rise for the core.

- A flat November PCE chain price figure with a 0.1% core price gain.

- A 1.7% drop in November trade price reading for imports and a 0.5% decrease for exports.

The data are still tracking a pull-back in headline y/y inflation due to easy comparisons, and the November oil price plunge has introduced a new downdraft in the inflation metrics as we approach 2019.

USDCAD has turned down from the key 1.3400 resistance level earlier in the day. Support is the daily pivot at 1.3368 and the 200-period moving average and S1 at 1.3325. Correspondingly, US has rallied over 2% today from morning lows at $50.80 to R1 and the 200-period moving average at $52.20.

Click here to access the HotForex Economic calendar

Stuart Cowell

Head Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.