European stock markets struggle ahead of ECB decision.

The stock rally in Asia that was underpinned by improved confidence on US-Sino trade talks failed to give a lasting lift to European markets, with GER30 and UK100 unchanged from yesterday’s close. Investors remain cautious ahead of the ECB decision and the EU summit, where UK PM May will be trying to get further concessions from EU leaders after surviving the leadership battle yesterday.

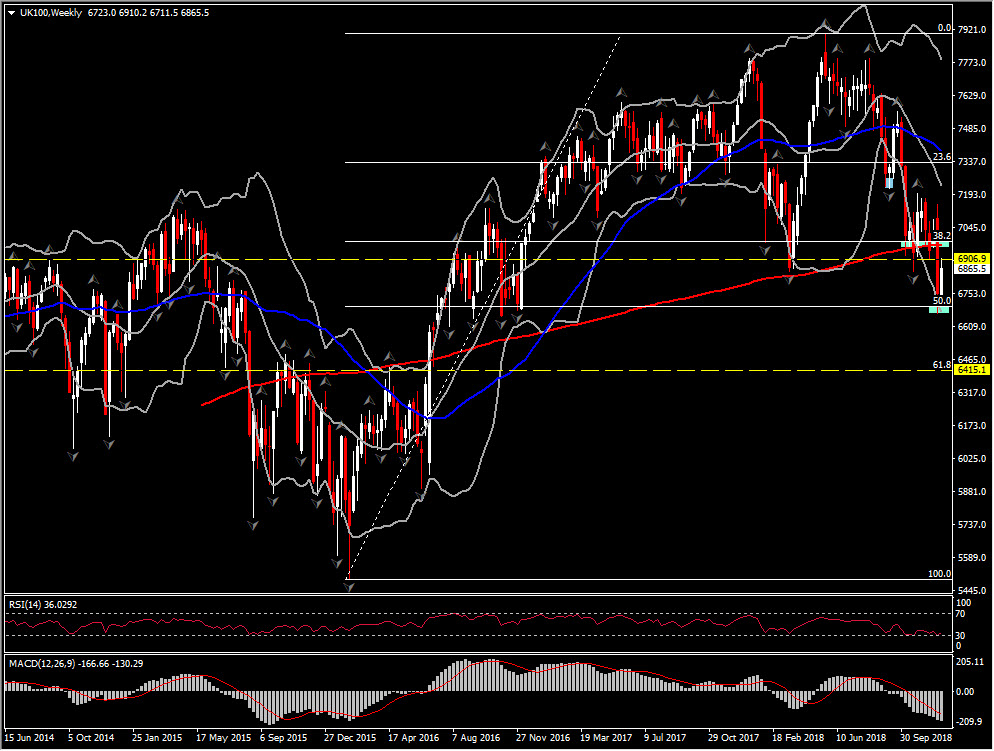

Interestingly, along with Pound discount during 2018, we have seen so far UK100 moving lower for 5 consecutive months, after rejecting all-time record high at 7903 in May.

Currently is trading below the 6900 area, returning more than 38.2% of 2-year gains, after a 9-week consolidation above this barrier. Hence the sharp pullback seen last week is considered to be significant as it drove UK100 below 200-week SMA and a breath above a strong Support area, at the midpoint of 2016-2018’s performance.

This could provide near- or medium-term Support for the pair, however the long term outlook remains negative for the asset, especially on the ongoing Brexit uncertainty. Hence in the medium term Support holds at 6668-6700 area. Further losses below this area could turn our attention in the long term to 6420, with immediate Support holding at the round 6600 level (61.8 Fib. level since 2016 low). Weekly momentum indicators support the increase of negative momentum, as RSI remains below 50 and MACD is extending further to the downside below signal line, supporting the continuation of the negative outlook for FTSE.

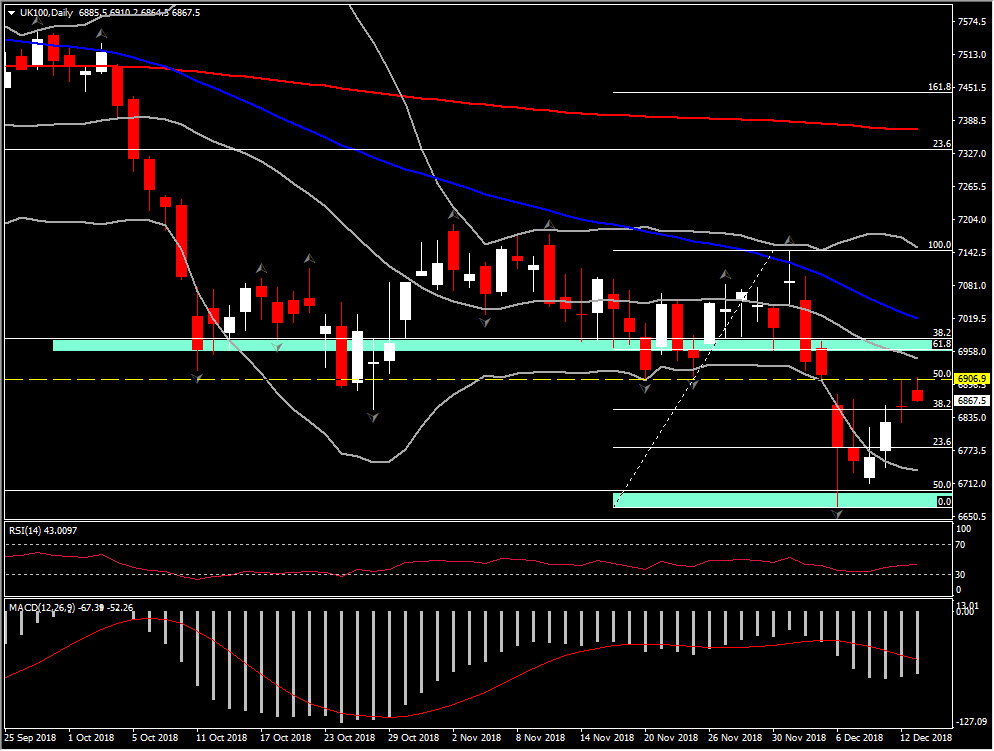

In the short term nevertheless, the UK100 rebounded this week from year’s low, however yesterday’s doji candle along with today’s bearish move, suggest that a break of immediate Support within the day, below 6850, could imply the retest of the 6700 hurdle.

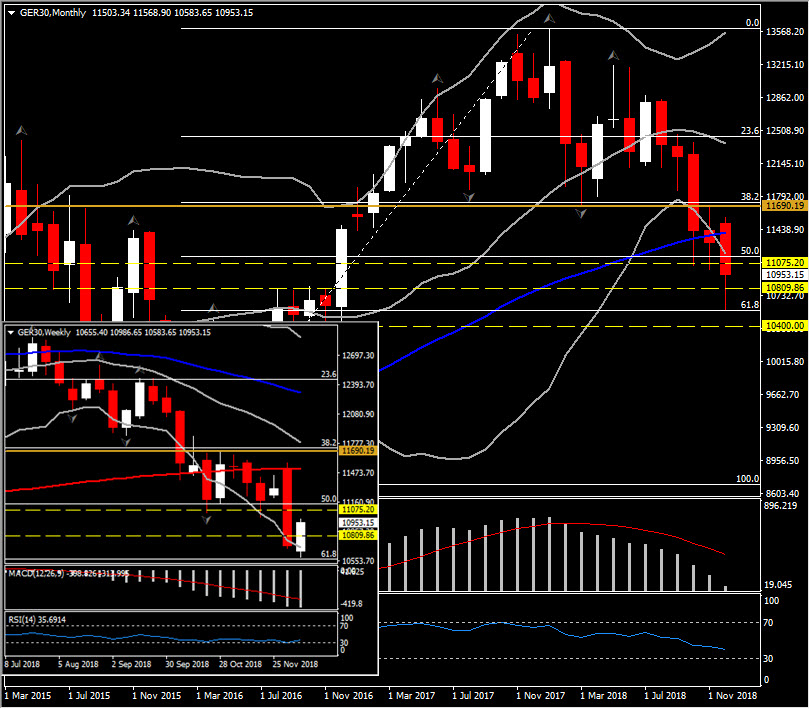

GER30 also triggered our attention, as in contrast to UK100, GER30 already crossed the 50% Fibonacci retracement level set since 2016 low. This along with the fact that the pair is sloping below 200-week SMA for the 5th week, adds further negative bias to the asset.

In the long term, the next Support area is for the asset is at 10400-10570, which coincides with the 61.8% fib. retracement level and the 5-month Support between August to December 2016. Resistance is set at the trend-line of Head and Shoulders formation, at 11690 (see weekly or monthly chart).

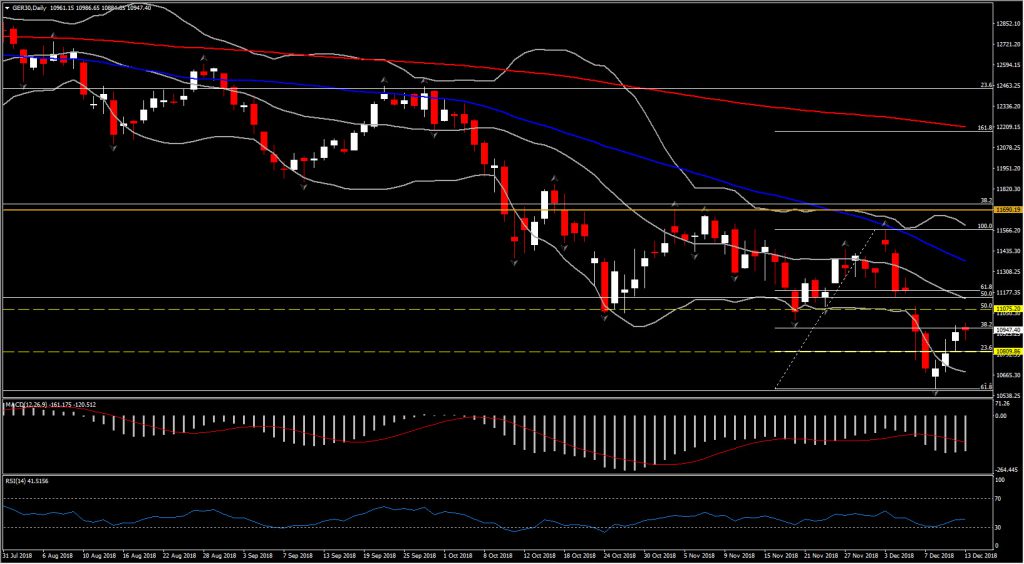

Meanwhile, in the short term, similarly to UK100, GER30 recovered slightly giving some hopes for an upside movement. However the big test remains on the 11000 Resistance level. A breakdown of this level along with a move above last Thursday’s open – which is an old support that has turned into a new resistance, at 11095, could switch the near-term outlook into positive. A break of this Resistance could imply the retest of December’s peak at 11566. Immediate Support holds at yesterday’s low, at 10809.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.