FX News Today

- The 20-year Treasury yields are down -1.3 bp at 2.814%, as the sell off in stock markets, continued during the Asian session. Topix and Nikkei are down -1.99% and -1.82% respectively.

- Dovish RBA minutes: No strong case for a change in monetary policy.

- China’s President Xi Jinping offered no fresh stimulus plans or a further opening of the economy in his keynote speech marking 40-years of Chinese reforms.

- Concern rises over the outlook for Chinese and World Growth amid ongoing trade tensions weighing on sentiment.

- US stock futures are slightly higher though as the Fed decision comes into view, with Powell expected to confirm that the central bank will switch from autopilot to data dependency on rate hikes after the widely expected move this week.

- USA500 closed at the lowest level in 14 months.

- Oil prices declined and the WTI future fell back to $48.93 per barrel, as risk of demand destruction hits prices.

Charts of the Day

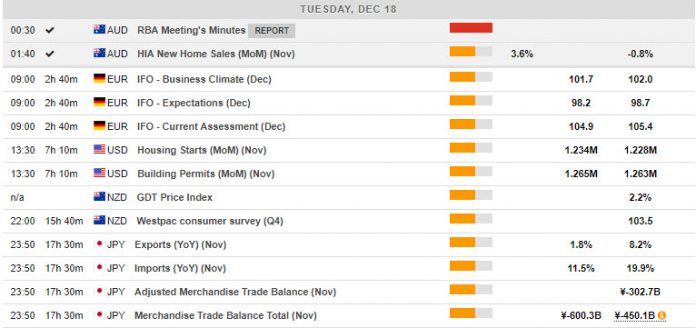

Main Macro Events Today

- German Ifo Business Climate – Expectations – To fall back to 101.7 from 102.0 in November, with the expectations reading, in particular, under pressure. The manufacturing sector is looking shaky again amid fresh challenges for the automobile sector, which continues to struggle with emissions standards and the lingering diesel scandal, which has considerably undermined confidence, especially in Germany where consumers are facing driving bans without compensation from producers.

- US housing starts – Expectations – They are estimated slipping 0.2% to a 1.225 mln pace in November, after a 1.5% gain to 1.228 mln in October.

- Canadian Manufacturing shipments – Expectations – They are expected to rise 0.5% in October after the 0.2% gain in September.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.