USDCAD and GBPCAD

Canadian Yields tipped marginally lower after October GDP overshot projections but retail sale came in on the soft side of expectations. USDCAD spiked to 1.3562, after breaking day’s Resistance at 1.3541.

Canada GDP rebounded 0.3% in October after the 0.1% decline (m/m, sa) in September. The increase in October overshot expectations. Goods producing industries saw a 0.3% gain in October, while a 1.0% bounce in wholesale production was the driver, as expected. This consider be an upbeat report that starts Q4 GDP off on a solid footing for Canadian economy.

Meanwhile, Canada retail sales grew 0.3% in October after the 0.1% rise in September (revised from +0.2%). A 1.3% increase in motor vehicle and parts dealers, alongside a 1.9% climb in gasoline stations drove the pick-up in total retail sales values during October, as expected.

While the GDP report steals this report’s usual thunder, the lack of growth in total sales volumes does suggest consumption may be on the soft side in Q4.

The duo of reports does not threaten the expectations for no change from BoC in January or March, but the firm October GDP does provide some support for an April rate increase of 25 bps.

Nevertheless, as Fed has shifted to a lower tightening trajectory, oil prices and other industrial commodity prices tumbled to fresh trend lows on global growth concerns. Hence, this backstop, which looks likely to sustain well into 2019, should keep USDCAD bias towards the upside.

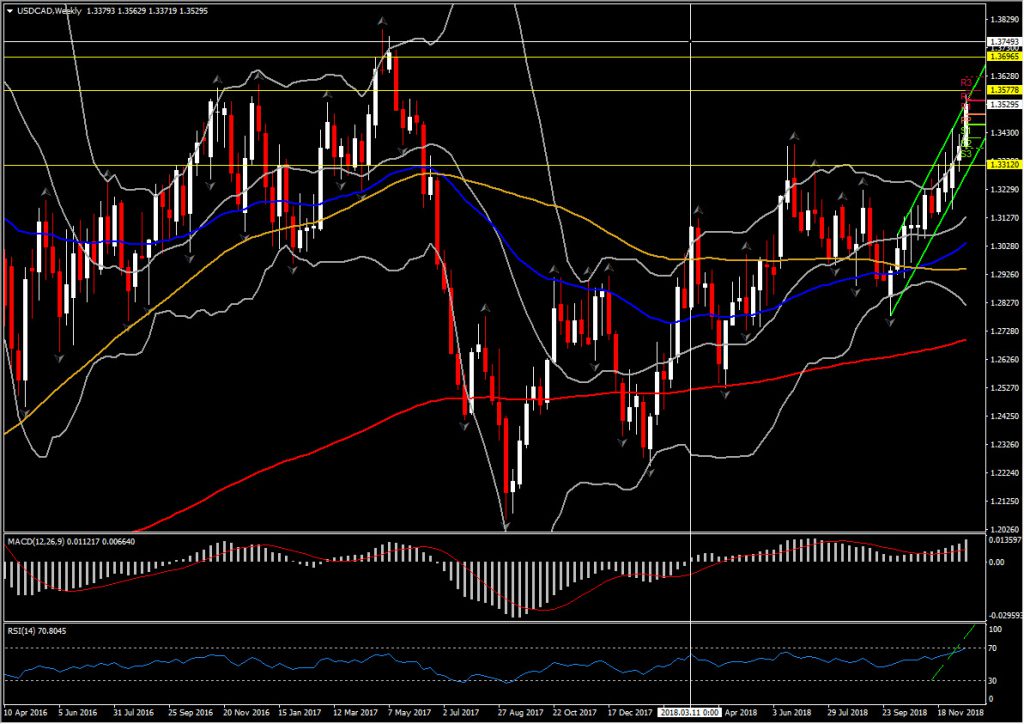

The Support for USDCAD remains at the PP level and day’s low at 1.3490. Next immediate Resistance comes at R2, at 1.3577. Overall, the 2017 high area at 1.3700-1.3793 provides an upside waypoint, as the asset remains in a strong bullish sentiment since October. The asset is trading to the upside for the 7th day, while is in an upchannel since October 10.

Similar picture presents the GBPCAD, as it perked up to 1.7160 high. The asset so far has a very strong week and month, as it moves above 20- and 50-day SMA since Tuesday. A break of the Resistance level at 1.7170, could suggest the retest of 3-month Resistance hurdle at 1.7250-1.7285, which coincides with 200-day SMA and teh latest 2 weekly up fractals. Support comes at 1.7090, while next once stands at the round 1.7000 key level.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.