BOJ Governor Haruhiko Kuroda reiterated to parliament, that ultra-loose monetary policy should be maintained for now. Consumer inflation is expected to continue to slow next year and beyond, after surging above its 2% target this year, due to soaring energy prices.

Nonetheless, Kuroda noted that when the time comes, the BoJ will plan a way out of the easy policy. The key is how to raise interest rates and reduce the BOJ’s expanded balance sheet. The BOJ could combine multiple means and ensure markets remain stable in executing a smooth exit from policy that is easy, but it won’t be simple. Regarding the depreciation of the exchange rate, Kuroda said a Fed rate hike may not necessarily weaken the Yen, if stock prices remain weak.

In the same parliamentary session, PM Fumio Kishida said that a sharp yen movement was undesirable. While a weak Yen benefits exports and firms with overseas assets, it hurts households and some businesses with higher costs.

Technical Overview

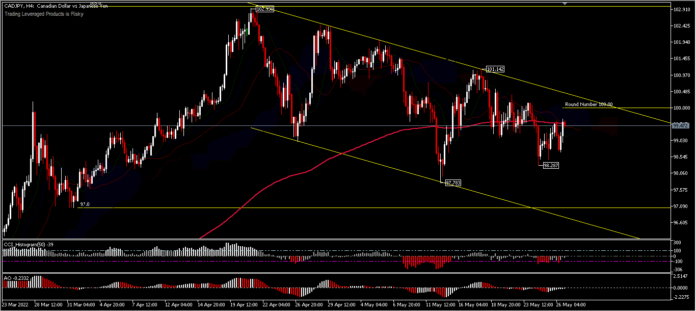

The CADJPY cross is trading in a limited range and has not yet broken out of its April price range, between 97.00 and 103.00. BoJ policy has not allowed the Yen to strengthen at this time. Meanwhile, the BOC in April already raised interest rates for the 2nd consecutive year, the largest in 20 years, with plans to end the re-investment and effective quantitative tightening started last April.

The intraday bias remains neutral and the price position is at the 200-period EMA. The pair is struggling to change the main trend and so far, is trading below the 100.00 round-figure mark. A rally towards this figure could strengthen the bullish dominance and a break of the resistance at 101.14 could test the recent top at 102.93. On the downside, a move below the minor support at 98.28 could bring correction to the 97.00 low.

Note that it is important to gather additional positive momentum to help form a new bullish trade to hit the positive target on the upside. Meanwhile, a move below 97.00 could be the start of a short-term decline.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.