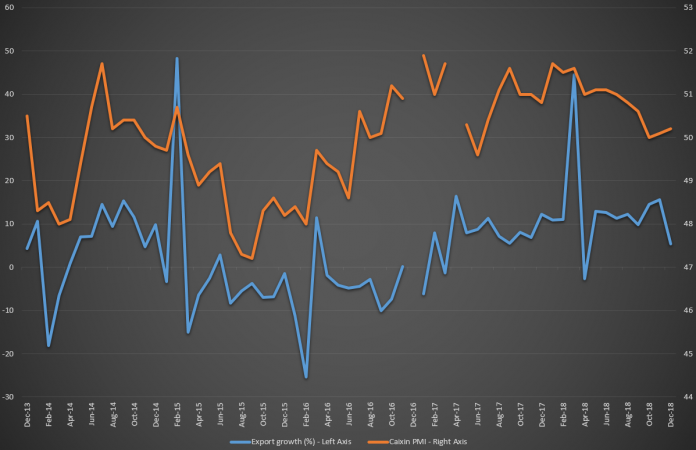

The first major piece of information in 2019 was a drop in China’s Caixin/Markit PMI to 49.7 in December, compared to 50.2 in November. This marked the first time the indicator fell below the 50.0 mark since May 2017, when it stood at 49.6. As the Figure above indicates, while the indicator is not new to the contraction region (i.e. below 50), a reduction which is also coupled with a significant slowdown in export growth can potentially cause problems for the Asian giant, especially if this is more related to demand cooling than the effect from tariffs.

This appears to be the case as the data suggest that, ironically, exports to the US increased by more than in the other major regions. At the same time, imports declined supporting the view that restocking is lower, especially at steel mills which have been overly hurt by the initial US tariffs. Still, China still boasts an overall huge $44.7 billion trade surplus, also aided by a weaker Yuan.

China is, at the moment, an economy which relies heavily on exports to sustain its growth. This modus operandi is not particular to the country’s idiosyncrasies but is the same as the economic model followed by developing countries throughout the world. Naturally, the more reliant a country is to inflows of capital from abroad, the more it can be hurt if these inflows suddenly pause: a prime example of this took place in Brazil, as the country experienced sharp GDP drops and high unemployment in the 2015-2017 period following a combination of large reductions in Foreign Direct Investment inflows and bad government policies.

Chinese authorities appear to keep in mind that such a situation may unfold and are taking steps to potentially ease off any effects from a tightening in the external environment. Over the course of 2018, the Chinese Central Bank cut bank reserve ratios four times, setting the ratio at 14.5% in October compared to 17% at the start of the year, in order to boost domestic consumption. The move was expected to put about 850 billion Yuan into the banking system.

The move could potentially provide the wrong incentives and further promote what appears to be a property bubble, with prices rising 31% since June 2015 and reaching levels which are nearly 40% higher than the US, where per capita income is more than 700% higher. There are reports of markets populated with unsold properties, with analysts suggesting that China’s property market is not so good any more, and some estimating that one in five apartments in Chinese cities sits unoccupied; the country’s largest state-backed investment bank expects a “year of recession” in 2019.

A drop in real estate sales necessarily implies a decrease in prices which should, in turn, have a bearing on the banking sector which already appears to be overextended. Non-performing loans (NPLs) stood at 1.9% in June 2018 and vary significantly across banks, reaching almost 15% in some cases. Still, the NPL definition in China is quite relaxed, as loans have to be overdue for more than nine months to be classified as NPLs, compared to just three months according to international financial standards. An early estimate, back in 2016, put the number of NPLs at 5%, even though this could be very conservative at this point in time, as Fitch ratings assigned a negative outlook on the sector, forecasting lower loans growth and higher NPLs.

Domestic developments have also come to the policymakers’ attention. The Communist Party pointed out today that regional economies need to reduce their reliance on the property market, while the continued depreciation of the Yuan, down 9.9% since May, has resulted in both making Chinese goods cheaper and the value of total inflows higher in local currency terms.

Still, commenting that reliance needs to be reduced and actually promoting a viable alternative are two different things. Furthermore, experience in both developed and developing economies has shown that a banking crisis is hard to prevent once a real estate bubble has been formed, and, in addition, the only way one can ease its effect is by injecting more money into the economy. This fight-fire-with-fire tactic would further depreciate the Yuan but, most importantly, it would perhaps shake investor confidence in the economy, pulling funds from the country collapsing the currency and easily reversing the trade surplus.

The only thing which could save the Chinese economy is its sheer size: despite the large possibility of a crisis, China is one of the largest growth markets for the majority of the world’s firms. At a time when the world is searching for opportunities a recession in China could actually pose a drag on corporate profits and lower valuations in the world’s stock markets. Still, the Asian giant could stand to lose much more as it is reliant on these corporations to provide work in the mainland, a result of the country’s need for exports and foreign inflows. Finally, China’s fall would not leave the world economy unscathed, as it could take much of the Asia-Pacific region down with it. Australia, given its important trade ties with China, stands to be one of the first and most important victims.

Click here to access the HotForex Economic Calendar

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.