Tomorrow’s release of the US December jobs report will be a big focus with markets primed for an outsized reaction in the event the report disappoints expectations.

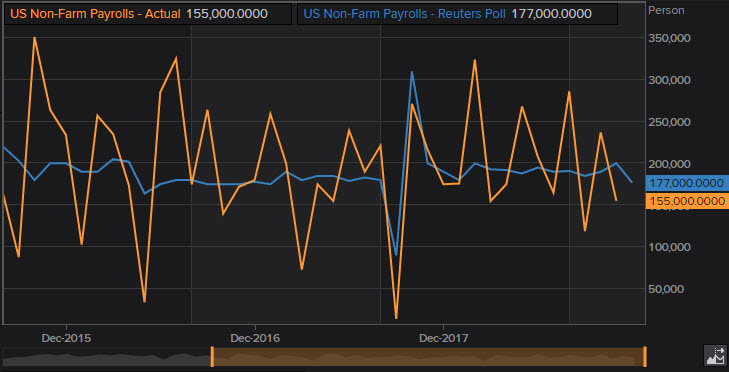

After a restrained 155k November increase that likely reflected survey week disruptions from the California fires and cold stormy weather elsewhere, a 177k December nonfarm payroll (NFP) rise is anticipated. A distortion reversal should lift the December workweek and hours-worked.

Despite high anxiety levels in financial markets, the outlook for job growth remains strong,

though claims have risen modestly and producer and consumer confidence has moderated somewhat recently. The vehicle sector should also lift employment in December, as the assembly rate ticks up despite an expected vehicle sales rate down-tick.

Meanwhile, today’s big ADP gain despite the spike in initial jobless claims for week ending on December 29, continue to add to the ongoing upside risk for the December employment report.

We saw a 271k December ADP rise that sharply exceeded 178K median expectations, with a 205k total BLS payroll increase, after a big downward revision in the November ADP rise to 157k from 179k that reversed the gap to the 161k private payroll increase for that month.

Figure: Thomson Reuters Eikon. (2018). [United States Non-Farm Payrolls, 2015-2018]. Retrieved January 03, 2019 from https://eikon.thomsonreuters.com/index.html

The ADP figures tend to be extra volatile in December,

and this may partly explain the out-sized gain. We have seen a solid 47k December rise for goods jobs that tracks still-firm factory sentiment readings despite recent down-ticks, with gains in factories and construction and loss in mining, alongside a much stronger than expected 224k service sector jobs increase. The “as reported” ADP figures have overshot private payrolls by 21k per month on average since the methodology change of October 2016.

US initial jobless claims jumped 10k to 231k in the week ended December 29, a bigger gain than forecast. This period marks the first full week of the government shutdown. Continuing claims bounced 32k to 1,740k in the December 22 week following the 3k increase to 1,708k. Some of the surge in initial claims was possibly a result of the government shutdown, while the holiday period is also notoriously volatile.

The four-week average for initial claims has a strong inverse relationship with the monthly payroll gain. These two series diverged through this expansion, but reconciled in 2014 for the first time since the recession, and have swapped places since then. Claims are now surprisingly tight relative to the rate of job growth likely due primarily to reduced labor market churn.

Today’s reporting period extends through day 8 of the government shutdown, and there is a likely lift from laid off private contractors that should extend into January. Federal employees are captured by a different series that is released with an extra one-week lag, and today’s report revealed a flat figure in the week that captured only the first day of the shutdown. A surge is likely in next week’s report as the shutdown continues.

In conclusion, following the healthy ADP print, though jobless claims ticked higher for the holiday week, and despite the fact that US government shutdown continues, markets keep anticipating a rise in the NFP number. A positive result could confirm 2018 as one of the best years for US Employment.

Click here to access the HotForex Economic calendar.

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.