The Pound extended yesterday its Friday’s gains, with a gain of +1.2% against the US Dollar. To date, the Pound has recorded +3.9% in gains against the US Dollar from its temporary low of 1.2154, meaning that it has reduced the previous month’s decline by 50%. The Pound fell sharply following the May Monetary Policy report in which the Bank simultaneously raised its inflation forecast but pushed back against market expectations for the number of rate hikes to come.

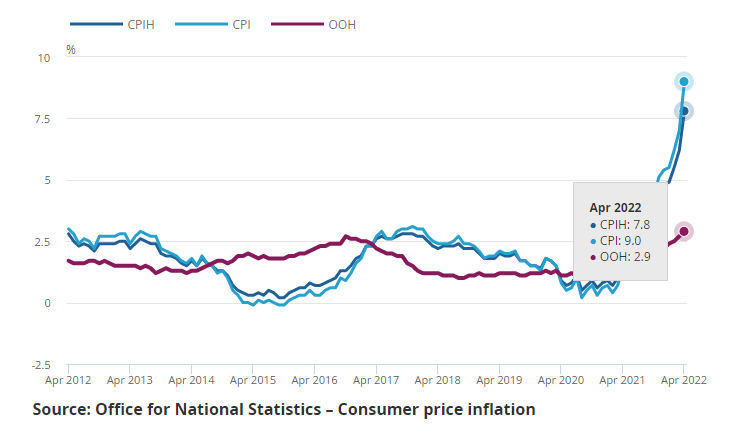

The BoE is considered to be too slow to react to inflation, because the BoE’s overly complex framework was designed during an era of low and stable inflation and is not suitable for a world of high inflation and uncertainty. The biggest inflation spike in 40 years has tested the BoE’s monetary policy framework for price stability. UK annual inflation is currently at 9.0% y/y through April, mainly due to soaring energy costs. On a monthly basis, consumer prices jumped 2.5%.

The main concern for the central bank at this point is whether import inflation is starting to affect domestic inflation, particularly through rising wages and the prices businesses charge for their goods and services. Domestically, however, the BoE may have to take on an additional burden, as Rishi Sunak announced a £15 bn spending increase, including a £5 bn cash handout to 8.4m households to avert a cost-of-living crisis. This assistance is to stimulate the economy, but on the other hand will add to inflationary pressures which, according to the market, will force the BoE to increase the current 1% interest rate to 2.25% in Q1 2023.

Technical Overview

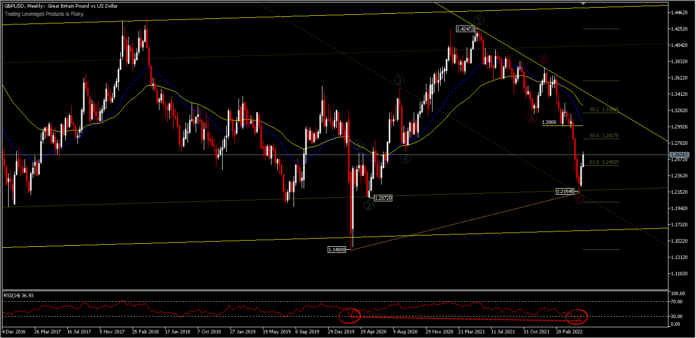

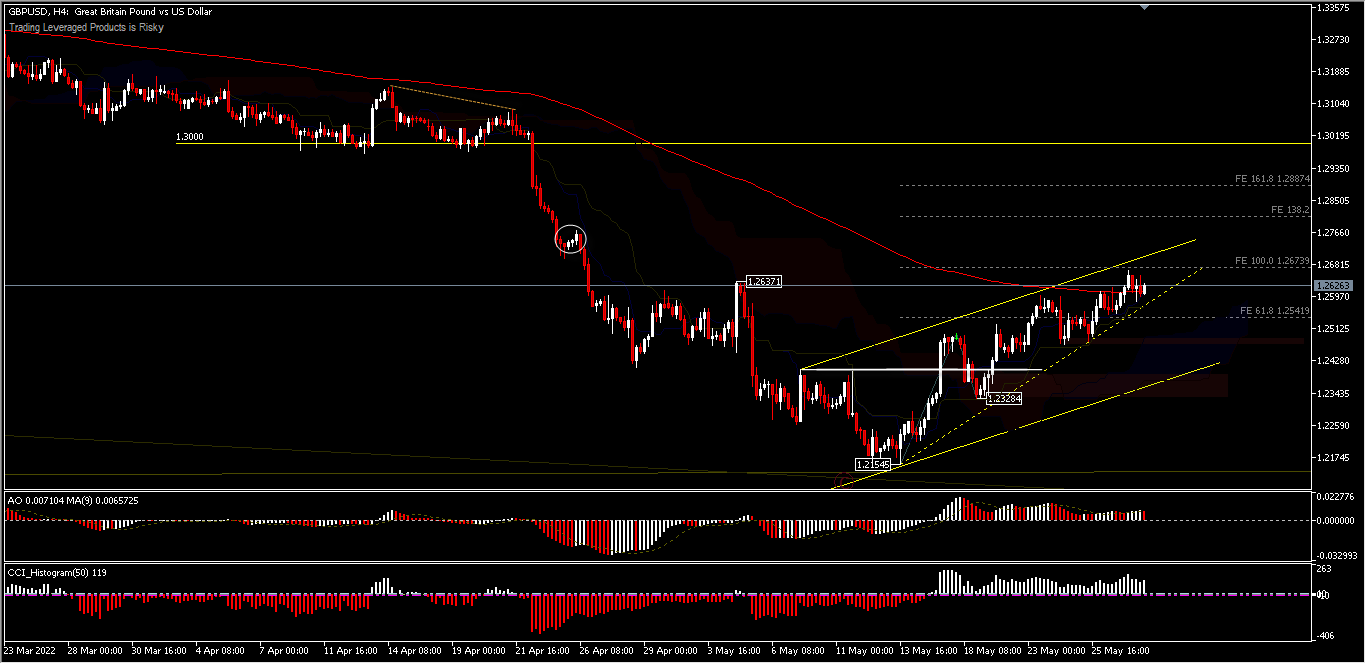

GBPUSD made a temporary rebound, before touching the support at 1.2072. Last week’s increase was a continuation of the rebound, recording a temporary high at 1.2665. Overall, the decline from 1.4247 still reflects that the UK economy has not recovered since the June 2016 Brexit.

The rebound from 1.2154 extended to 1.2665 last week. The intraday bias remains on the upside for the projections for FE 138.2% and 161.8% FR, in the case of another crucial break of the resistance at 1.2637. The upside barrier is likely confined to the psychological 1.3000 mark. This means, as long as the price is below 1.3000, the GBPUSD may still be dominated by bearish bias. A break of the 1.2480 minor support would turn the bias back to the downside, to test 1.2328 and the 1.2154 low. The oscillation histogram is still validating price movements even though the divergence looks faint, but currently the rising wedge pattern is in the middle of the 200-day EMA.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.