FX News Today

- Japan remained on holiday, but elsewhere in Asia bond markets got support from ongoing wobbles in equity markets, where a revenue warning from Apple hit holiday-thinned trade.

- The ASX managed a 1.36% gain, but the Hang Seng lost -0.81% and the CSI 300 is down 0.31%, with comments from the central bank, which once again promised measures to support small companies, helping to contain losses.

- US stock futures are sharply lower, led by a -2.7% decline in the NASDAQ mini future.

- Oil prices are also down on the day and the front end WTI is trading at USD 45.54 per barrel.

- European stock markets closed mixed on Wednesday after a rebound on Wall Street saw indices clawing back some of their earlier losses. However, a rare revenue warning from Apple revived concerns about the outlook for the world economy and hit holiday-thinned Asian markets, while sending US and European stock futures south.

- Investors are increasingly pricing out any further move towards policy normalisation from central banks and with tomorrow’s release of Eurozone HICP expected to bring a sharp deceleration in the headline rate, Bunds are likely to remain supported.

- Brexit jitters meanwhile continue to hang over UK markets with no sign that May has the majority needed to get her deal through the Jan 14 vote in parliament.

Charts of the Day

Main Macro Events Today

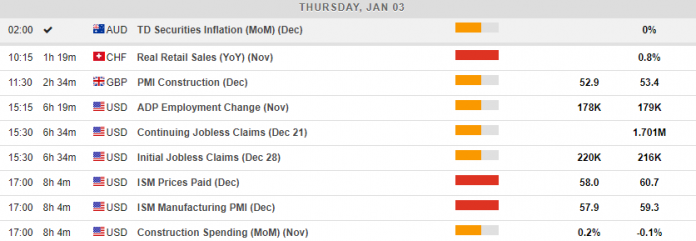

- UK Construction PMI – The UK Construction PMI is expected to come out at 52.9, compared to 53.4 last month, although the Manufacturing PMI came out higher than expected yesterday.

- US Jobless Claims and ADP Employment Change – Initial Jobless Claims are expected to have increased to 220K in the last week of December, compared to 216K in the previous week. ADP Employment Change for November is still expected to be positive, albeit growing at a slightly slower pace than October.

- ISM Prices and Manufacturing PMI – ISM Prices serves as a proxy for inflation and is expected to have remained above 50 but slowed to 58.0 compared to 60.7 last month. Similarly, the manufacturing PMI is expected to come out at 57.9 compared to 59.3 last month.

Click here to access the HotForex Economic Calendar

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.