FX News Today

- 10-year Treasury yields are up 2.2bp at 2.58%, while 10-year JGBs fell back -3.7 bp to -0.049% as local stocks slumped in catch up trade at markets opening.

- Topix and Nikkei lost -1.53% and -2.26% respectively, while elsewhere in Asia markets stabilised or bounced back. China ledi the way after an unexpected improvement in the Services PMI, confirming additional measures to boost the economy and as concern over US-Sino trade relations eased since vice ministers from both countries prepare to start talks Monday.

- The CSI 300 is up 2.02% and the Shanghai Comp up 1.64%, as China announced measures to support the economy that include a cut in reserve requirements (RRR) for banks, as well as cuts in taxes and fees. Targeted RRR cuts, which are designed to support small and private companies will also be included, and Beijing will step up “countercyclical adjustments” of macro policies.

- News that the US House passed a spending bill package in an effort to end the partial government shutdown also helped to underpin sentiment and US futures are moving higher after another dismal day on Wall Street yesterday.

- Oil prices also benefited from improved sentiment and the front end WTI future is trading at USD 47.70 per barrel.

- Brexit developments and the latest troubles in Italy’s banking system will remain on the radar in Europe today.

Charts of the Day

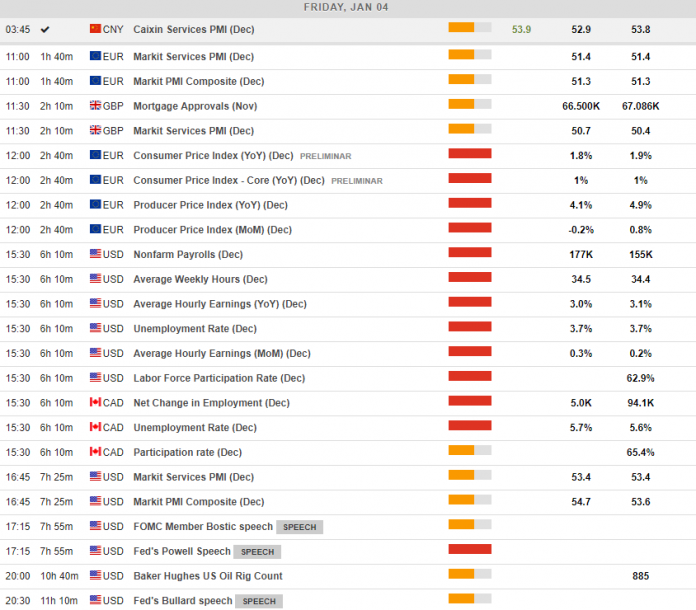

Main Macro Events Today

- EU Composite and Services PMI – EU PMIs are expected to remain the same as last month.

- UK Services PMI – The UK Services PMI is expected to register an improvement, at 50.7 compared to 50.4 in November, also in line with the better than expected Construction PMI release yesterday.

- EU CPI and PPI Inflation – Euro Area overall inflation is expected to stand at 1.8% y/y, compared to 1.9% y/y last month. Core inflation is expected to have remained at 1%, while the PPI is expected to have grown by 4.1%, compared to 4.9% in November.

- US Labour Market Data – NFPs are expected to have grown to 177k, compared to 155k last month, with Average Hourly Earnings expected to have grown by 3% y/y, compared to 3.1% last month.

- Canada Employment Data – The Canadian unemployment rate is expected to rise to 5.7%, compared to 5.6% last month, while employment change is expected to have stood at 5k compared to 94k last month.

- US Markit PMI – Services and Composite PMIs are expected to have remained the same and increased from last month respectively.

- Fed Chairman Powell Speech – Jerome Powell, the Fed Chairman, is set to participate in a panel discussion at the American Economic Association’s Annual Meeting.

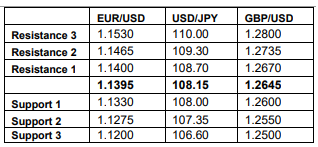

Support and Resistance

Click here to access the HotForex Economic Calendar

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.