USDCAD has dropped for a second straight day, putting in some more distance from the 20-month peak that was seen at 1.3663. A rise in oil prices amid a revival in risk appetite in global markets has helped the Canadian Dollar, while US Fed funds futures have now priced out Fed tightening expectations for 2019 and are factoring in a 25 bp rate cut at the 18-month horizon.

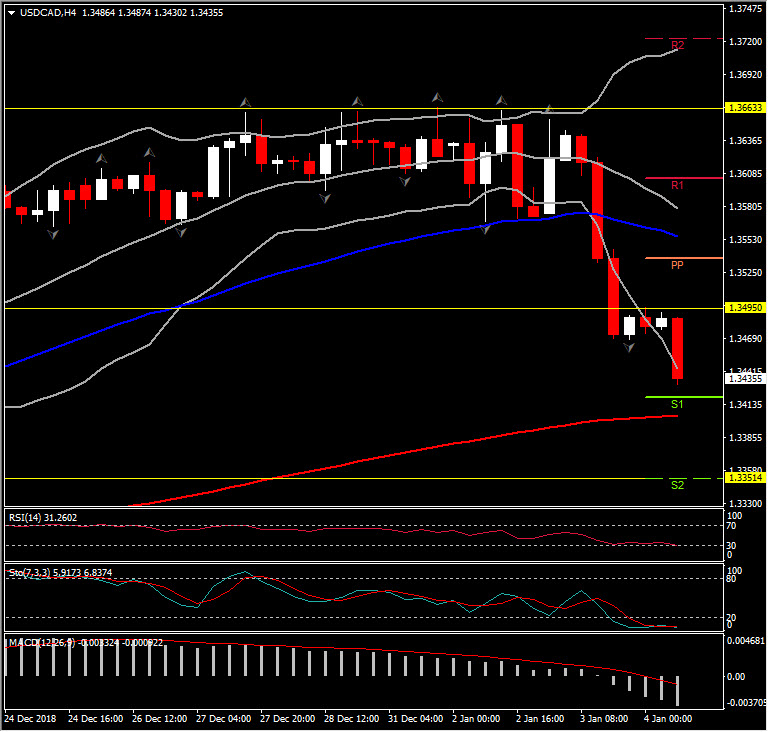

USDCAD has descended into two-week low territory under 1.3431. The early December low at 1.3160 provides a downside waypoint. Immediate support is set at S2 at 1.3350, which coincides with 50-day EMA. Resistance for today is set at 1.3495 (4 consecutive session peak in the 4 hour chart). In the long-term Resistance stands at the 2018 peak, at 1.3663.

Focus today will be on the dual releases of the US and Canadian jobs reports for December. The US version is expected to show a 205k headline rise (median 177k), with the unemployment rate ticking down to a new cycle low of 3.6% from 3.7% in the prior three months.

As for Canadian employment, a rise of 20.0k is anticipated after the broad-based 94.1k surge in November. The unemployment rate is seen edging up to 5.7% from the record low 5.6% in November. Canada is about to release its November industrial product price index which is projected to fall 0.5% (m/m, nsa) after the 0.2% rise in October as weaker energy prices weigh. The raw materials price index is expected to tumble 5.0% in November following the 2.4% pull-back in October as lower oil prices weigh. On balance, the data should be supportive of USDCAD.

Click here to access the HotForex Economic calendar.

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.