FX News Today

- USDJPY has posted a six-day high at 109.00. Yen crosses have also remained buoyant amid a backstop of re-established risk appetite in global markets, in turn feeding an outperforming bid in Japanese equity markets, while the Dollar has concurrently firmed up a tad against most currencies after descending yesterday.

- 10-year Treasury yields are down -1.1 bp at 2.685% while 10-year JGB yields rose 1.8 bp to -0.08%.

- Asian bond as well as stock markets traded mixed, as the focus remains on US-China trade talks.

- A weaker Yen helped Japanese markets to outperform and Topix and Nikkei are up 0.39% and 0.82% respectively. The Hang Seng meanwhile is unchanged, CSI 300 and Shanghai Comp are down -0.23% and -0.30% respectively, while the ASX closed with a gain of 0.69% and US and European stock futures are also moving higher. The front end WTI future is trading at USD 48.54 per barrel.

- Markets look a little less committed presently, wanting specifics from the ongoing US-China trade talks and a break in the partial government shutdown, the consequences of which are becoming more evident as time ticks on.

- The Trump administration expressed optimism of a “reasonable” deal and news that China dispatched one of Xi’s top aids to the low level negotiations in Beijing underpinned hopes of progress. The US Secretary of Commerce said yesterday that a deal can be reached that “we can live with.”

- Meanwhile US President Trump’s TV address today will be watched closely with investors hoping for clues on the possible end to the government shutdown.

Charts of the Day

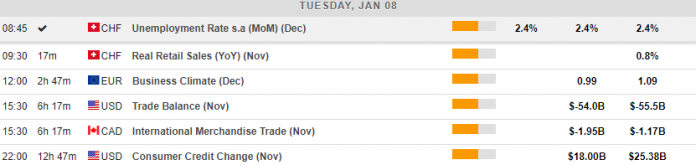

Main Macro Events Today

- EU Business Climate Indicator – Business Climate is expected to have decreased to 0.99 in December, compared to 1.09 in November.

- Canadian Trade Balance – The Canadian trade deficit is expected to have increased to $1.95 billion, compared to $1.17 billion in October.

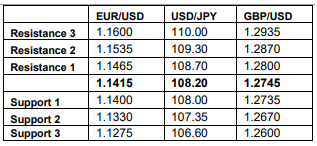

Support and Resistance

Click here to access the HotForex Economic Calendar

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.