One of the biggest pieces of news in the past year was the legalization of cannabis in Canada, allowing users to legally purchase specific amounts for personal use. Despite the fuss, and the potential for a $5 billion dollar market in cannabis products, there is an even bigger market for hemp, the non-psychoactive Cannabidiol (CBD) extract of the cannabis sativa plant, which does not get you high but is thought to help with a wide range of ailments, and whose industry value is estimated to reach approximately $22 billion by 2022.

Why is the industry worth that much? Put simply, CBD is used in practically everything, from muscle aches, to arthritis, to bacon-flavoured dog oils, sweets, drinks, and sauces. The main customers of this industry are Millenials, i.e. people who were born between 1981 and 1996 and thus provide the industry with an important customer base which should remain loyal for a long period of time. Interestingly, the older generation also appears to have been increasing purchases of CBD products, mostly regarding products aimed at treating ageing conditions. As such, companies from Coca-Cola to Walmart have been investigating the commercial possibilities of CBD.

It is this fast-growing industry that GW_Pharma, Tilray, and Canopy are a part of. These three stocks are pushing the boundaries of their industry, aiming to expand beyond their native countries (UK for GW and Canada for the other two) into the US, where a huge market still remains untouched.

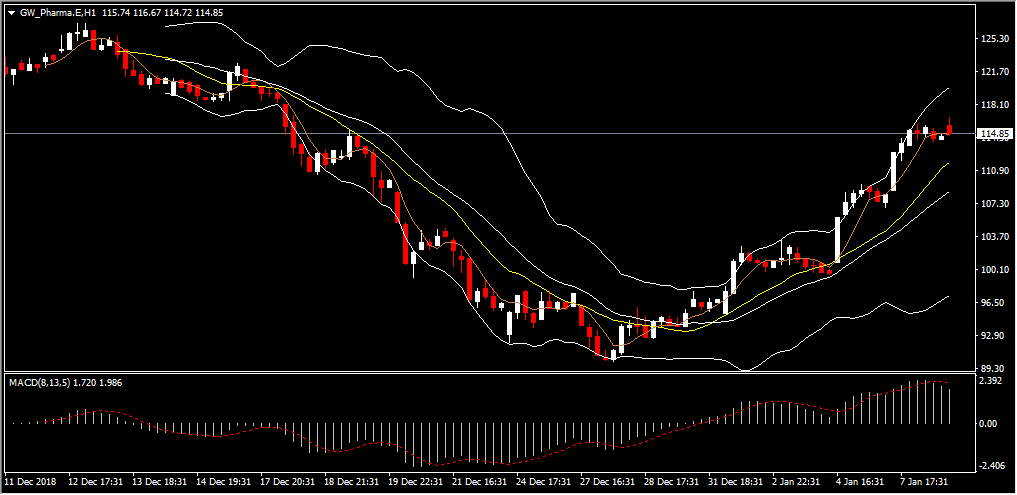

In particular, GW_Pharma is the oldest of the three companies, having been publicly listed in the London Stock Exchange since 2001, and on Nasdaq as of 2013. The company was awarded a US Food and Drug Administration approval for the use of a pharmaceutical formulation for epilepsy, and is currently seeking a European approval. On this news, the GW_Pharma stock climbed 4.2% in early November, as analysts suggest that the drug, Epidiolex, could reach about $1.8 billion of sales by 2026, while it is expected to start bringing in revenue this year.

Tilray, on the other hand, was the first cannabis company to go public on Nasdaq in July. The company recently finalised an agreement with the pharmaceutical giant’s Novartis Canadian arm for its medical marijuana products, allowing Tilray to use its supply chain. In addition, Tilray is also expanding into the drinks industry, after agreeing to a joint investment into cannabis-induced non-alcoholic drinks. It’s initial price stood at $17, doubled to $35 per share in a month and has now doubled again, reaching $70.72 at the time of the writing of this article, after reaching a high of $97 in early December. It’s market capitalization currently stands at $6.7 billion, worth more than half the Nasdaq companies. However, a note of caution as private shareholders will be able to sell their stocks as of January 2019, hence putting some potential downwards pressure on the stock.

Canopy is the world’s largest licensed producer of cannabis and hemp, operating in 13 countries across five continents. Having received $4.5 billion CAD by Constellation Brands, an international producer of alcoholic beverages, in exchange for 30.8% of its share capital, in August, Canopy boosted its presence in the US market by purchasing a hemp research leader in Colorado. Furthermore, the company has suggested that it will enter the US market, after the Farm Bill, which legalised hemp, was passed in December.

Notice that all three companies are innovators in a nascent industry, which means that their stocks are prone to bouts of both optimism and pessimism across the markets, leading to higher volatility. Given that cash flows in the industry are as yet uncertain, both with regards to product pricing as well as to the number of customers, stock prices tend to react strongly to new information, especially since the opening of a new market can potentially lead to a significant increase in revenues.

This kind of revenue uncertainty tends to lead to stock price volatility which investors can potentially exploit. Naturally, as with any financial instrument, proper risk management techniques need to be employed in order to ensure that traders can protect themselves from unexpected price movements in the opposite direction of their trade.

Click here to access the HotForex Economic Calendar

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.