BOJ Governor Haruhiko Kuroda said that a weak Yen is beneficial for the Japanese economy if the moves are not too sharp. He stressed that moves in the currency market should reflect fundamentals and that central banks are carefully watching their impact. The Japanese economy is still recovering from the pandemic and facing downward pressure from rising commodity prices, he said, and therefore monetary tightening is not at all the right step. These dovish comments on Monday further weakened the Yen.

The comments came as the Yen was broadly selling off, fuelled by a spike in 10-year T-note yields to a 3-week high on Monday. The yield on the German 10-year bond also jumped to as low as 1.323. USDJPY hit a high on Monday, up +0.77%, posting fresh 2-decade highs. The central bank divergence is the main bearish factor for the Yen, as the Fed is in the middle of a rate hike cycle, the ECB is poised for a hike, and the RBA has just raised rates, while the BOJ is still chasing QE and keeping rates at record lows.

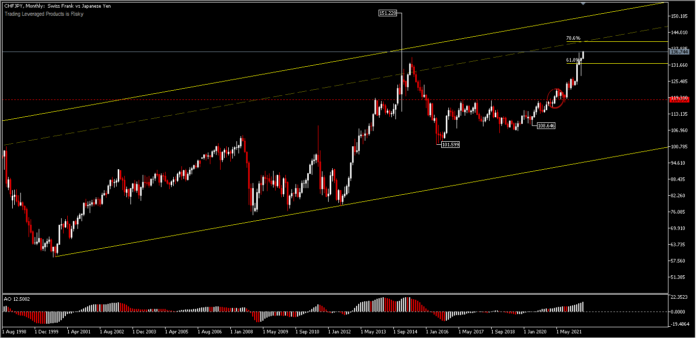

Technical Overview

CHFJPY – Another currency with negative interest rates which is often used as a hedge currency, as uncertainty over the world’s prospects spreads. The BOJ is at -0.10% and the SNB is at -0.75%, but the Yen is often in the spotlight compared to the Swiss franc. Switzerland with its calmer monetary policy is far from the spotlight, while the BOJ, with its ultra-easy policy, has often been in the media spotlight and has built a negative stigma on the Yen since the pandemic hit. The CHFJPY currency pair has soared, printing a 7-year high, gaining more than 25% from its May 2020 low. Confirmation of the long-term trend has been in place since the pair broke a multi-year high of 118.59 in April last year. The move to the upside has even surpassed the 61.8% FR retracement level of the 2015 peak draw and 2016 low. A move to the upside should test the 78.6% FR (140.00-140.50) level if the move continues north.

CHFJPY, H8

In the intraday period this morning, Tuesday (07/06), the pair surpassed the resistance at 136.17. A move to the upside is projected for FE 61.8% at 139.01 (from pullback lows 117.52–136.17 and 127.49). As long as 127.49 holds as support, the outlook remains on the upside. The price returning below the 136.17 move will confuse the outlook and the bias will settle down for a while.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.