USDJPY and Yen crosses have remained buoyant amid a backdrop of firm global equity markets. USDJPY retested 109.00 but has so far left yesterday’s 1-week peak at 109.08 untroubled.

Stocks continue to rally on hopes for a breakthrough in the US-China trade standoff. Both sides agreed to extend talks into an unscheduled third day amid reports of progress on Chinese imports of US goods and increased access to Chinese markets, and Bloomberg cited sources reporting that President Trump, who tweeted that “talks are going very well,” is now eager to strike a deal.

The MSCI Asia-Pacific (ex-Japan) Index has gained over 1.5%, reaching a 26-day high. The USA500 Index closed on Wall Street yesterday with a 0.97% gain, and USA500 futures are showing an 0.4% advance in overnight trading. In Japan today, wages data came in on the warm side of expectations, rising 2.0% y/y versus the median forecast for 1.2% y/y.

Despite this, EURJPY and AUDJPY have posted fresh 1-week and 11-day highs, respectively.

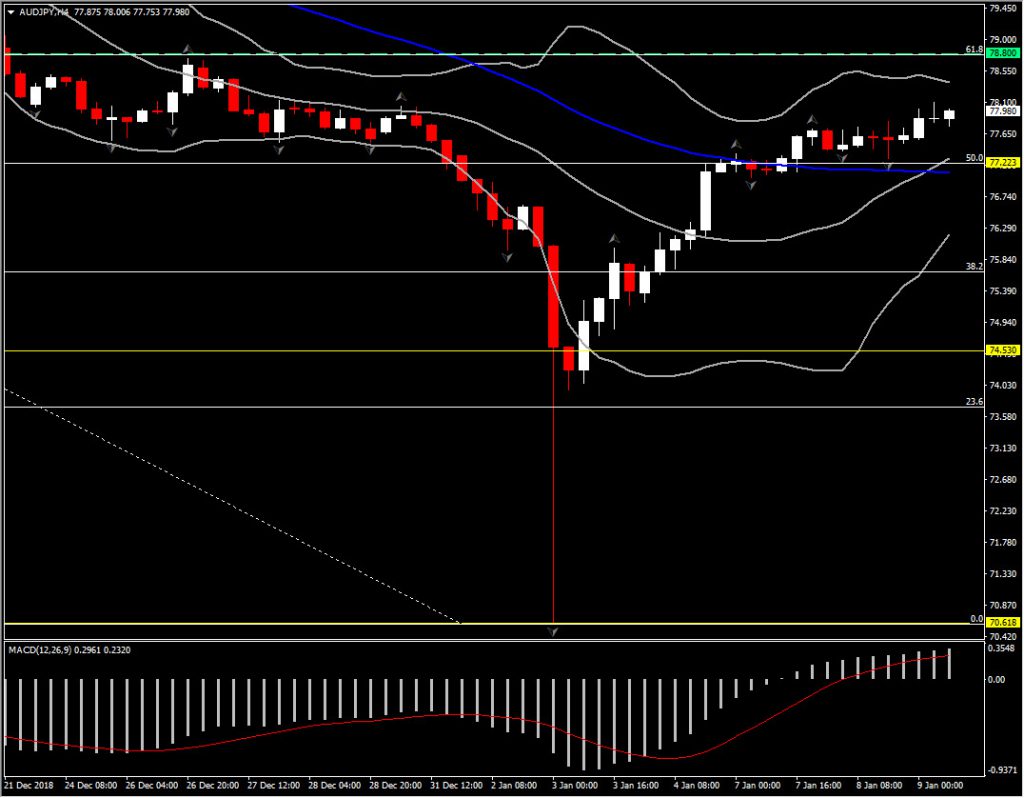

AUDJPY retraced more than 50% of December’s losses, after falling dramatically to its low area first established in 2009, at 70.60, last Thursday. The pair is above 50% Fib. level and the 77.00 level, for a 3rd consecutive day .

Momentum indicators are still negatively configured, showing that the overall weakness of the Aussie does not seem to have faded yet. However, the short term technical indicators, along with the move above the month midpoint, imply buying pressure and the possible retest of 78.80 barrier.

This barrier is the confluence of 61.8% Fib. retracement level, 20-day SMA but also 2-year Support, which could now provide strong Resistance for the asset. Support for the day holds at 77.08-77.20 area.

Click here to access the HotForex Economic calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.