Trip.com Group Limited, a Chinese multinational online travel company founded in 1999, which engages in integrating a wide range of travel products, services and differentiated travel content, as well as on-the-go support to travellers around the world, is estimated to report Earnings, Monday June 27 after the US market close.

图 1:Trip.Com :money.cnn

Despite industry fluctuations and weaker seasonality, the company delivered a solid performance in general as it remained adaptive to fast-changing conditions, continued to expand product offerings and to improve content capabilities and implemented strict control on the operational cost. Market recovery from the pandemic has also served as a stepping stone to the consistent results. According to the company’s financial report released in March 2022, net revenue and adjusted EBITDA improved by 9% and 6% respectively for the full year 2021.

For the upcoming earnings announcement, consensus estimate for sales stood at $4.0B, up 5.26% from the previous quarter but down -32.20% from the same period last year. On the other hand, earnings per share (EPS) is expected to hit –$0.48, slightly up 11.11% from the previous quarter, but down -142.48% from the same period last year.

图 2:Air Passenger Market in Detail – March 2022:IATA

Broader re-openings and loosening of travel restrictions in many countries have led to a surge in travel demand. According to latest data released by the International Air Transport Association (IATA), total traffic (namely revenue passenger kilometres, or RPK) over Europe and North America have improved significantly by 246.9% and 96.5%. RPK over Asia-Pacific is down -17.9% following Omicron-related restrictions. Trip.com has its businesses running in North America, Europe, and Asia. Thus, an increase in RPK over countries in this region shall fundamentally benefit the company. Some countries in Asia (for instance, Singapore, Malaysia, Bangkok, South Korea) which have loosened Covid restrictions may serve as another tailwind.

3:National Index – May 2022。 Ipsos

On the downside, there are undeniably travel price hikes following rising inflation, which may derail travel recovery, though, that may be “by the end of the year and for 2023”. On a wider scale, global consumer confidence remains on a downward track. According to Ipsos, a significant drop in value of a number of indicators namely National index, Investment Index and Jobs Confidence Index over various countries signalled a gloomy economic outlook – a headwind for development of companies.

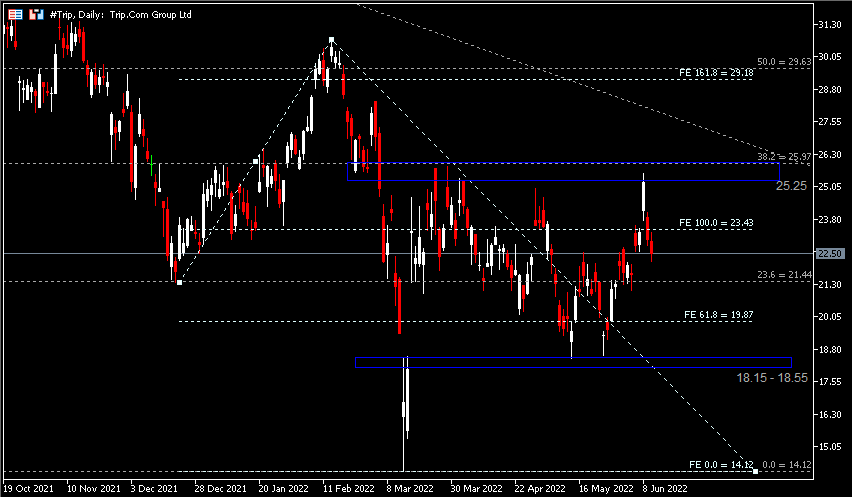

Technical Analysis:

The Daily chart displayed #Trip share price saw its highest price this year at $30.70 (15th February), before hitting bottom later at $14.12. This is a historical new low since the outbreak of Covid-19 pandemic ($20.10 recorded on 18th March 2020). The company’s share price remains range-bound during Q2 2022 (Upper range: $25.25 – $25.97; Lower range: $18.15 – $18.55). Currently, $23.43 serves as minor resistance. A break above this level may indicate possibility for the bullish momentum to extend towards the upper range $25.25 – $25.97, followed by $29.18 – $29.63. On the other hand, $21.44 serves as the nearest minor support. A bearish break below the said support may indicate downside potential for the company share price to test the next support at $19.87, followed by the lower range $18.15 – $18.55.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.