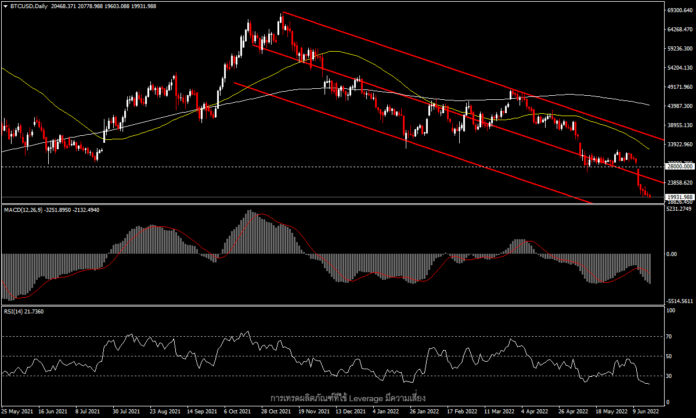

BTCUSD, Day

The crypto market continues to be in turmoil. Bitcoin (BTCUSD) dropped below $20,000 over the weekend, hitting a record low since December 2020 in the $17,800 zone, before attempting to rise above $20,000 on Monday morning.

This new low came after three companies which manage large sums of other people’s funds, Celsius Network, Babel Finance, and Three Arrows Capital, announced the suspension of customer withdrawals.¹ Celsius Network, which nurtures individual investors with crypto lending. manages $12 billion in assets.

Babel Finance, a crypto lending service provider with about 500 customers and which only raised $80 million in funding in the past month, gave notice of suspension of customer withdrawal indefinitely. Finally, hedge fund Three Arrows Capital (3AC), which focuses on crypto startups and has $10 billion in assets under management (March figures) is experiencing huge losses after investing $200 million in Luna and turning to zero last month.

However, such turbulence is not exclusive to the crypto market. The central banks’ attempts to fight inflation by raising interest rates is leading to concerns that the implementation of such policies could slow down the currently sluggish economic recovery, also known as stagflation.

From a technical point of view, the bitcoin sell-off from the breakout of the original $28,000 low zone last week appears to be ongoing, with no trend reversal seen so far. However, the current $19,800 price zone, the same all-time high seen in 2017, may be the last hope before the price returns to the $10,000 level again for an uptrend view. It remains to be seen whether the price can significantly return to above $20,000.

¹https://www.theverge.com/2022/6/17/23172539/3ac-celsius-babel-crypto-loans-hedge-funds-uh-oh

Click here to access our Economic Calendar

Chayut Vachirathanakit

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.