FX News Today

- Asian stock markets managed to post modest gains, despite the confirmation of the slowdown in Chinese GDP growth to 6.4% y/y, which left the full year rate at 6.6%.

- Topix and Nikkei are up 0.56% and 0.26% respectively, and the Hang Seng gained 0.27%, while the CSI 300 and Shanghai Comp are both up 0.5%.

- Hope that trade tensions will eventually be resolved in talks continues to underpin sentiment, with some room for further gains after markets priced in quite extreme risks at the end of last year.

- Reports from Friday indicate that China is planning to ramp up purchases of US goods although a Bloomberg report suggests that both sides are making little progress on the key issue of intellectual property protection.

- All of these dampened the move higher in Asia and saw US futures heading south.

- The front end Nymex future is trading at USD 53.99 per barrel after reaching a session high of USD 54.17.

- There is a US Bank Holiday today, with emphasis turned to Sterling.

Charts of the Day

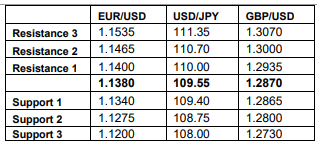

Support and Resistance Levels

Click here to access the HotForex Economic Calendar

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.