With official rates widely expected to remain unchanged the focus on Thursday is on the forward guidance and the press conference. The ECB is likely to catch up with the changed growth outlook and turn cautious.

Draghi will almost certainty sound much more dovish this time around than in December when he still had to justify the decision to phase out net asset purchases. Still, the Central Bank President is expected to admit that growth forecasts are likely to be undershot and that external risks, including Brexit, are tilting the balance to the downside, he will likely promote a picture that sees slowing growth momentum, rather than a full scale recession.

So while the ECB’s current policy stance, which is already very accommodative, remains necessary, the guidance is unlikely to change much, which leaves the possibility of a rate hike late in the year on the table and the central bank in wait and see stance for now.

Draghi will likely also be quizzed on the question of further TLTRO loans, although it may be too early for a decision on that front just yet. The issue will likely be brought up in this meeting when the end of the previous round of target long term loans comes into sight and banks will be forced to find refinancing options.

In the market, EURUSD settled in a narrow orbit of the 1.1350-1.1371 area today, above the 2-week low seen yesterday at 1.1336. A flat-to-downward bias could prevail given the backdrop Eurozone-slowing narrative.

Greater odds for a stronger break to the downside could be seen, if there is positive news on the partial shutdown in the US and/or a breakthrough on the US-China trade negotiation front, while ECB is not expected to affect the direction of the pair significantly. EURUSD resistance comes in at 1.1407-10, whilst Support holds at 1.1345-1.13450.

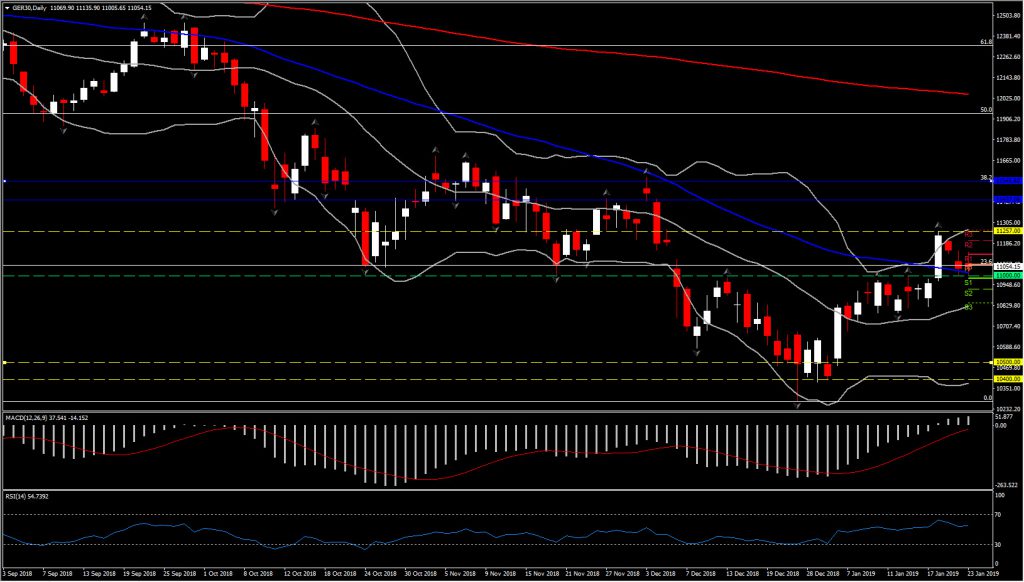

Meanwhile, Stock market sentiment has started to stabilise and US futures are moving higher while most European indices have erased early losses and are now in positive territory. The UK100 is still down -0.23%, weighed down by a stronger Pound, but the GER30 is up 0.22%.

GER30 remains below at the lowest levels seen the last 2 years, while in the near picture is trading below Friday’s peak for a 3rd day in a row. However significant is the fact that despite the slip lower, holds a floor at 11000 level and the 50-day SMA.

Momentum remains strongly configured with the RSI still above 50, whilst MACD lines turn positive since Friday. Hence if the pair holds Support at 10980-11000 area, then this could suggest a potential swing higher , with the Next level to be watched at 11440-11545 area ( latest up fractal and 38.2% Fib. level since 2018 peak). Immediate Resistance is set at Friday’s high, at 11257.

However if positive momentum seen decreasing, along with a decisive move below 10980, could attract more bears in the market and we could see the index retesting 2018’s lows at 10400-10500 area.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.