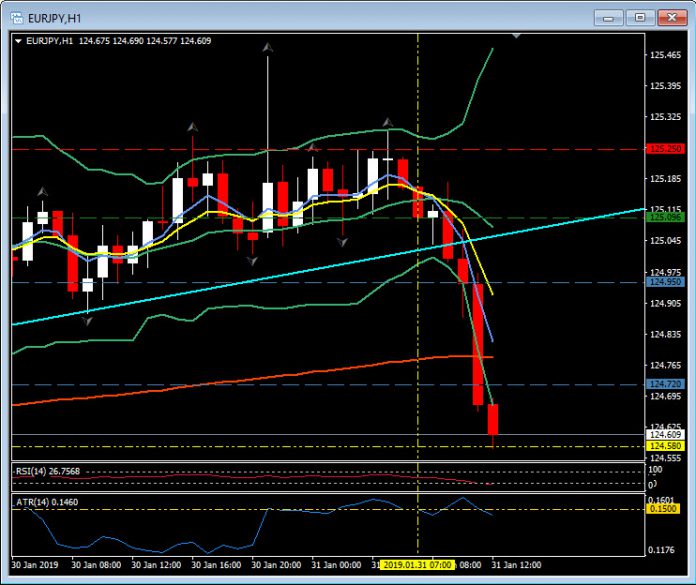

EURJPY, EURUSD & EURGBP, H1

Eurozone jobless rate held steady at 7.9% in December, in line with expectations and unchanged from the November reading. Official rates fell significantly last year and are by Eurozone standards at relatively low levels, with spare capacity in the labour market pretty much eroded in countries such as Germany. Cross country differences remain substantial though and youth unemployment remains high at 16.6% in December, even if this is already markedly lower than the 17.8% in December 2017. Youth unemployment rates of 6.0% in Germany contrast sharply with a rate of 32.7% in Spain and the 31.9% in Italy. There clearly remains much room for structural reforms to boost the labour market, but on the whole the improvement last year backs the ECB’s central assumption that rising wage growth will increasingly underpin underlying inflation in coming months.

Eurozone Q4 GDP growth held steady at 0.2% q/q, as expected. National data was mixed though with Spanish numbers earlier today coming in higher than expected at 0.7% q/q, while the Italian economy is now officially in technical recession, with the -0.1% q/q contraction in Q3 followed by a -0.2% q/q decline in the fourth quarter of 2018. Like French numbers yesterday, the Spanish rate also seems to have been boosted by strong exports, which could suggests that UK companies stocking up and preparing for a no-deal Brexit may have helped to compensate for the impact of the “yellow vest” protests in France, which seem to have held back production in the last quarter of 2018. The diverging developments across Eurozone countries will do little to change the ECB’s increasingly cautious stance, although clearly most of Italy’s problems are once again home-made.

EURJPY on the Crossing EMA Strategy would have triggered lower today at 08:00 and completed a quick move down to T1 and T2. EURUSD and EURGBP look to be following in the Yen’s footsteps at 13:00.

For a complete guide to the simple Crossing EMA Strategy be sure to watch our webinar.

https://www.hotforex.com/sv/en/trading-tools/past-webinars.html?webinar_lang=en#webinars

And the Special Report video post – The Crossing EMA Strategy for Intraday Traders.

https://analysis.hotforex.com/the-crossing-ema-strategy-for-intraday-traders

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.