US equities snapped back into the green after the January payrolls report hit 304k, though downward back revisions, distortions from holiday hiring and the shutdown influenced the data on the margin (BLS confirmed jobless rate uptick was due to shutdown).

Fed dove Bullard, who is a voter this year, downplayed the trend growth in jobs in a CNBC interview, saying it was a bit of a backward signal and he’s very pleased with the recent changes to the Fed’s policy stance with a flat horizon. Data will drive the Fed’s actions. He noted a good January jobs report, though with the caveat of a big downward revision to December and a lot of noise.

On the economy, there’s a near universal view that the 3% growth rate will have to slow down, though that doesn’t mean anything bad. Regarding the global situation, it’s not been as robust as hoped, especially in Europe. China is also growing more slowly than anticipated. These are important factors for the Fed.

PMI reports from Asia and Europe came up short and lent a softer tone to global trade, though some progress on US-Sino trade talks was embraced by Chinese indices. Online retail behemoth Amazon guided sales forecasts lower for the quarter after a holiday boom. Reversing from the red, the USA30 is 57 points higher and USA500 rose 1 point, but USA100 is still off 29 points in pre-open action.

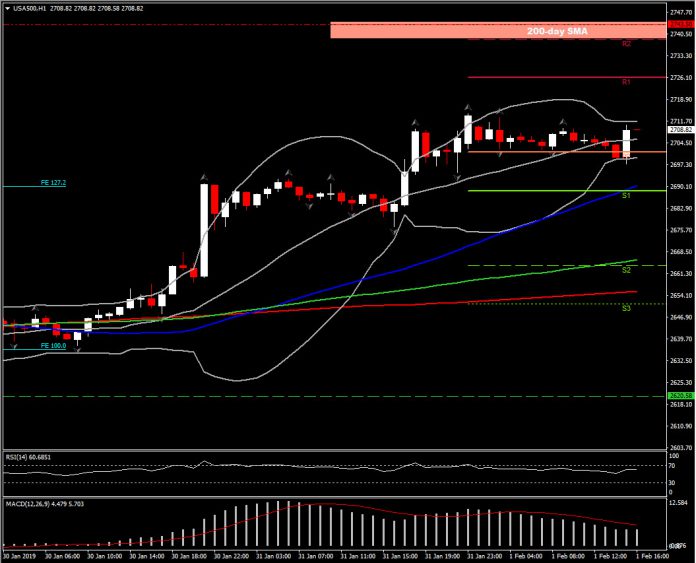

Next Resistance for USA500 on the break of yesterday’s peak at 2714, stands between R2 for the day and the 200-day SMA, i.e. 2,740.00-2,743.5. Support is set at 2695.00 (latest down fractal).

There is still a raft of ISM, construction, U. Michigan, inventories and autos on tap as we continue to catch up with missing shutdown reports.

Click here to access the Economic calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.