FX News Today

- RBA left the cash rate on hold as expected and conceded that some downside risks have increased. RBA set to make subtle shift to the dovish side.

- RBA’s central scenario for the economy is around 3% growth in 2019.

- AUDUSD perked up to 0.7260 from 0.7204.

- Alphabet beat on profits and revenue, by making $8.94 billion on $39.27 billion revenue, but shares fell 3% on continuing pressure on advertising prices and decreasing margins.

- European stock futures are moving higher, while US futures are struggling and slightly in the red.

- Better than expected BRC retail sales out of the UK helped to underpin sentiment ahead of Services PMI.

- WTI retreated 1.2% to $54.0 area, down from 2019 highs of $55.74 bbl – Currently at $55.00 area.

Charts of the Day

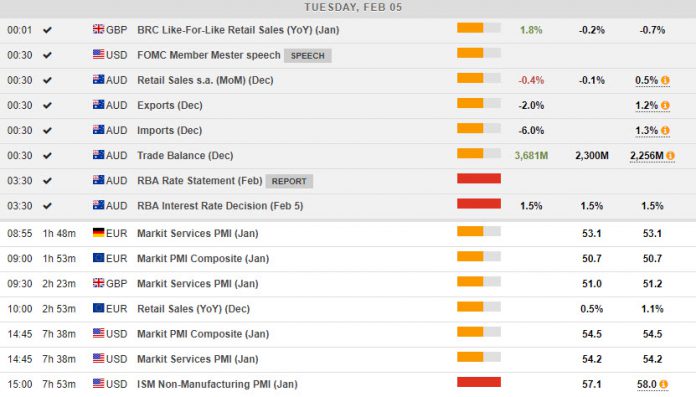

Main Macro Events Today

- Eurozone Services PMI – The overall Eurozone Services PMI for January is expected to come in unchanged from the preliminary number at 50.8, which should leave the composite at 50.7.

- UK Service PMI – It is expected to come in with a headline of 51.0 after 51.2 in December.

- EU Retail Sales – They are expected to have corrected -1.8% m/m, after the strong November reading.

- US Service and ISM Non-Manufacturing PMI – The ISM-NMI Index is expected to slip further to 57.5 in January from 58.0 in December, versus a 13-year high of 60.8 in September. Services PMI is expected to be unchanged at 54.2 for January.

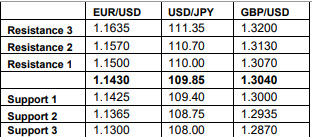

Support and Resistance

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.