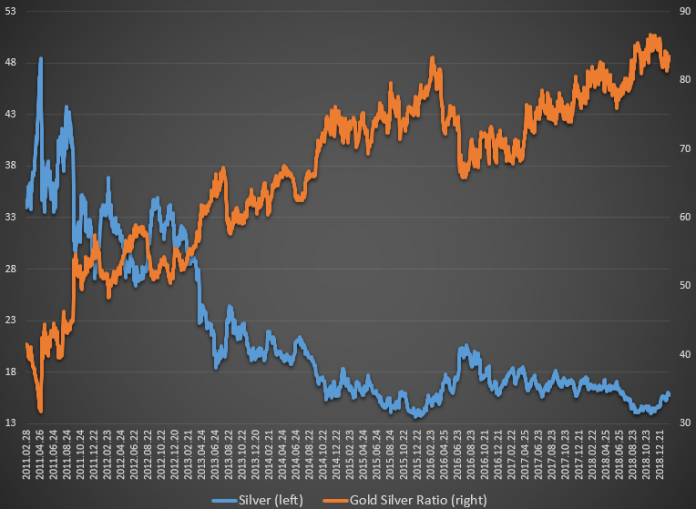

Silver entered a correction phase last week, following a rally which lasted for approximately two months and raised the price by 12.5%. At the current level of $15.73 per ounce, Silver is trading at about 83 times less than the price of Gold. Even though the Gold-Silver ratio has declined from a peak of 86 in late November, it still appears to be quite high, compared to previous years, as the above figure suggests.

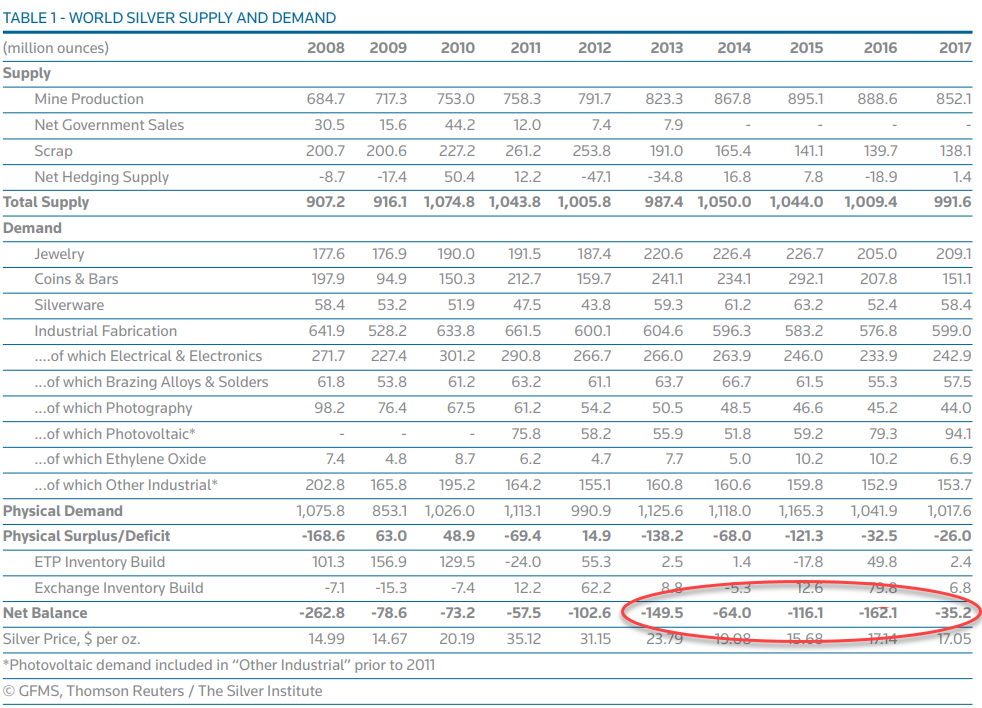

The big question is what caused this rally and whether it can be sustained. Taking the longer-run view, fundamentals appear to point toward a rather unconvincing story: in theory, demand has been consistently greater than supply at least since 2013, however, prices have been on a decline since 2011. This appears to be in contrast to the price of Gold which has been trading largely stable, at least since 2013.

Thus, the question still remains: if we can conclude that fundamentals and Gold are not the culprits, what has been pushing the price of Silver down? Investor sentiment cannot really be the answer as the period of time is quite long to simply shake off the fundamentals and just trade on emotions; in the long-run fundamentals always win, at least in theory.

Note that there are very few data releases for Silver and thus traders cannot really know exactly how fundamentals will evolve during the year. All they have to observe, at least on a weekly basis, are US Mint Sales, which appear to have hit rock bottom in 2018, marking the lowest point since 2007. Part of the reason for the decline can be attributed to the Silver price drop as investors can easily obtain older coins at lower premiums. The overall decline in the price of Silver appears to have been the cause of exasperation for investors who do not see their bullion increase in price. Shouldn’t this have pushed prices down then, given that coins and bars make up for 20% of Silver’s demand?

The answer is that the effect would not have been as large as expected, not because of its non-importance but because of another factor which has a tremendous impact on the price of Silver but constitutes neither a demand nor a supply factor: the US interest rate. Back in November, markets realised, for the first time, that the Fed was not going to pursue its interest rate schedule as planned and less rate hikes were expected. As a result, Silver now appeared to be a much more attractive opportunity than before; naturally, the same holds with Gold. Nonetheless, Silver was already quite underpriced and thus its reaction was much more spectacular: as suggested above, it rose by 12.5% compared to 8.5% for Gold in the November-January period.

The big question is what will happen now. Thus far, the price of Silver has already priced in the Fed guidance for two rate hikes in 2019; in the case that the US slowdown persists and the Fed is forced to cut back on its plans, Silver has much to gain. On the other hand, in the case that the US economy performs better than expected, more rate hikes could potentially push its price down. With regards to demand for the precious metal, it appears that forecasters believe that the major demand factors will register increases during 2019, especially if this is driven by growth in the tech sector. In contrast, supply is expected to decline during the year.

Technically, the Support level of $15.59 (Fib. 50%) appears to still be rather far, even though the price of Silver has been declining since the final days of January. If broken, the next Support level would stand at $15.20 (Fib. 38.2%), a level also supported by the 200-day MA. With regards to Resistance, $15.98 (Fib. 61.8%) remains the ceiling for Silver.

Click here to access the Economic Calendar

Dr Nektarios Michail

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.