FX News Today

- 10-year Treasury yields are down 0.5 bp at 2.690% but JGB yields are up 1.3 bp at -0.016%, despite a 0.59% decline in the Nikkei and a 0.83% drop in the Topix amid another mixed session in Asia.

- Japanese shares were hit by corporate earnings, while the ASX continued to rally, gaining 1.10%, in tandem with local bonds after the dovish shift at the RBA this week.

- The RBI meanwhile surprised with a cut in the repo rate by a quarter point. Hong Kong and China remained closed and despite some movement, investors continue to hold back ahead of the next round of US-Sino trade talks next week.

- US futures are heading south despite a cautiously upbeat assessment of the economy from Fed Chairman Powell, who said “the US economy is now in a good place”.

- The front end WTI future managed a session high of USD 54.04 before falling back to USD 53.79 per barrel.

Charts of the Day

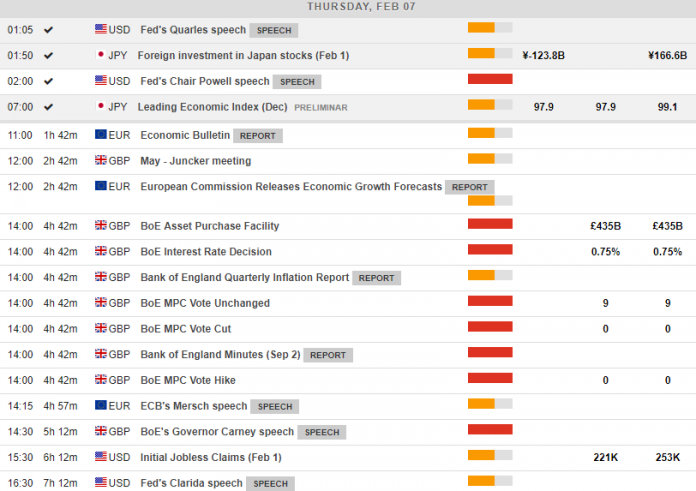

Main Macro Events Today

- Theresa May meetings in Brussels – Theresa May and the European Commission’s president will meet today, with the UK PM hoping to obtain fresh concessions, despite the EU’s insistence that it will not renegotiate the Brexit deal. In late afternoon, May is also expected to meet with Donald Tusk, the European Council President.

- BoE Interest Rate Decision – BoE is not expected to bring forth any changes to its interest rate policy ahead of a Brexit agreement and thus the rate is expected to remain at 0.75%.

- BoE Carney Speech – Mark Carney is expected to speak along with other MPC members about the BoE inflation report.

- Fed Clarida Speech – FOMC Member, Richard Clarida is due to speak at the Czech National Bank’s conference about the neutral interest rate, with audience questions expected.

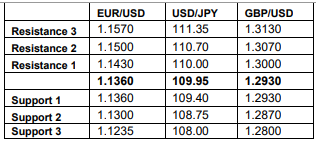

Support and Resistance

Click here to access the Economic Calendar

Dr Nektarios Michail

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.