Twitter was the last social media company to report its Q4 earnings. Twitter stock price fell more than 3% following its earnings announcement, despite beating Wall Street expectations.

The company reported overall revenue of $909 million for the fourth quarter from $868.2 million projected, posting a 24% increase from last year’s reading due to the growth in its advertising business. Earnings per share spiked to $0.31, exceeding consensus estimates of $0.25 from a Reuters poll with 32 out of 39 analysts having a hold to Buy recommendation.

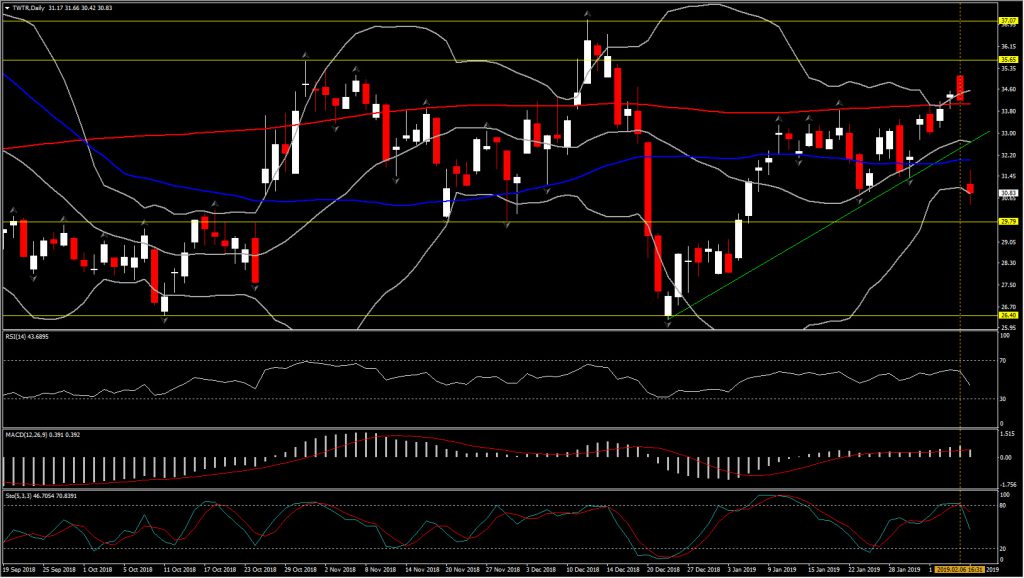

Into US open today, the stock drifted further by more than 9% since yesterday’s close, at $30.42, while it remains up, nearly 10% year to date. The strong fourth quarter results however came in contrast to stock price decline to 1-month lows. The decline was a result of a lower than expected number of users, however the main mover of this move was the company’s forecasts for the first quarter of 2019 revenue.

According to Twitter Inc. there would be a decline in the total revenue for Q1 2019, down to $715-$775 million, while the operating expenses and the spending on safety and security would continue increasing this year as it moved to protect the integrity of its platform. This raised Investors’ concerns regarding the company’s profits for 2019.

Turning to the technical side, Twitter stock price is currently trading below all 3 daily moving averages with immediate Support at November’s Support, at $29.80. However real support for the asset come at the bottom of the 6 month sideways channel, at 26.25-26.40 area.

The daily momentum indicators present the decline of positive bias for the asset in the near future. The daily RSI crossed 50 zone today, whilst MACD lines’ clash in the positive territory, unable to present a clear direction yet. Hourly indicators however are negatively configured, suggesting further decline for the rest of the day.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.