USD moved down from new to 20-year highs at 107.00 but remains in demand (USDIndex 106.64), US Stocks flat on close (NASDAQ +0.35%). FED Minutes leaned to the hawkish side. – ‘more restrictive’ policy as likely if inflation fails to come down. Asian markets are mostly positive (Hang Seng -0.13%, Nikkei +1.4%). Yields closed up +3.3%. Oil fell another -1.0%, Gold plummeted again to $1735 & BTC rotates at $20k. UK PM Johnson has now lost over 50 members of his government but refuses to resign. AUD outperforms overnight.

Yesterday US ISM Service PMIs were better than expected but still at 25-mth low & JOLTS showed 11.25m job vacancies (1.9 jobs for every unemployed person).

- USDIndex tested 107.00 and remains on Bid at 106.65 now.

- Equities – USA500 closed +0.36% 13.69pts (3845), US500FUTS at 3854 now.

- Yields 10-year yield higher, closed at 2.92%, trades at 2.90% now. Yield curve inverted again yesterday.

- Oil & Gold had weak sessions – USOil traded down to $95.10 lows and remains under $100.00 at $98.48. Gold fell to 1732, next support at 1725, trades at 1745 now.

- Bitcoin continues to trade around $20K, testing $20.3K today.

- FX Markets – EURUSD remains pressured at 1.0200, USDJPY rallied from under 135.00 to test 136.00 now. Cable trades at 1.1950 now.

Overnight – German Industrial Output missed at 0.2% from 1.3%. Australian Trade Balance much better at 15.97b vs 10.7b & 13.25b prior.

Today – US ADP Employment & International Trade, ECB Minutes, EIA Oil Inventories, Speeches from Fed’s Waller & Bullard, ECB’s Lane & Enria, BoE’s Pill.

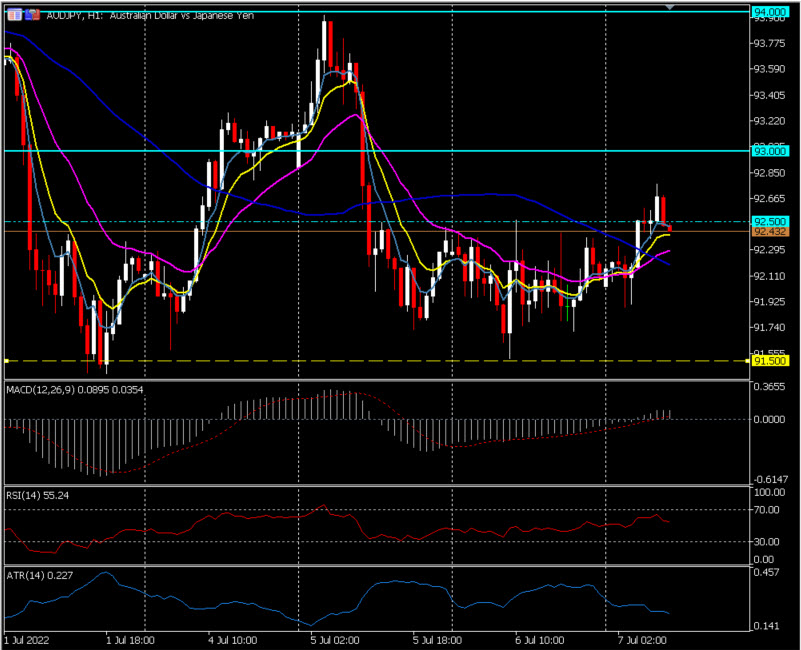

Biggest FX Mover @ (06:30 GMT) AUDJPY (+0.42%). AUD lifted by trade data. Rallied form allied from 91.50 Wednesday to 92.70 today before cooling. MAs aligning higher, MACD histogram positive & rising, RSI 55.24 & rising, H1 ATR 0.227, Daily ATR 1.398.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.