In general, the factors driving the sharp weakening of the commodity landscape are Fed tightening, a strengthening US Dollar and geopolitical concerns. This has raised fears of recession and deflation, but a more volatile Europe has lifted the US Dollar, which in turn has put further pressure on commodity prices.

The US Dollar Index on Wednesday rose +0.55% to trade at 106.79 after testing the 107.00 price level and setting new 2-decade highs. A stronger-than-expected US ISM services index and the May JOLTS jobs report continue to support the Dollar. The June ISM services index fell -0.6 to 55.3, higher than expectations of 54.0, and the May JOLTS jobs fell -427,000 to 11.254 million, suggesting a stronger-than-expected labor market of 11.000 million.

The minutes from the June FOMC meeting say the bank sees significant risks from entrenched inflation and that tighter policy is possible if needed in due course. Fed officials see the possibility of a 50 or 75 bp rate hike at the July FOMC meeting.

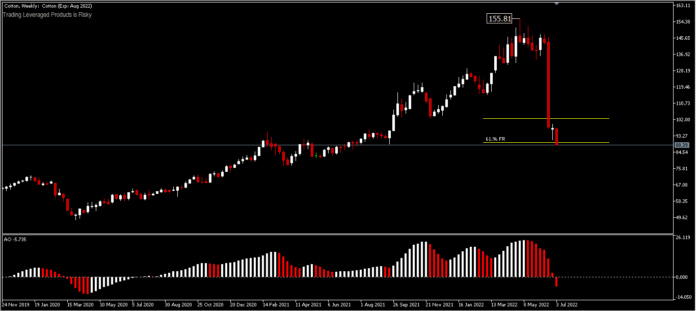

Commodity trading this week saw a sharp decline. Although the precious metals did not come close to oil’s -10% fall, gold lost -4%, silver -3.5%, copper -4.9%, palladium – 3.4%, platinum -3.2%. In terms of agricultural products, cotton lost -9% (down more than -40% since May’s peak) and coffee -5.7%.

Sensitive commodities such as crude oil, metals and crops were hit. Copper, the underdog, entered a bear market, down more than 30% from its peak in March. This is important because it has happened at the beginning of every recession in the last thirty years.

Prolonged inflation and a looming recession are weighing on consumers’ minds. Many employers are beginning to cancel job offers, which indicates a gap in the labour market whose strength has so far prevented a recession. Inflation has reached all sectors of the economy.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.