The parent company of the US Bank National Association and the fifth largest banking institution in the United States, US Bancorp, which has a market cap of $68.54 billion, a PE ratio of 9.95, a PEG ratio of 1.62, and a beta of 1.00 with a debt-to-equity ratio of 0.73, a current ratio of 0.75, and a quick ratio of 0.74 will report Q2 2022 Earnings this Friday, July 15th before the market opens.

The big US banks’ second-quarter earnings are expected to fall sharply from a year earlier as loan loss provisions rise as the pandemic recovery paves the way for a possible recession. A severe downturn could lead to real loan losses and negate existing gains.

The decline in profits comes from banks adding to their reserves for estimated loan losses. Unlike last year they have benefited from a reduced cushion as expected losses from the pandemic did not materialize and the economy strengthened. Mortgage income is expected to decline as higher interest rates reduce mortgage demand and refinancing. The bank’s asset management business will also likely report lower earnings due to lower stock and bond prices.

In the previous report, the financial services provider US Bancorp (USB) reported Q1 2022 EPS of $0.99, topping the consensus estimate of $0.93. The company’s revenue was $5.60 billion, compared to consensus estimates of $5.55 billion. Its quarterly revenue was up 2.3% year over year. US Bancorp has generated earnings per share of $4.64 in the past year ($4.64 diluted earnings per share) and currently has a price-to-earnings ratio of 10.0. Profits for US Bancorp are expected to grow 17.83% next year, from $4.43 to $5.22 per share.

The Zacks Consensus estimate for second-quarter earnings of $1.07 moved slightly south last week, with the figure also representing a 16.4% decrease from the figure reported last year. However, the consensus estimate for revenue is pegged at $5.89 billion, representing a 2.3% increase from the figure reported last year. Management expects total revenue growth of 5-7% sequentially, supported by seasonal strength in many procurement businesses, continued loan growth and the impact of higher interest rates on net interest income (NII) and write-off recoveries from fees.

Net interest income and bank margins are likely due to higher interest rates. Continued economic expansion is expected to have supported the lending environment during the quarter. Amid these conditions, credit demand is expected to improve.

Card fees tend to rise with higher consumer spending. In addition, the demand for online payments for products and services is expected to be quite good. The consensus estimate for credit and debit card charges of $382 million represents a sequential increase of 13%. While the removal of some fees may have impacted the cost of the service, it is believed to have been offset by higher customer spending activity. This likely led to an 8.5% increase in service fee revenue on deposits. Total non-interest income was set at $2.5 billion, representing an increase of 5.9% from the amount reported in the previous quarter. US Bancorp currently has a Zacks Rank #3 (Hold).

Looking at the company’s dividend growth, the current annual dividend of $1.48 is up 10.4% from last year. Over the past five years, US Bancorp has increased its dividend 5 times annually with an average annual growth rate of 8.43%. Going forward, future dividend growth will depend on growth in earnings and payout ratios, which are the percentage of a company’s annual earnings per share that are paid out as dividends. US Bancorp’s current payout ratio is 36%. This means the company pays out 36% of its 12-month EPS as dividends.

Revenue growth looks solid for USB this fiscal year. The Zacks Consensus Forecast for 2019 is $4.35 per share, representing a year-over-year growth rate of 6.10%.

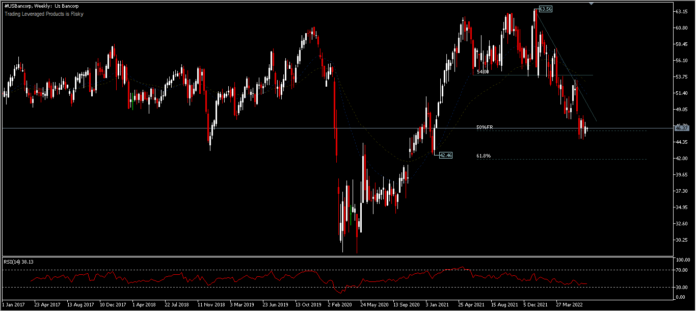

Technical Outlook

US Bancorp’s share price has depreciated -27% from its peak in January 2022 (63.56) to its close on Monday, July 6, 2022. The decline in share value followed most of the fall in global banking prices stocks, due to the threat of inflation and higher interest rates. It is currently trading at 46.37 in the 50% retracement area of the May 28.35 pullback low and January 2022 high of 63.56.

The bearish wave structure is quite dominant below the 26-day EMA, although the price has been range bound for the last 3 weeks, between $44.76-$48.14. On the downside, due to a disappointing report driven by global sentiment, the asset price could test the 61.8% retracement around $41.84. While the earnings report is better, the asset price may recover to break the minor resistance at $46.14 and is likely to test the $54.00 price level which is a resistance now. In general, asset prices are still in bearish territory.

Multiple asset management and banking target prices for US Bancorp ahead of the earnings report have been met. For example from Jefferies Financial Group from $52.00 to $45.00. Jefferies Financial Group’s price target suggests a potential downside of 2.45% from the company’s current price. UBS Group cut shares of US Bancorp from a “buy” rating to a “neutral” rating and cut their target price for the company from $64.00 to $56.00.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.