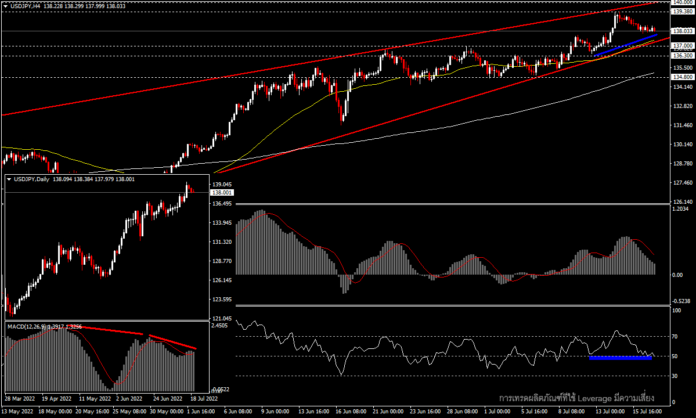

USDJPY, H4

The USDJPY pair has eased from the high seen last week at 139.38 ahead of the Bank of Japan (BOJ) interest rate decision meeting on Thursday. The bank is expected to maintain the ultra-low interest rate that has been in place since January 2016 at -0.1%, while other major central banks are using aggressive interest rates to curb rising inflation. Although the Japanese government has begun to express concerns about the sharp decline in the Yen, it has declined to comment on intervention.

In addition to keeping the interest rate negative, efforts to curb bond yields near 0% at 0.25% were evident during the second quarter of 2022, when Japan’s 10-year Treasury yields swung up and down in the 0.25% zone, another factor that put pressure on the Japanese Yen. Meanwhile, Japan’s inflation rate rose for the ninth straight month to a seven-and-a-half-year high of 2.5% in April and May, and its GDP growth rate in Q1 contracted to -0.1% from 1% in Q4.

However, the BOJ’s interest rate decision meeting may be in the spotlight for the short term. If the market finds no surprise or interference from the Japanese government they will turn their attention to the next Fed rate decision meeting that is taking place next week. The Fed is expected to raise interest rates another 0.75% after a major rate hike of 0.75% in June too.

The USDJPY started the week with a correction above 138.00, while in the larger timeframe saw a rising wedge reversal pattern in the H4 timeframe that has been forming since May. This is accompanied by the bearish divergence signal seen in the Day timeframe, with support at 137.00, 136.30 and the next support at the 134.80 zone. The uptrend sees the possibility of a hidden bullish divergence that could encourage the pair to swing further in the rising wedge, which has first resistance at the previous high at 139.38 and the psychological figure of 140.00.

Click here to access our Economic Calendar

Chayut Vachirathanakit

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.