USDIndex down to 106.52. US Stocks continued to rally overnight, after European and US markets posted broad gains yesterday (NASDAQ +3.11%) amid strong earnings and the expected resumption of Russian gas supply to Europe helping lift risk-on sentiment and ease fears of a recession. UK CPI inflation lifted to 9.4% y/y in June from 9.1% y/y in the previous month. Core inflation eased slightly, but at 5.8% y/y still remains far, far above target. German PPI inflation eased slightly.

Earnings: Netflix shares jumped after earnings beat; it lost fewer subscribers than expected and says cheaper ad tier is coming in early 2023. Boeing rose on deal to sell jets to 777 Partners, Johnson & Johnson and IBM fell on dollar impact warning, Halliburton, Hasbro & Truist rose after profit beat. Johnson & Johnson beat analysts’ estimates on strength in its pharmaceuticals unit, even as the company cut its full-year adjusted profit forecast due to a stronger Dollar. Twitter Inc. and Elon Musk will go to trial in October over whether the billionaire must complete his $44 billion acquisition of the social media company, a Delaware judge ruled on Tuesday. Amazon.com filed a lawsuit against the leaders of more than 10,000 Facebook groups it accused of publishing fake reviews on the e-commerce site, the company announced on Tuesday.

- USDIndex is mired at two-week lows to 106.52. It has fallen 2 handles in two days from a 20+ year high of 108.54 last Thursday.

- Equities – USA500 climbed 2.76%, USA100 surged 3.11% followed by a 2.43% jump in the USA30. JPN225 gained 2.7%, the ASX 1.7% and Hang Seng and CSI lifted 1.6% and 0.2% respectively.

- Yields 10-year Treasury yield is up 0.2 bp at 3.02%.

- Oil down to 98.70 & Gold steady at $1707.

- FX Markets – EURUSD has climbed to 1.0233 ahead of Thursday’s ECB meeting. USDJPY has corrected to 137.52. Cable at 1.2008.

Today: Canadian CPI. Earnings – Tesla, ASML Holding, Abbott Laboratories etc. For Europe the day of reckoning will come tomorrow when the ECB meeting coincides with the day the Nordstream 1 pipeline is supposed to re-open after scheduled maintenance work. If Russia doesn’t re-open and the ECB announcement disappoints Eurozone stocks and the EUR are likely to sell off in tandem with Eurozone peripherals.

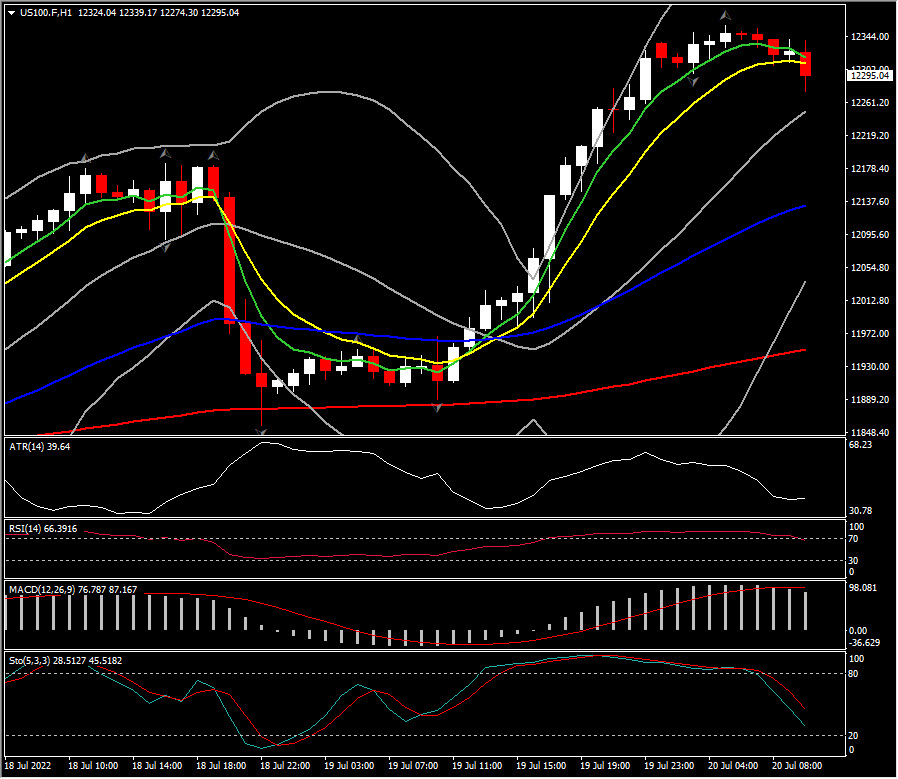

Biggest FX Mover @ (06:30 GMT) US100 (+3.10%). Spiked to 12,356. Next resistance 12,600 & 12,945. MAs aligned, turning lower in 1-hour chart, MACD histogram & signal line hold higher, RSI 66 but falling.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.