Danone, an infant formula manufacturer based in Ireland which leads the market in both dairy and plant-based product categories, as well as operating other businesses in waters, infant and adult nutrition, saw its stock price jump over 2.5% overnight after the company raised its 2022 sales revenue growth outlook .

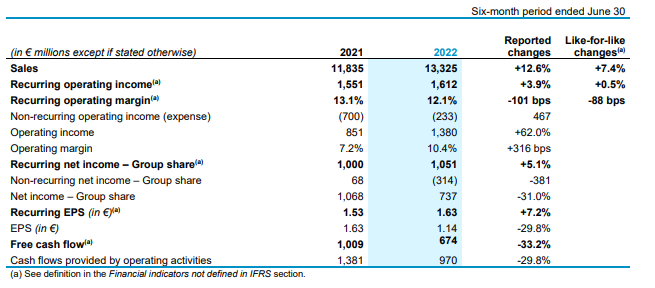

Fig.1: Key Figures Six-month Period Ended June 30. Source: Danone Financial Report.

Based on its latest interim financial report, like-for-like (LFL) sales in Q2 2022 were up over 7%, resulting in +7.4% net sales (or €13.3B) for the first half of 2022. Recurring EPS was up +7.2% (y/y) to €1.63, while recurring operating margin stood at 12.1%.

Danone has businesses around the globe. By region, sales growth of the company in the first half of 2022 are +9.7% (Rest of the World), +8.3% (China, North Asia & Oceania), +7.2% (North America) and +5.4% (Europe). Despite the Russia-Ukraine conflict (Russia is the fifth largest market to Danone in terms of contribution to sales), the management remains optimistic and raised its sales guidance to between +5% and +6% (previously was +3% to +5%).

In fact, Danone has been actively developing different types of products to stay competitive worldwide. These include plant-based formula (to satisfy the demand of flexitarians and vegetarians), protein bars, ageing powder drinks, etc. Its strategy in partnering with various e-commerce platforms has further scaled its presence, bringing a greater variety of offerings to consumers worldwide.

Technical Analysis:

The Daily chart shows #Danone gapped up higher at market open today, before giving up its gains and retracing lower back to €55. Above the current price lies the FR 50.0% level, at €55.88. This level shall confirm whether the formation of head and shoulder pattern is successful. A closure above the level would deem the pattern a failure, thus opening up more upside room towards the next resistance at €58.10 and €61.26. Otherwise, if the candlestick closes below the FR 50.0%, the 100-day SMA at €53.66 may serve as the nearest support, followed by €50.91 and €46.47.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst – HF Educational Office – Malaysia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.