Booking Holdings Inc. is a company dedicated to the implementation of technology for tourism such as search engines and an online travel agency that includes flight reservations, lodging, and car rental among other services. The company owns and operates several travel fare aggregators including booking.com (their main source of revenue), kayak.com, momondo, rentalcars.com, etc. It operates in 200 countries with approximately 100 million active users and a capitalization of 78.63B.

Booking Holdings Inc. is expected to release its second quarter 2022 earnings report this Wednesday, August 3 after the market close.

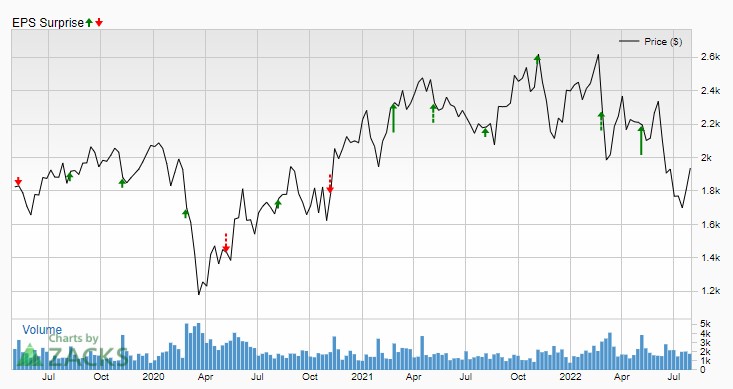

Source: https://www.zacks.com/stock/chart/BKNG/price-eps-surprise

According to Zacks, Booking ranks #4 (Sell) at position #146/#251 in the internet-commerce industry. Expected EPS is $17.73-$17.85, after last quarter’s EPS of $3.90 with a Surprise EPS of 2885.71%. Compared to the same quarter of last year with $-2.55 this would be an increase of +795% y/y and with an ESP of +0.67% this would be the 6th time that it has exceeded expectations. Net sales are expected at $4.35B compared to the same quarter of last year, at $2.16B, an increase of +101% y/y. EPS has had 0 upward revisions and 3 downward revisions in the last 30 days.

Despite Booking shares being down 30% from their current high, the company has been on the mend as the pandemic subsides and travel spending is reinstated on increased demand despite the economic contraction plaguing the world due to inflation. All indications are that global travel spending will eventually return to pre-pandemic levels and the company should continue to deliver growing bookings and other beneficial business metrics going forward as a continued recovery. The problem however is that the markets have priced in most of the rally higher, which explains the overall market sell off.

In the first quarter of the year, the company presented a record in its reservations reaching $27B (+7% compared to 1Q 2019), mainly thanks to Booking.com which contributed 34% of its reservations processed by its own payment platform. For the summer, reservations on the platform increased by 15% compared to 2019, while Europe and North America increased by more than 30%. It is expected that for this quarter there will also be an operating profit.

Booking has also dabbled in a bid to appeal to younger generations, creating its first TikTok marketing campaign.

Booking’s goal is to inspire people to travel, create positive interactions with the brand and make them think of the company as travel leaders.

-Laura Kaye, Director of Social Media at Booking.com

A current obstacle to consider for Booking and all travel companies is that not only are there outbreaks of Covid in several countries that are once again placing restrictions on their populations (such as in China) but also that the world is facing a new virus that could cause problems, although to a lesser extent. Monkeypox, which started a viral outbreak in the United Kingdom at the beginning of the year, already has more than 22k cases worldwide, with health authorities very attentive and alert to its progress. In the US there are more than 5k cases and last week an emergency was declared in NY and San Francisco accelerating the planning for the control of the outbreak, which although it has not yet caused lockdowns, if it continues with the current rate of spread there is a chance of them happening in the future, albeit a low one.

On the other hand and following the recovery, Booking.com has had a 12.5% increase in website performance compared to last month with a total of 424.6 million visits with a 39.57% bounce rate. There has been a consecutive increase, with 347.8M in April, 377.5M in May and 424.6M in June, with the US being the main contributor with 16.92% of the total, followed by Germany with 7.74%.

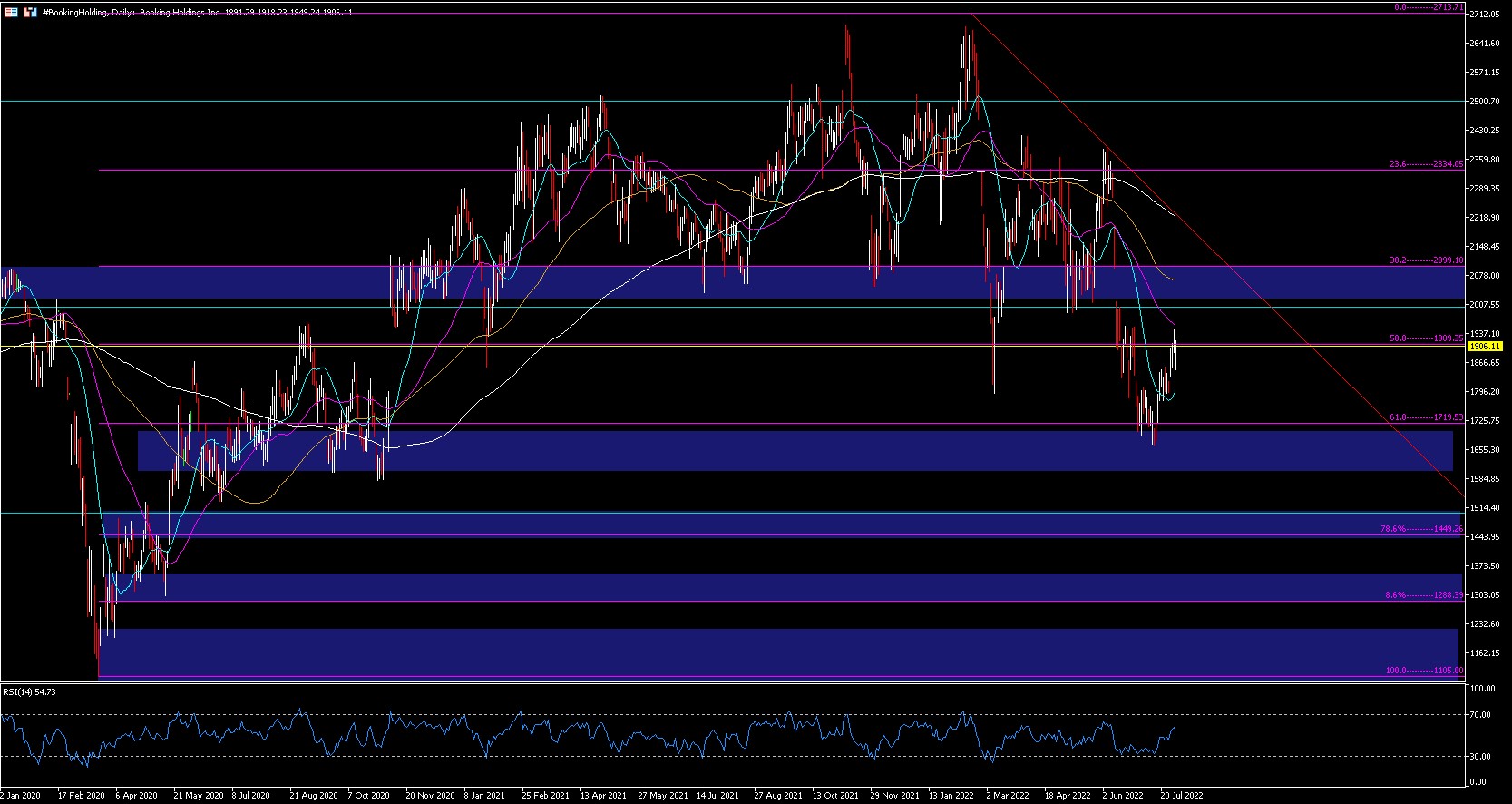

Technical analysis

Booking Holdings Inc has been in a downtrend for 6 months from its high at 2,713.64 and is currently trading at 1,906.11 with a rebound from last month’s low at 1,666.98. Price is currently at the 50% Fibo at 1,909.35 of the bullish momentum that started from 1,105 in March 2020 to all-time high in February this year.

The price could not stay above 2,500 and last month it broke the psychological level of 2,000; despite the fact that last month it rose more than 3% the price has not managed to recover the psychological mark and for the moment remains below it.

Support is at the 20 period SMA D1 at 1,797.57, a wide support range of 1,600-1,700, the psychological level at 1500.00 and lastly the lows of the current cycle at 1,105; from there support is at the nearby highs of April-May 2012 at 770.00. Current resistances are at the 50-period D1 SMA at 1,956.19, the 2k psychological mark, the 100-period daily SMA at 2,068.84, the 38.2% Fibo at 2,099, the 200-period D1 SMA which currently coincides with the downtrend at 2,200, highs of June at Fibo 23.6% at 2,334.05, psychological mark of 2,500 and up to all-time highs. Daily RSI at 54.73 with a bullish bias, although down from 57 to 54.

Click here to access our Economic Calendar

Aldo Zapien

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

Sources:

- https://www.nasdaq.com/es/market-activity/stocks/bkng/earnings

- https://www.zacks.com/stock/quote/BKNG

- https://www.zacks.com/stock/news/1960224/booking-holdings-bkng-outpaces-stock-market-gains-what-you-should-know?art_rec=quote-stock_overview-zacks_news-ID03-txt-1960224

- https://www.nasdaq.com/articles/booking-holdings-bkng-outpaces-stock-market-gains%3A-what-you-should-know