E-commerce giant Alibaba Group Holding Limited is expected to report earnings for the fiscal quarter ending June 2022 on Thursday, August 04, 2022 prior to the market opening. The earnings report will likely be overshadowed by US-China tensions and the threat of delisting from the Securities and Exchange Commission. The SEC on Friday last week added Alibaba to a list of foreign companies whose audits cannot be fully vetted by the Public Company Accounting Oversight Board, putting Alibaba’s shares at risk of being delisted from the NYSE if the company’s accounts cannot be audited for three consecutive years.

Alibaba’s strong efforts to add value for consumers and sellers through product enrichment efforts and platform innovation are expected to drive e-commerce business growth in the quarter to be reported. New monetization formats and strengthening of online physical merchandise volumes in China’s retail market, adaptation of advanced technology, along with increased validation for Taobao and Tmall portals, adoption of Big Data and AI into e-commerce platforms and good performance from Lazada, AliExpress, Trendyol , and Daraz are likely to have helped Alibaba’s International trade retail business perform well in the quarter under review. This should be supported by solid momentum across most members on the alibaba.com platform, coupled with strong cross-border related value-added services.

In addition to the strength of the e-commerce business, the growing enterprise cloud segment and, solid momentum across the financial services, retail and telecommunications industries is likely to continue to drive its cloud computing revenue in the quarter under review. However, the company has spent a lot of money on its core online retail businesses, including supermarkets, stores, new AI, digital entertainment and cloud computing businesses. The impact of increased costs is expected to be reflected in the results.

According to Zacks Investment Research, the consensus EPS forecast for the quarter was $0.83. The reported EPS for the same quarter last year was $2.16. Alibaba currently has +18.93% Earning ESP and Zacks Rank #3 (Hold). )

There are concerns that China’s tech crackdown initiatives and zero-COVID policies, which led to regional lockdowns, could hurt corporate earnings results. Chinese e-commerce companies have seen slow revenue growth in recent quarters, due to slowing consumption and intense competition. Amid the challenges ahead, analysts expect Alibaba to post its first year-over-year decline in quarterly revenue since going public, according to data from FactSet and information from Dow Jones Market Data, with sales expected to fall by about $1.5 billion.

Truist Securities analysts wrote that the easing of COVID-related lockdowns in Shanghai should be a positive catalyst for growth this quarter and corporate earnings could suggest that the worst may be behind it. However, competition from live streaming platforms in China is limiting Alibaba’s opportunities.

FactSet estimates that Alibaba will report revenue of $30.3 billion, down from $31.8 billion a year earlier. The FactSet consensus calls for RMB 10.70 ($1.58) in adjusted earnings per share in the June quarter, down from RMB 16.60 ($2.45) in the year-earlier period. Of the 57 analysts tracked by FactSet who cover Alibaba shares, 52 have a buy rating, 4 have a hold rating and one has a sell rating. The average target price is $153.56. Keep in mind, though, that Alibaba’s stock price has fallen in 10 of the company’s last 11 earnings reports.

Based on Tipranks, analysts are optimistic about the stock and have a Strong Buy consensus rating of 21 Buy, 1 Hold, and 1 Sell. Alibaba’s average target price is $154.05. The average price target represents a change of 65.25% from the last price of $93.22.

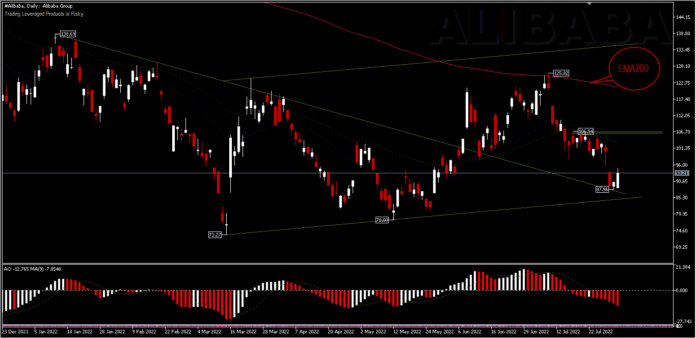

Technical Overview

US-listed Alibaba shares have lost more than half of their value over a 12-month span and this week’s earnings report may not be strong enough to reverse the downside momentum. The price position is currently around 93.00 after strengthening for a second day. The bear pressure still looks quite real, with the price moving below the 26/52 day EMA.

On the upside, price could seek to test 106.94 and a better earnings report could support a move up to 125.83 price levels and the 200-day EMA. As long as the price remains below 125.83 the outlook for the future remains unclear, and further consolidation may continue.. On the downside, a move below the 87.96 support would lead to a test of the 73.27 low.

Intraday bias suggests a short rebound above the trendline, while any further move to the upside will be blocked by the 200 EMA. Overall price still looks bearish, however long term investor interest may see the price has been undervalued.

¹). Zacks ²). Marketwatch

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia