The Australian Dollar’s weekly performance has yet to show any meaningful change against the British Pound, following the latest RBA monetary policy decision on Tuesday. Governor Philip Lowe said in his August monetary policy statement that the RBA places a high priority on safeguarding the domestic economy and will bring inflation back to its 2-3% target. The RBA said on Tuesday that it still expects to raise rates further over the next few months, but they will however be cautious when doing so.

Meanwhile, there are hints at the possibility of a 50bp hike at the BoE meeting today (Thursday). In the current business climate with high inflation and the central banks aggressively raising interest rates, a 50bp hike is not seen as a big number anymore. Ironically, the BOE hasn’t raised interest rates by 50bp since 1995, so such a policy could be significant, despite what the market expects. If this is what the BOE does, it will bring interest rates to 1.75%, still well below the rates of the Fed and many other major central banks.

The BOE is under heavy pressure to ease the UK’s cost of living crisis, with inflation rising to 9.4% in June, after a 9.1% rise in May. Inflation expectations are also rising, which will make it harder for the BOE to contain inflation. The risk of faster tightening could send the UK economy, which is already showing signs of slowing down, to the brink of recession and worsen sentiment towards Sterling.

GBPAUD will get support, if the BoE takes a hawkish step, although it is still a debate whether the UK economic data has met the BoE criteria for this action. The risk could be from an unchanged gain of 25bp, which would put more pressure on Sterling. However, the AUD is also likely to be sensitive to the implications of the RBA’s latest economic forecast, due for release on Friday.

Technical Overview

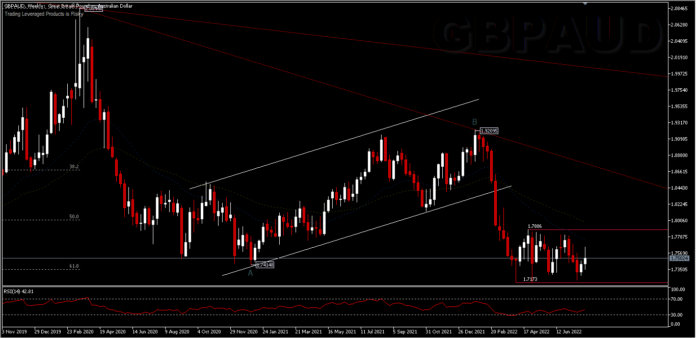

In the longer term, the GBPAUD pair still maintains a bearish bias, as can be seen from the asset price which is still below the 26-week exponential moving average. A move to the downside remains within the FE61.8% projection at 1.7100 (from a pullback to 2.0844 – 1.7414 and 1.9209 peaks), although at the moment, the cross is still in consolidation mode between 1.7173 – 1.7886. The range of this range will determine the direction of the next trend, if there is a break on both sides. A downside break would only confirm, that the bearish trend is far from over and further declines will take place for the 1.7000 psychological price level and further down. Meanwhile a break to the upside would record 1.7886 as a short term bottoming and the bias would be to the upside for the 1.8125 support which would become resistance.

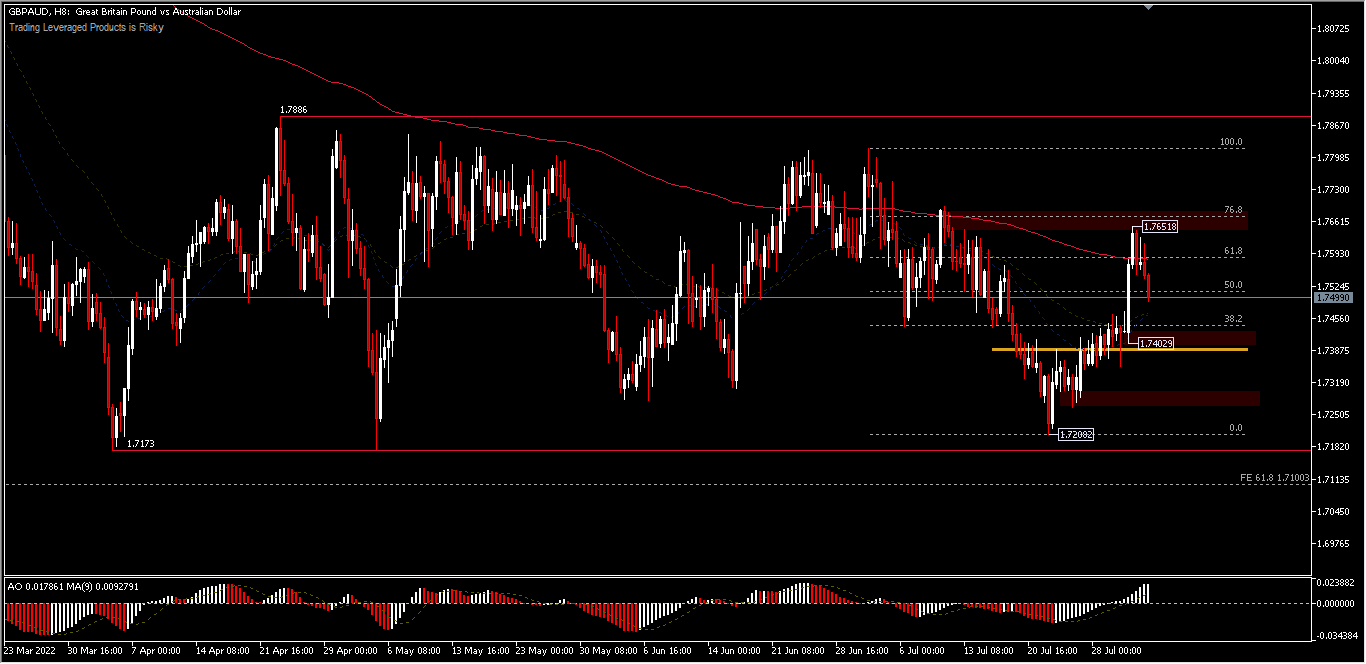

GBPAUD,H8 – In Wednesday’s trading, the cross was seen losing its rally momentum below the 76.8%FR level to register a high of 1.7651. The decline partially erased the recovery of the previous 2 days. Bias is temporarily neutral; a move above would 1.7651 open a chance to test 1.7886 and conversely a break of 1.7402 would again bring the bias to the downside for 1.7173.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.