The Estée Lauder Companies (EL.s) founded in 1946, is the leading global beauty industry company with skin care, makeup, fragrance and hair products distributed internationally through strong and profitable digital commerce and retail channels. Estée Lauder has a portfolio of more than 25 brands such as M·A·C Cosmetics, Clinique, and La Mer. It has 60,000 employees with more than 1,600 independent stores in around 150 countries and last year it was one of the main manufacturers of beauty products, ranking 6th out of the main personal care brands with the highest annual growth rate of the main cosmetic companies worldwide in 2021. The company has a capitalization of $98.41B and is ranked #228 on the Fortune 500.

Estée Lauder Companies Inc. is expected to report its earnings results for the fourth quarter of fiscal 2022 and for the full year this Thursday, August 18, before the market opens.

EL.s is down -23.2% YTD, well below the SP500 at -11.5%. However, in the last quarter the company reached +7%, beating the SP500 by +4.8%.

Zacks positions the Estee Lauder Companies Rank #3 (Hold) and in the top 33% (#169/252) of the Cosmetics industry. EPS of $0.33 (-57.69% y/y) with -9.58% ESP is expected for this report, a rather murky figure when compared to most of the previous ones. A profit of $3.44B is expected, which would be a year-on-year contraction of -12.51%. The estimate has had 2 upward revisions and 3 downward revisions in the last 60 days. The company has a P/E ratio of 34.90 and a ratio PEG of 3.35. Last quarter the company reported EPS of $1.9 and revenue of $4.25B.

For fiscal year 2022, EPS of $7.14 is expected, which would be a growth of 10.7% y/y, and revenues of $17.622B, which would translate to a growth of 8.7% ($16.22B in 2021) year-on-year, although $20.88B was expected. By 2023, 22.34B is expected.

The largest share of net sales was in Europe, the Middle East and Africa with 42.84% in 2021.consumer spending

Management advised that there could be headwinds thanks to various factors including the pandemic and multiple outbreaks of covid causing lockdowns in Shanghai and other parts of China which wreaked more havoc on the supply chain than there already was, as well as Russia’s invasion of Ukraine that sent world inflation to levels not seen for decades and caused a change in consumer spending and outlook. The average annual expenditure on cosmetics, perfumes and bath products per consumption unit in the United States was $199.17 in 2020. The makeup market has not stopped rising; this year it expects $37.05B and expectations for future years is even higher, according to Statista.

In addition, the annual growth of the global cosmetics market has recovered in a surprising way, up 16% from its fall in 2020, far exceeding previous years that had an average of 3.6%.

Despite the headwinds, the company has made efforts to implement a good e-commerce infrastructure supported by new technologies and digital experiences with constant updates for users, giving online reservations for each appointment in the store, omnichannel programs and high-tech services, which it has benefited from as consumers have shifted to e-commerce rather than physical in recent decades and now even more fueled by the pandemic.

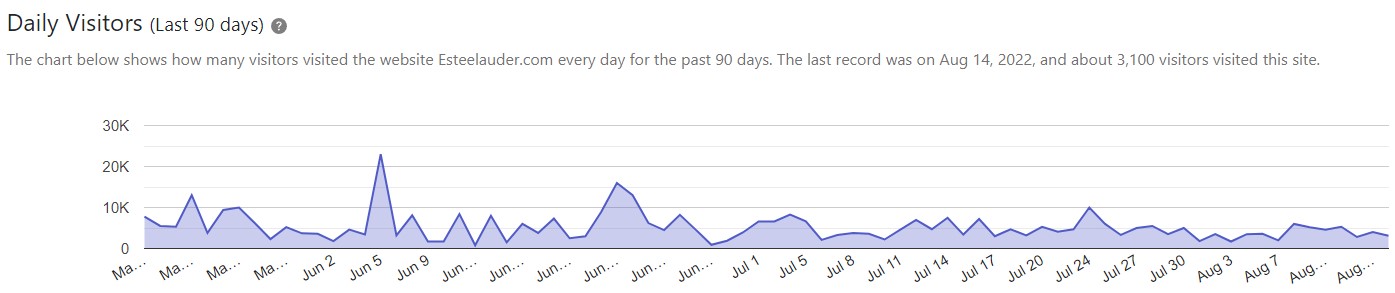

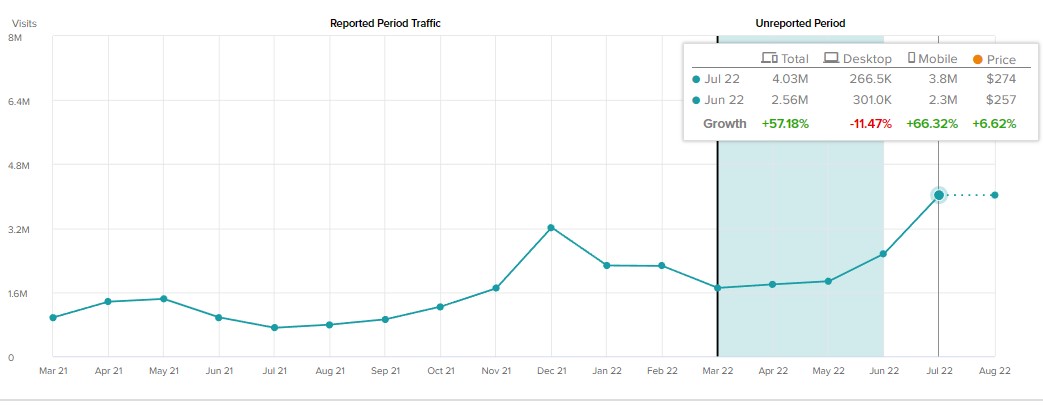

The main website www.esteelauder.com is ranked #82,994 in the world and #13,639 in the United States. Website ad revenue could average $165.54 per day based on traffic averaging 3k visitors/day, a minimum of 800v/day, and peaking as high as $24k on certain days, according to Statscrop. Although the majority of sales were in Europe and Asia, the site’s traffic in the month of July was mainly in the United States with 97.6% of total visits, followed by Uzbekistan with 1%. The website had a growth of +57.18% YoY with 4.03M visits in July against 2.6M last year, according to TipRanks.

Technical Analysis – The Estée Lauder Companies W1 $276.39

During 2020, the price of The Estée Lauder Companies gave an upward momentum from a low of $135.50 in March to reach its current all-time high of $373.91 in January of this year. From there, the price has had a downward break that left a low of $224.98 in May, coinciding with the SMA of 200 weekly periods and the 61.8% Fibo at $226.57 and lows of 2021, where it rebounded to remain hovering for several months at the psychological level of $250.00 and the 50% Fibo at $254.70.

In recent weeks the price has broken the resistance of the 20 weekly SMA at $258.531 and is on the way to test the 38.2% Fibo at 282.84. Above it is the 100 weekly SMA at $288.862 and the 50 weekly SMA at $295,154 which is close to being crossed, although it could be just a retracement to continue the decline – if not the key psychological level and resistance would be $300 followed by $350 and then its all-time high. Support would be at the 200-period SMA currently at $233.484 in the range of the aforementioned 61.8% Fibo, followed by the $200 psychological level.

Click here to access our Economic Calendar

Aldo Zapien

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

Fuentes:

- https://www.zacks.com/stock/quote/EL

- https://www.zacks.com/stock/news/1968059/what-awaits-the-estee-lauder-companies-el-in-q4-earnings