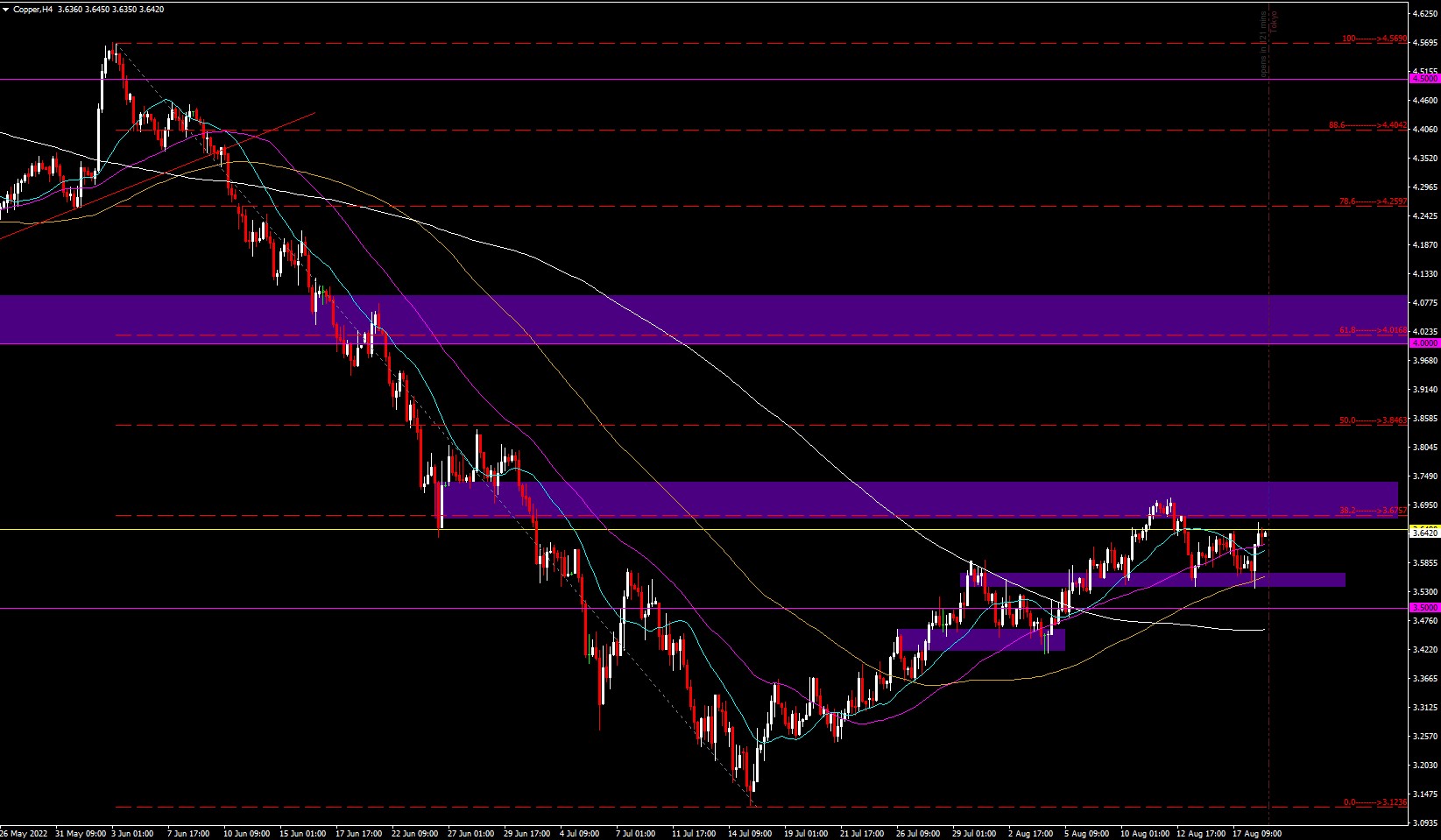

Copper H4

The price of copper began a decline from June highs at 4.5690 to lows at 3.1236, from here the price recovered the 3.50 level and came to test the Fibo 38.2% at 3.6757 last week and we have tested support at 3.5500 already with 3 tests to date , this last one also testing the 100-period SMA H4 that formed a bullish envelope that exceeded the 20- and 50-period SMA, close to the highs of the month at 3.7080.

We have a resistance range from 4.00 to 4.10 that encompasses the 61.8% level at 4.0168. however this could be just a pullback to continue down, we have the 50-20-100 and 200 moving averages in a range from 3.4590-3.6200.

Silver – XAGUSD H4

Silver started falling from highs of 26.916 after failing to hold above the psychological level of 25.00 during April and ended up falling to lows of 18.133 in July. From here the price formed an equilateral triangle breaking to the upside and rising to test the current resistance near 21.00 at 20.70, which could be a retracement to drop back to the aforementioned lows below 19.00. We are currently testing the 200 period SMA at 19.50.

Highest resistances at 22.5 which coincides with the Fibo 50.00. The 61.8% Fibo at 23.561 above matches the current bearish trendline, and support broken at 24.00. Supports at the psychological level of 19.00 below the July lows at 18.130, in case of breaking this level we would have support until the June 2020 lows at 16.940.

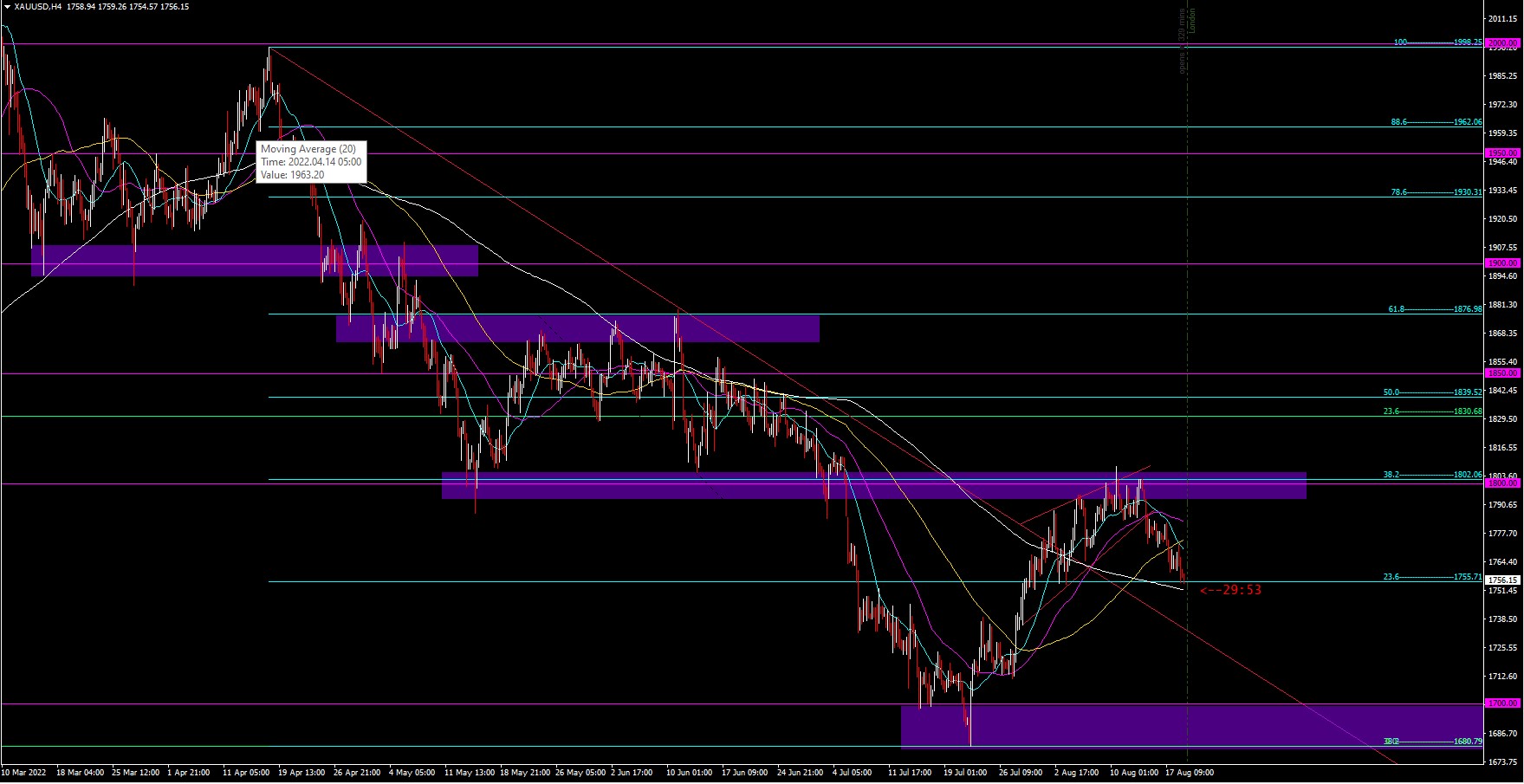

Gold – XAU/USD H4

The Gold price is trending down from 1998.25 in April this year after hitting all-time highs at 2072.96 and falling as it failed to hold the key 2k level. The price has fallen over the past 4 months and left lows at 1680.79 which are also lows from August and March of last year, leaving a current key support range from that low to the psychological level of 1700.00. As of mid-July the price recovered until it tested the psychological level of 1800.00 several times, which coincides with the Fibo 38.2% at 1802.06, the level that it broke at the end of June/beginning of July and which was also the low of May.

Upon reaching this level the price reduced the strength of the bullish rally and formed a bearish wedge pattern which has already been broken. Currently the price is at 1756.54 and has broken the moving average of 20+50+100 periods and below that there is the 200 period at 1751.57. The rebound in resistance could be a setback to continue the fall and test or break the support range of 1700.00; if this range is broken there could be a fall to the psychological support of 1600.00.

Palladium H4

Palladium has also had a downward trend since its maximum at 3431.95 in March, leaving minimums at 1768.35, and has started a setback that recovered the 2k and tested the Fibo 61.8% at 2260.71 of the upward impulse of Dec 21 and leaving a maximum at 2289.90. Within this retracement we can see a Wolfe Wave pattern and point 5 was the one that said Fibo tested. Currently the price has fallen to the bullish guideline of the pattern where it stopped in range along with the SMA of 100 +20 periods at 2141.80. If the pattern happens, the objective would be below the psychological level of 2k and Fibo 78.6 at 1942.31 and at previous lows close to Fibo 88.6% at 1752.79 and the lows previously marked, while breaking this support would see the price drop to the low of the previous bullish momentum at 1.5k-1536.74.

If the pattern does not occur and the upside recovers, we would see resistance at Fibo 61.8% again, followed by a range at Fibo 38.2% from the drop at 2403.85 to the psychological level of 2.5k, Fibo 50.0 at 2.6k and 61.8 at 2796.45 and up to 3k.

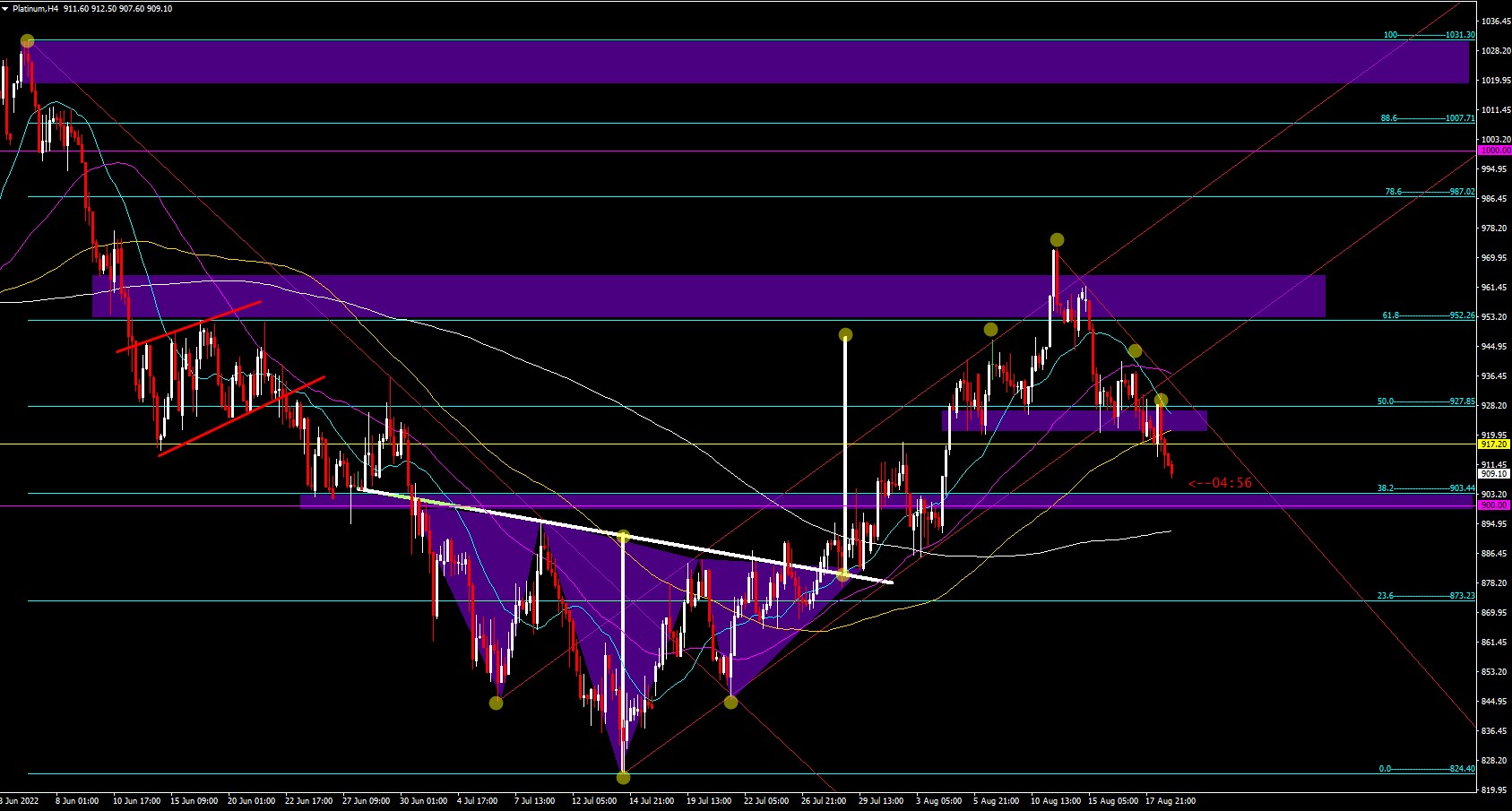

Platinum H4

Platinum fell from a high of 1031.30 in June to reach a low of 824.40, where it formed an inverted crown pattern to rise to test the 61.8% Fibo at 952.26 with a high of 972.50, followed by breaking the 20 and 50 period SMAs and the bullish channel that it had. Currently it is testing the psychological level of 900.00 and perhaps the SMA of 200 periods in 892.82; if it breaks them it could head for the lows of 824.

Click here to access our Economic Calendar

Aldo Zapien

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.