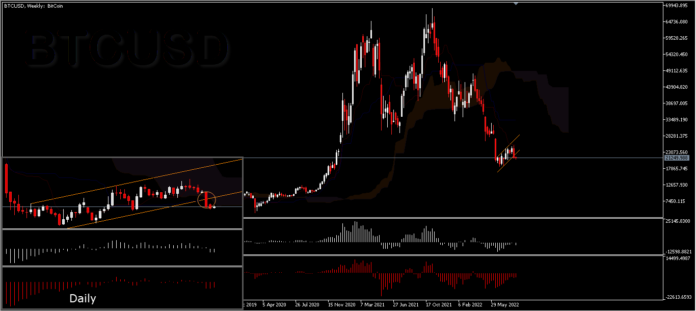

BTCUSD’s bearish pattern still dominates trading, having failed to move further above 25k. Even a breakout of the rising wedge pattern on the intraday, triggered a sell-off across the market. Attempts to form an uptrend over the past few weeks have broken and are likely to move further down, still dominating the market sentiment.

The impact of the decline made Altcoin prices experience a massive sell-off again. At the time of writing, BTC is trading at $21.2K, while ETH is trading at $1,611.

From a technical point of view, at H8 the price broke the bullish trendline and moved below Kumo, and the bearish bias is likely to test the 1st support at 20,666. After confirming the price decline through the first support structure, it is estimated that the bearish momentum will bring the price to the second handle at 18,874. To the upside, the 22,513 is the next resistance level. Broadly, bear dominance is still very strong.

From news perspective, the latest cryptocurrency news say the government of El Salvador is working on a recovery plan for the distressed Bitcoin lending company, while in other news, Texas Senator Ted Cruz has been encouraging Bitcoin mining, as according to him, mining gives birth to entrepreneurs and generates family prosperity.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.