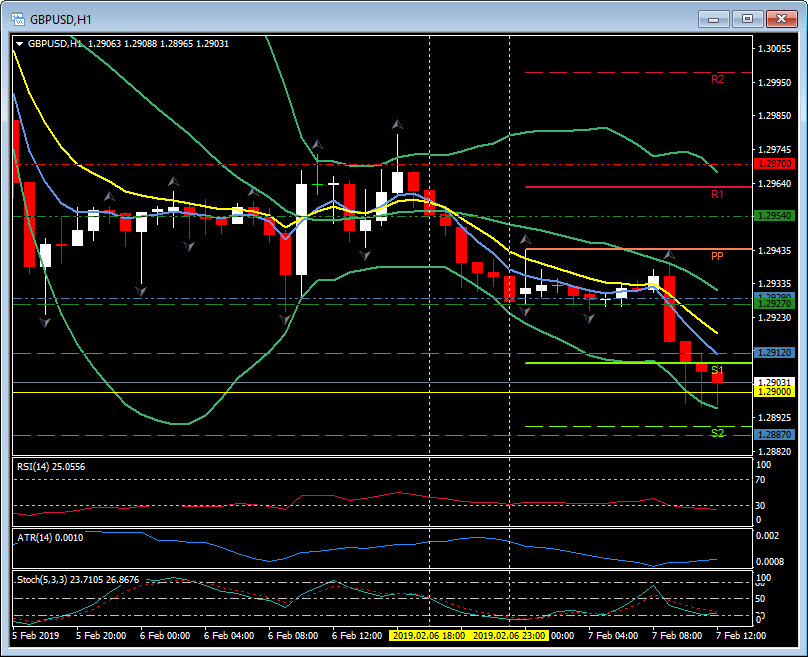

GBPUSD, H1

The central bank’s Monetary Policy Committee (MPC) concludes its two-day policy meeting today, announcing at noon in London (12:00 GMT). No changes to the repo rate and QE totals is all but a certainty after unanimous votes at the nine-member committee, with Brexit uncertainty having firmly placed the BoE into wait-and-see mode. This would leave the repo rate at 0.75%. The BoE will also publish its latest quarterly Inflation Report, which will furnish updates on its growth and inflation outlooks. Market expectations are for a downward trimming to both GDP and CPI projections relative to those given in the last Inflation Report in November, to be accompanied with overall dovish-leaning guidance from the BoE. UK CPI fell to a two-year low of 2.1% y/y in December, which was slightly below the BoE’s projections, while the January UK PMI surveys brought clear evidence of slowing activity as a consequence of Brexit uncertainty.

The press conference that follows at 12:30 GMT could have added spice, following Donald Tusk’s comments yesterday and Governor Carney’s willingness to express the bank’s view on the economic consequences of all possible outcomes.

With 50 days to the (current) Brexit deadline the market is still expecting a Deal, at some point, and although the spectre of a No Deal Brexit has risen in the last few weeks this is still seen as unlikely. However, 50 days before the referendum vote in June 2016, a vote to leave the EU was also seen as unlikely.

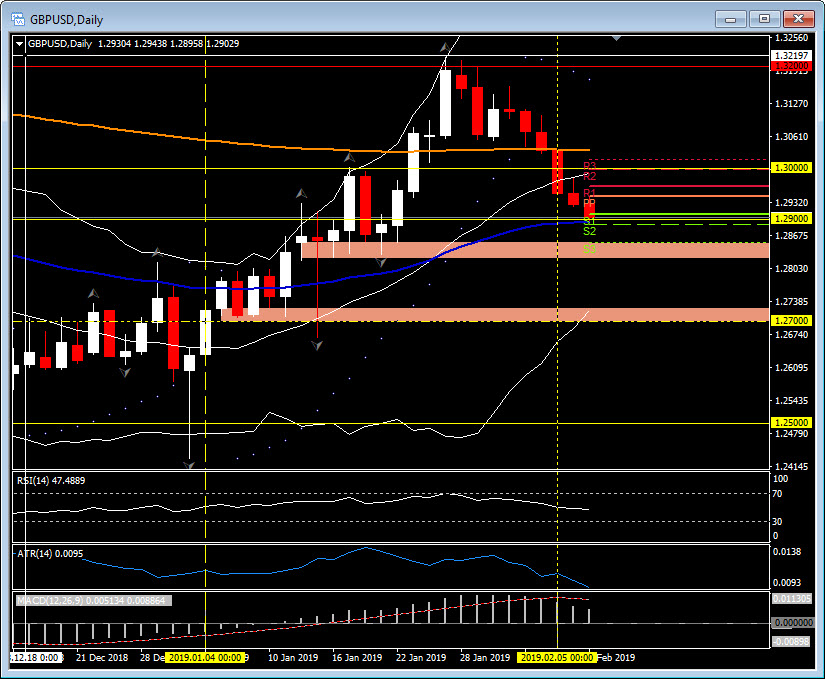

Sterling remains in the spotlight with Cable trading around 1.2900 and the 50-day EMA. The daily chart breached the 20 and 200-day moving averages on Tuesday (February 5) continuing it’s down trend from the January 25 high at 1.3210. The 50.0 Fib level and S3 1.2850 and the 61.8 Fib levels 1.2725-00 are the next two key support levels. A break and breach of 1.3000 and 1.3050 would be required to reverse the 8-day down trend.

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.