European stock indexes capitalized on the US market close by recovering from last week’s losses, the Euro fell to 0.9877 for the first time in 20 years against the US Dollar before closing up +0.08% on Monday. European gas prices remained high, after Russia said its main gas supply pipeline to Europe would remain closed indefinitely. The news sparked fears of a recession in Europe, with businesses and households hurt the most by high energy prices.

European natural gas futures jumped 15% to above €245 per megawatt hour on Monday, after hitting a three-week low of €203 on Friday. The Nord Stream pipeline was already running at just 20% capacity before the flow was stopped last week for a 3-day maintenance period. Gazprom’s decision will deepen Europe’s ongoing energy crisis, with countries seeking alternatives to Russian gas supplies, including liquefied natural gas from the US. EU ministers will hold an emergency meeting this week to discuss the energy crisis and determine specific measures to combat rising costs, which could include capping gas prices.

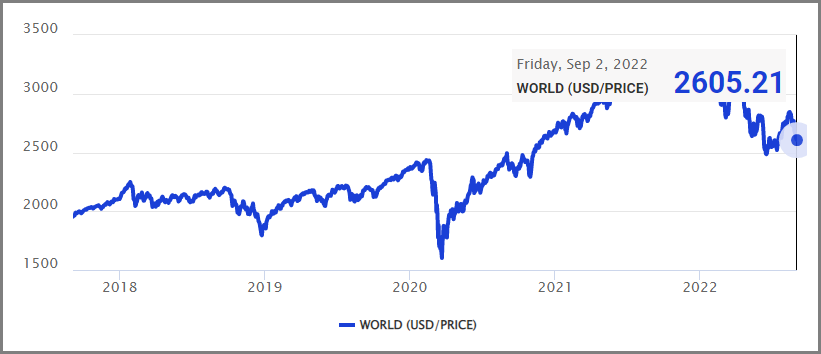

Meanwhile, the MSCI world equity index, which tracks shares in 47 countries, was down more than 0.4% at Friday’s close, last week. In Monday’s trading, the EU50 attempted to bounce back by collecting modest gains of 0.5% while the UK100 was ahead, gaining 1% and GER40 recovering more than 1%.

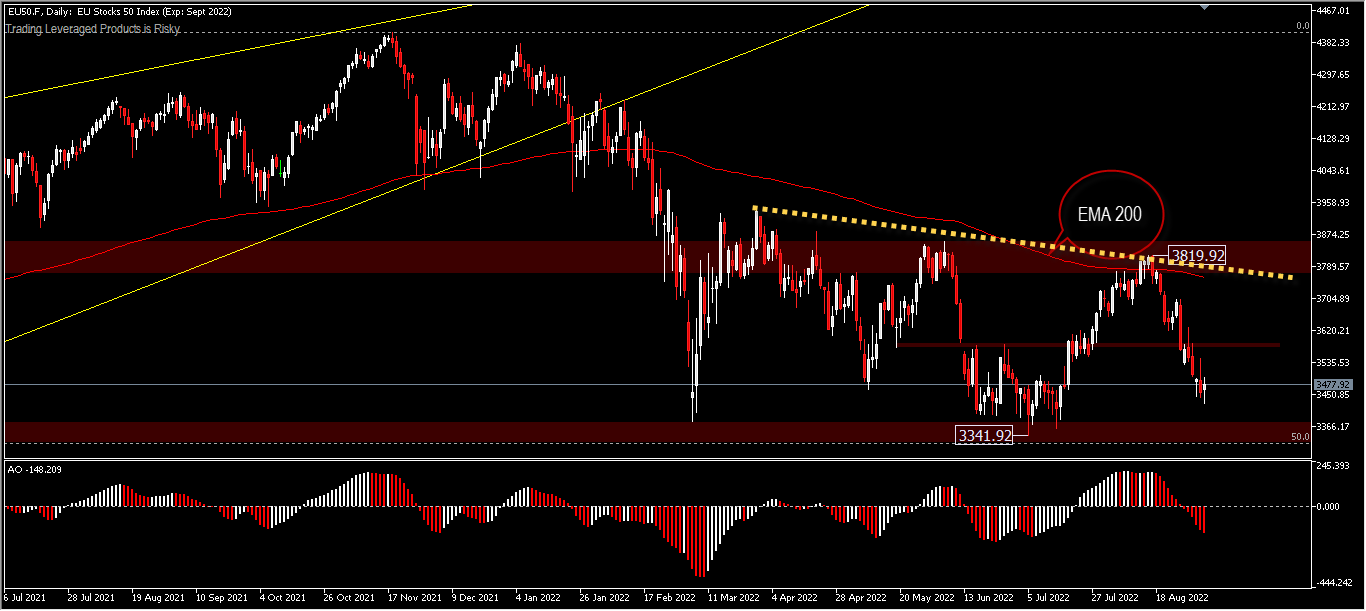

EU50,F remains under pressure with price moves below the 26-week and 52-week moving averages, while on the daily period the 200-day EMA is clearly the main barrier. Range-bound trading has been in effect for the past 27 weeks with key support seen at 3341.92 just above the 50.0%FR level of the March 2020 draw low and November 2021 peak. On the upside, the resistance stands at 3819.92. A move below the 3341.92 support, the index could move to the 61.8%FR level around 3066.00 or further to the 2885.00 support. Meanwhile, the index looks difficult to move higher with the conditions that Europe is currently facing.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.