The Hershey Company is best known as one of the biggest chocolate conglomerates in the world, established in 1894 by Milton S.Hershey. Some of the chocolate-based candies under the company include Hershey’s Kisses, Reese’s, Kit Kat, Whoppers, Cadbury, etc. In addition to that, the company also manufactures and sells a wide range of products, including baking products (baking chips, baking bars), snack food (Skinny Pop Popcorn, Paqui chips, ONE protein snack bar, Lily’s non-processed sweets etc), and syrups, spreads, and toppings. As well as all that, the company has also built HersheyPark which offers lots of entertainment (and that comes with lots of perks such as free breakfast and park tickets, resort benefits, extra cash bonuses, etc) for tourists and local visitors, including water park attractions, ZooAmerica and Hershey’s Chocolatetown. All of these have made Hershey the successful company it is today.

Hershey has manufacturing plants both locally in the US and overseas, namely in Brazil, Mexico, Canada, India and Malaysia. It recently reported that the company is going to expand its Mexican plant in which it is expected to raise output by 25%. Historically, the company has shown resilient growth even in the midst of major crises, from the influenza pandemic of 1918, the Great Depression, two world wars, and the recent Covid-19 pandemic and economic recession. Taking Covid-19 as an example, a study has shown that more people are inclined to purchase comfort food such as chocolate and candies as an escape from heightened stress levels during the challenging period.

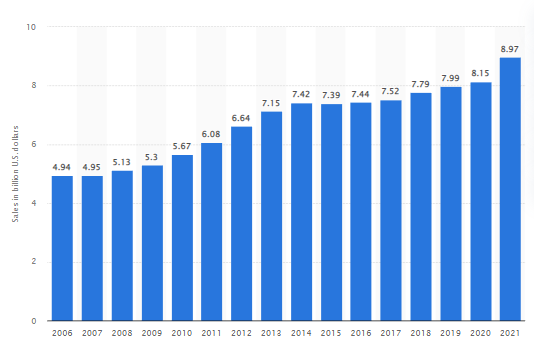

The management expressed concern over its sales at the initial stage of pandemic outbreak, however, statistical data proved it wrong. As shown in fig.1, net sales of the company broke $8 billion by the end of 2020, and it continued to increase to nearly $9 billion in 2021. Its net income for the year was $1.478 billion, up 15.55% from 2020.

The Hershey Company took a great leap in both sales and earnings per share (EPS) in 2021. Its annual sales last year were up +11.11% from the previous year, and +15.38% from three years prior. Coming into 2022, the company continued to progress better, with sales in Q1 and Q2 hitting $2.7B and $2.4B, both higher than consensus estimates.

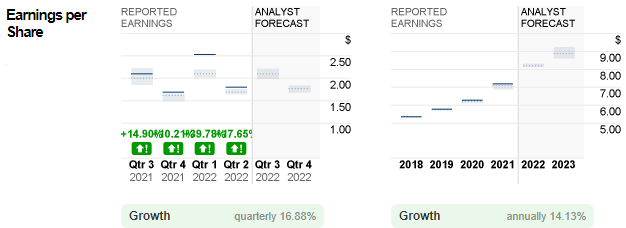

Its EPS is generally on par with market expectation. In 2021, the company’s EPS stood at $7.19, up +14.31% from the previous year, and +34.14% from three years prior. In 2022, EPS for both Q1 and Q2 hit $2.53 and $1.80 respectively, also exceeding analyst expectations.

The company is due to report its Q3 financial results on 27th October. The general forecast for sales and EPS are $2.6B and $2.10, respectively. Sentiment remains optimistic. Its strategy effectiveness in product marketing, pricing, place and distribution, as well as promotion and advertising plays a great role in improving Hershey’s competitiveness globally, and also attaining its goals and vision.

According to Zacks’ findings, the Hershey company has done a better job in its financials compared to its industry. This year, its growth rate hit 14.35%, higher than its industry (11.70%) and the S&P 500 index (8.62%). Based on this outcome, Zacks ranks the company at #2 (Buy).

Technical Analysis:

The #Hershey (HSY.s) share price was traded in a strong bullish trend since gaining support in May 2018, leaving its lowest print at $89.01. To date, total gains are over 150%. Post Q1/2022, the company’s share price was consolidated within range. It hit its lowest on 19th May, at $201.30, before rebounding and hitting its highest on 24th August at $234.44. This price together with $231.90 form the nearest resistance zone, followed by $241.40 and $254. Nearest support is found at $221. Breaking this level may indicate the bears will continue testing minor support at $231.50, then the lows of the consolidated zone at $201.30.

Click here to access our Economic Calendar

Larince Zhang

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.