EURUSD on Friday was up +0.43% to close at 1.0035, slightly below the 26-day EMA. The pair rose to a 3-week high by posting 1.0113 (50.0%FR) on positive carry-over from Thursday, when the ECB raised its key refinancing rate by 75bp to 1.25%, with indications of further rate hikes.

The ECB’s hawkish comments at the weekend pushed German 10-year bond yields to 2-month highs and strengthened euro rate differentials. ECB Governing Council member Knot said Thursday’s 75 bps rate hike by the ECB was a strong and big signal, but more steps should be followed, while another colleague Kazimir said the ECB needs to continue with firm hikes to cope with very high price hikes. Muller warned that delaying a rate hike was riskier.

European gas prices continue their gradual, but protracted correction from historic record levels reached two weeks ago, as European energy ministers are considering new mechanisms to limit unreasonably high prices, or at least try to mitigate the negative impact of these prices on the larger economy.

Technical Analysis

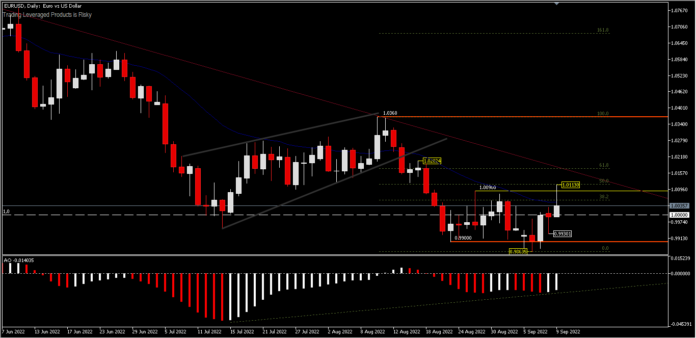

EURUSD has not shown significant changes, after the interest rate hike by the ECB. The pair is still in the bear’s control. The intraday bias at the beginning of the week tends to be neutral. On the downside, the price movement will test the parity level again, before there is a significant change in regional economic sentiment. Below parity there are 2 intraday supports to consider at 0.9930 and a low of 0.9086. Consolidation trading is likely to continue in the price range 0.9086 – 1.0113, before any change. A move above 1.0113 could test the 61.8% level of 1.0368 and 0.9086 draws near the 1.0200 round-figure mark. However, the outlook will remain bearish as long as the resistance at 1.0368 remains intact.

A divergence bias is seen from the oscillation indicator, but requires confirmation of the descending trendline break first.

Related article :/513161/

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.